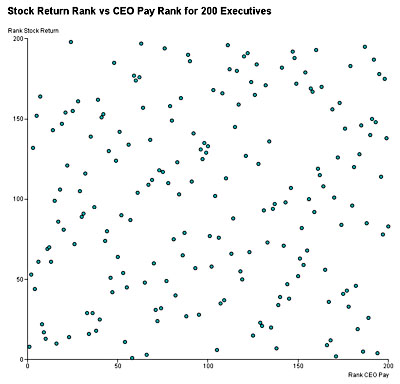

Bloomberg has done a bit of charting of CEO pay vs. performance, and their results are on the right. Bottom line: there’s essentially no link whatsoever between how well CEOs perform and how well they’re paid:

Bloomberg has done a bit of charting of CEO pay vs. performance, and their results are on the right. Bottom line: there’s essentially no link whatsoever between how well CEOs perform and how well they’re paid:

An analysis of compensation data publicly released by Equilar shows little correlation between CEO pay and company performance. Equilar ranked the salaries of 200 highly paid CEOs. When compared to metrics such as revenue, profitability, and stock return, the scattering of data looks pretty random, as though performance doesn’t matter. The comparison makes it look as if there is zero relationship between pay and performance.

There are plenty of conclusions you can draw from this, but one of the key ones is that it demonstrates that corporate boards are almost completely unable to predict how well CEO candidates will do on the job. They insist endlessly that they’re looking for only the very top candidates—with pay packages to match—and I don’t doubt that they sincerely think this is what they’re doing. In fact, though, they don’t have a clue who will do better. They could be hiring much cheaper leaders and would probably get about the same performance.

One reason that CEO pay has skyrocketed is that boards compete with each other for candidates who seem to be the best, but don’t realize that it’s all a chimera. They have no idea.