<a href="http://www.shutterstock.com/cat.mhtml?lang=en&search_source=search_form&search_tracking_id=cFcQ3sWwsAyVBvMk0d087g&version=llv1&anyorall=all&safesearch=1&searchterm=financial+meltdown&search_group=&orient=&search_cat=&searchtermx=&photographer_name=&people_gender=&people_age=&people_ethnicity=&people_number=&commercial_ok=&color=&show_color_wheel=1#id=28252819&src=rcfo0MtuFIej3aiwuQDa1w-1-144">RedDaxLuma</a>/Shutterstock

Update, Tuesday, October 29, 2013: The House will vote on this bill tomorrow.

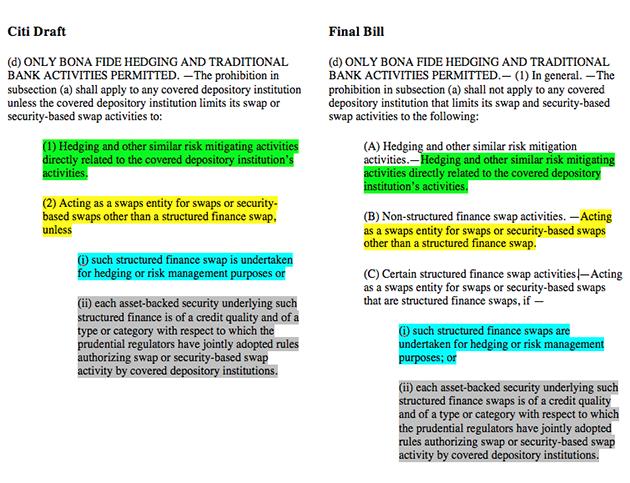

On Friday, the New York Times reported on the front page that Citigroup drafted most of a House bill that would allow banks to engage in risky trades backed by a potential taxpayer-funded bailout. The Times notes that “Citigroup’s recommendations were reflected in more than 70 lines of the House committee’s 85-line bill.” Special-interest lobbyists often play a role in writing legislation on the Hill, but such sausage-making is rarely revealed to the public. In this instance, members of Congress and a band of lobbyists have been caught red-handed, and Mother Jones has obtained the Citigroup draft that is practically identical to the House bill. As you can see in the side-by-side comparison below, the lobbyists for Citigroup really earned their pay on this job.

The bill, called the Swaps Regulatory Improvement Act, was approved by the House financial services committee in May and is headed for a vote on the House floor soon. It would gut a section of the 2010 Dodd-Frank financial reform act called the “push-out rule.” Banks hate the push-out rule, which is scheduled to go into effect on July 13, because this provision will forbid them from trading certain derivatives (which are complicated financial instruments with values derived from underlying variables, such as crop prices or interest rates). Under this rule, banks will have to move these risky trades into separate non-bank affiliates that aren’t insured by the Federal Deposit Insurance Corporation (FDIC) and are less likely to receive government bailouts. The bill would smother the push-out rule in its crib by permitting banks to use government-insured deposits to bet on a wider range of these risky derivatives.

Here is the key section of the legislation that Citigroup cooked up compared to the same section of the final bill:

The bill is sponsored by Republican and Democratic members—Randy Hultgren (R-Ill.), Jim Himes (D-Conn.), Richard Hudson (R-NC), and Sean Patrick Mahoney (D-NY)—and its passage would be great news for Citi and other financial titans. Five banks—Citigroup, JPMorgan Chase, Goldman Sachs, Bank of America, and Wells Fargo—control more than 90 percent of the $700 trillion derivatives market. “The big banks support [the bill] because it means that they’ll get to keep the public subsidy”—FDIC insurance and the implicit promise of a taxpayer bailout—”to their derivatives-dealing business,” explains Marcus Stanley, the policy director at Americans for Financial Reform.

The origins of the Citigroup proposal date back to 2011, when several large banks fought to repeal the push-out rule entirely. When it became clear that full repeal couldn’t pass, Citigroup pitched an alternative: allow banks to use FDIC-insured money to bet on almost anything they wanted. It proposed letting banks keep most types of derivatives trading in-house, requiring only that derivatives based on certain pools of assets, such as mortgages, be moved into separate entities. Citigroup was not able to get the measure passed before the end of the last Congress, but its allies on Capitol Hill reintroduced it this year.

Citi’s move to expand the types of derivatives it can trade comes as banks have increasingly been shifting derivatives out of their investment banking divisions (which aren’t backed by FDIC insurance) and into taxpayer-backed entities. “The rule is needed more than ever,” says Mike Konczal, an expert on financial reform at the Roosevelt Institute. The financial services committee passed the Citi-written bill on a 53-to-6 vote; all the no votes came from Democrats.

This is certainly not the first time that the financial industry has shaped financial reform laws for Congress. Citigroup was a central player in the 1999 repeal of the Depression-era law called the Glass-Steagall Act that forced banks not to engage in investment activities. Its lobbyists flooded Capitol Hill for that fight. “Citigroup was of course the bank that administered the coup de grace to Glass-Steagall,” says Stanley.

Citigroup’s drafting of the anti-push-out measure fits into “a long history of things being written by industry—and that generally has not worked out very well,” says Konczal. “This is very bad news.”

See how the Citigroup proposal allows more risky dealings by taxpayer-backed banks: