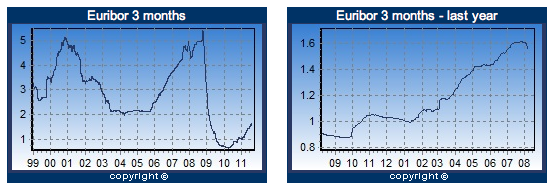

I happen to think that all the chatter about the markets responding to the S&P downgrade is mostly misplaced. Obviously there’s some reaction, but markets have been nervous for the past two weeks, and most of it seems to be related to problems in the eurozone. And I don’t blame them: I’m pretty nervous about the eurozone too. Still, here’s a contrarian take from Stuart Staniford. Back in the panic days of 2008, one of the financial indicators we all paid a lot of attention to was the TED spread, which measures how much banks charge to lend each other money. When it’s high, it means there’s a lot of stress in the system, but right now it’s chugging along extremely placidly and indicating no problems at all. There’s apparently no exact parallel measure for Europe, but as a rough proxy he looked at Euribor, the interbank lending rate in Europe. It’s up a bit, but only a bit:

Stuart: “This is also showing no sign of undue stress. In short there is no evidence of any kind of generalized credit crisis in markets at the moment. However, it’s worth noting from the TED data at top that such things can change extremely rapidly.” This is your good news of the day, such as it is.