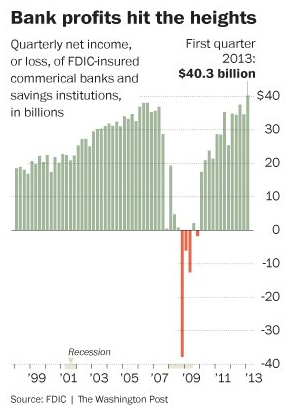

The nation’s banks are reporting record profits, according to new numbers out Wednesday from the Federal Deposit Insurance Corporation (FDIC). Most of the rest of us aren’t faring quite so well.

Bank profits topped $40.3 billion in the first three months of the year, according to the FDIC, attesting to a strong recovery… in the banking sector. “The banks are back,” Moody’s Analytics chief economist Mark Zandi told the Washington Post Wednesday. “Only four years after the banking system was literally looking into the abyss, it is highly profitable again.” The biggest banks, including Wells Fargo, Bank of America and Citigroup, accounted for most of the industry’s profits. Here’s what that looks like, via the Post:

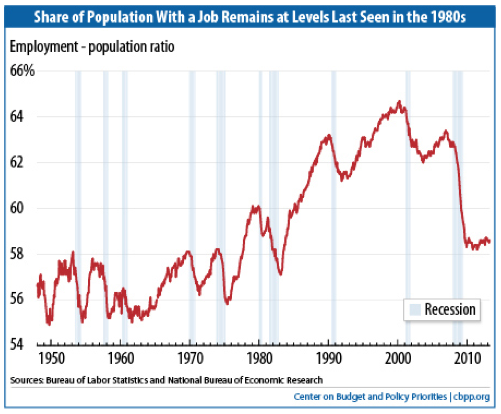

The wider economy hasn’t shared the banking sector’s return to prosperity. Yes, the unemployment rate has dropped a little. Consumer confidence is up. The housing market is healthier. But the current share of the population that is employed is still well below what it was before the recession. Here is a chart from the Center on Budget and Policy Priorities:

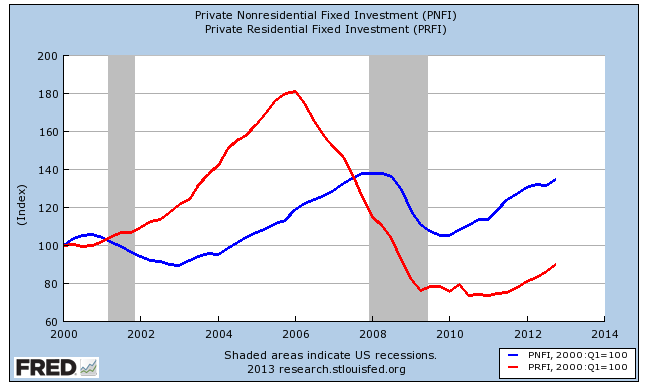

The housing market hasn’t bounced back at the same pace as bank profits, either. As Derek Thompson pointed out at The Atlantic earlier this year, overall business investment is growing, but companies are still reluctant to invest in housing. Here is what that looks like—the red curve is residential housing investment; the blue curve is non-housing investment:

The new FDIC numbers also show that loan balances at banks shrunk in the first three months of the year. As Isaac Boltansky, a banking analyst with Compass Point Research and Trading, told the Post, that’s “a sign that the broader economy still has room for improvement.” Indeed.