Here’s an excerpt from yesterday’s 60 Minutes interview with Mitt Romney and Paul Ryan:

Bob Schieffer: You say of course the wealthiest people pay the larger share, but don’t they also pay at a lower rate? When you figure in capital gains and all of that?

Mitt Romney: Well, it depends on the individual, what their source of income is. But if you look at the top one percent or five percent or quartile, whatever, they pay the largest share of taxes. And that’s not something which I would propose making smaller.

Paul Ryan: What we’re saying is take away the tax shelters that are uniquely enjoyed by people in the top tax brackets so they can’t shelter as much money from taxation, should lower tax rates for everybody to make America more competitive.

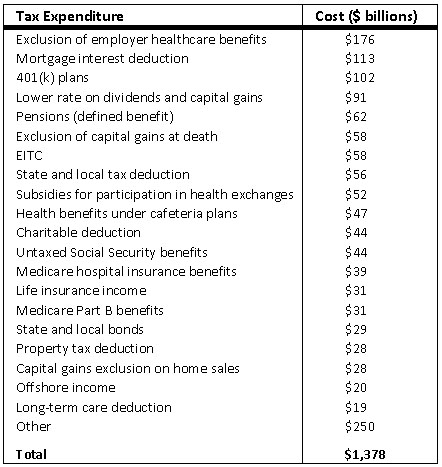

Needless to say, Bob Schieffer didn’t bother following up with the obvious question: “And what tax shelters do you have in mind, congressman Ryan?” You see, the biggest “tax shelters,” by far, are the exclusion of health benefits from taxation, the mortgage  interest deduction, deferred taxes on retirement plans, and special treatment of capital gains.

interest deduction, deferred taxes on retirement plans, and special treatment of capital gains.

In fact, if you take a look at the list of tax expenditures on the right, it’s not clear to me that there are more than two or three of them that Ryan and Romney really want to touch in any kind of serious way. But maybe I’m wrong. Maybe they really are willing to hack away at these things, and to hack away only above a certain income level.

If they are, though, they ought to say so, especially since they’re so eager to talk in detail about the lower tax rates they endorse for people in the top tax brackets. They never will, of course, because this is all a feint for the rubes. They almost certainly have no intention of touching this stuff. Still, it would have been nice for Schieffer to at least have the basic reporting skills to ask.