Over the past four decades, private equity has become a powerful, and malignant, force in our daily lives. In our May/June 2022 issue, Mother Jones investigates the vulture capitalists chewing up and spitting out American businesses, the politicians enabling them, and the everyday people fighting back. Find the full package here.

With more than $4.5 trillion in investments in thousands of companies across dozens of industries around the globe, private equity is everywhere—from the stores you shop at and the companies you work for to the food you eat and the music you listen to. You don’t have to go to the Hamptons to live the private equity life—just take a walk down your street. So what are you waiting for? Explore what the industry can do for you:

Public to Private

Where do the biggest private equity firms get their money for leveraged buyouts? If you’re a public worker, it might be your pension fund. Altogether, these funds hold about $480 billion in private equity investments, even though one study found that PE performed about as well as stock market index funds over the last 15 years—but with far higher fees.

Fast Food & Food Stamps

From Burger King to Qdoba, the fast-food sector is being gobbled up by PE firms, including Roark Capital, which is named after an Ayn Rand character and whose portfolio includes Dunkin’, Arby’s, Jimmy John’s, and many more. The Atlanta-based firm employs nearly 1 million food service workers—among the most likely of workers to need food stamps.

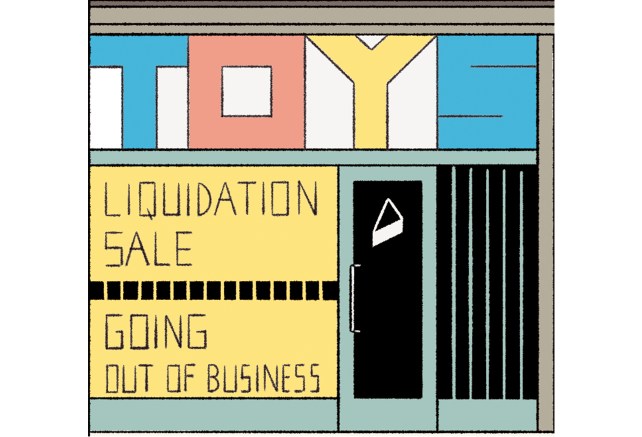

Final Chapter

After a 2011 leveraged buyout, private equity firms TPG and Leonard Green saddled J. Crew with $1.7 billion in debt and used a financial engineering strategy dubbed the “J. Crew Trapdoor” to shield assets from creditors before it filed for Chapter 11 bankruptcy in 2020. Other PE acquisitions of major retailers, such as Toys“R”Us and Payless ShoeSource, have also resulted in bankruptcies.

Leagues of Their Own

Oil guys and spoiled scions are the sports owners of the past. These days, it’s private equity–backed ventures such as the Fenway Sports Group, which owns baseball’s Boston Red Sox, hockey’s Pittsburgh Penguins, and English soccer’s Liverpool FC. CVC Capital Partners took a $2.2 billion stake in Spain’s cash-strapped La Liga last year, and many soccer fans fear that this sort of financialization will fuel more tradition-busting ventures, like last year’s aborted European “Super League.”

Smile, Sucker

In most of the US, dentists are required to own their practices. Yet private equity has found a way around this, buying up 27 of the top 30 dental support organizations—companies that handle a practice’s business side. In 2013, the Senate investigated, focusing on a DSO, owned partially by Carlyle, that had taken over Small Smiles. The chain, which serves primarily low-income children, paid employees based on how many expensive (and often unnecessary) procedures they convinced kids and parents to get.

The Old College Try

Tax-exempt endowments of elite universities have become a major source of capital for private equity schemes. In one recent year, Yale paid PE firms more than double what it shelled out in tuition assistance. PE firms from KKR to Warburg Pincus have also eagerly invested in for-profit colleges, guzzling up student loan cash. A 2020 study showed that when private equity buys for-profit schools, graduation rates drop and student debt grows.

Flip or Flop

Blackstone and other firms scooped up hundreds of thousands of homes on the cheap after the Great Recession and converted them to rentals. The result was a massive redistribution of wealth from middle-class families to large firms; instead of building equity, tenants face rising rents and evictions. By 2019, PE firms also controlled 150,000 mobile-home sites, often jacking up utility and other site fees.

Prison Profits

Private equity investors hold major stakes in most elements of the corrections industry—from prison food to ankle monitors. Three PE companies control nearly 80 percent of the correctional phone market, while two others provide medical care to inmates in at least 36 states. This market concentration has allowed firms like HIG Capital and Platinum Equity to rake in large profits by driving up the costs of calls to loved ones or reducing food portions to encourage commissary purchases.

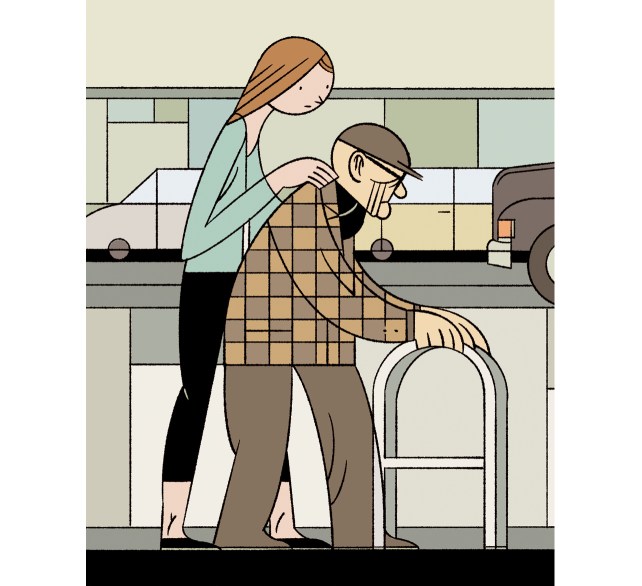

Life Support

By 2019, PE firms already owned 409 hospice care providers. KKR recently purchased BrightSpring Health Services, among the largest home health care providers, for $1.3 billion. One analysis predicted that PE takeovers would likely limit staff visits to sick patients and cut labor costs, based on trends in for-profit hospices. These same trends have already been documented in nursing homes, another major acquisition target.