Illustration: Sean Mccabe

Jeroen van der Veer is no pushover. The 60-year-old CEO stands out as a tough guy in an industry filled with them. In 2004, after taking the helm of Shell, the frugal, hawk-faced chief executive forced the $300 billion oil company through a painful restructuring. He borrowed a management model from his Dutch military days, deliberately holding strategy sessions in cramped rooms where his subordinates had to stand while their leader remained seated.

This tough demeanor was glaringly absent, however, when van der Veer met with Russian president Vladimir Putin in the winter of 2006. Shell had toiled for a decade to develop Sakhalin-2, a vast $22 billion oil and gas project on Russia’s remote eastern coast, when Putin seized the reins and handed them off to Gazprom, the state energy concern. To retain a financial stake in the project, Shell reportedly had to pay the Kremlin a special dividend worth hundreds of millions of dollars annually. Yet in announcing the deal, the hard-assed CEO came off more like a cheerleader. “Thank you very much for your support,” van der Veer gushed, addressing Putin as the two men stood together in an ornate Kremlin stateroom. “I think for us, the great news is there’s now stability, so we can all work together.”

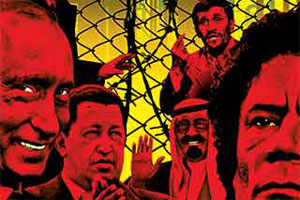

Groveling may not come naturally to guys like van der Veer, but they’d best get used to it. Soaring oil prices have emboldened Russia and other petrostates to stand up to Western execs and build up their own state-run petroleum operations. While some oil multinationals continue to haul in record profits, they’re rapidly losing global clout, and with their holdings on the decline, executives have little choice but to grin and bear it. We’re “seeing a further shifting in the oil industry in which national oil companies are the power brokers,” says Andrew Neff, senior energy analyst at economic forecaster Global Insight.

Anyone inclined to celebrate Big Oil’s recent misfortunes had better hold off on the champagne. For however badly the Western firms may have behaved, the new global oil barons could one day leave environmental and social activists nostalgic for the bad old days of ExxonMobil.

A decade ago, Western petroleum companies still ruled the world. To entice these firms to develop their oil resources, cash-strapped exporters such as Venezuela and Russia gave away the store. Fairly typical was the original Sakhalin-2 agreement, which let Shell recoup all the money it had put in before Russia earned a dime in oil revenues, and generous incentives from Caracas lured some 60 firms to Venezuela’s oil sector during the 1990s.

Funny how a sevenfold price increase changes the game. Years of global terrorism, war in Afghanistan and the Middle East, rebel attacks in Nigeria, and assorted other mayhem recently helped oil broach $100 per barrel. Asian industrialization has done the rest: China, once able to produce all the crude it needed, is projected to import three-quarters of its petroleum by 2025, and consume half as much as the United States. The booming demand has transformed Russia from a pauper state into one that sits atop nearly $500 billion in liquid assets, while Iran, with the world’s third-largest supply of crude, now earns record annual revenues from oil.

Pay ’em not to drill Ecuadoran president Rafael Correa says his country will leave nearly a billion barrels of oil untapped in the Yasuní, a delicate stretch of rainforest, if rich nations pony up $4.6 billion—half of the expected revenues. Seems like a pump dream, yet Spain has committed $4 million, others are interested, and the Clinton Global Initiative has embraced the project. But even supporters fear betrayal, so Ecuador will issue certificates redeemable if the Yasuní is later exploited. Correa recently approved drilling in another sensitive area, but still, sitting on Ecuador’s largest oil prospect would be truly historic.

—Mark Engler and Nadia Martinez

Big Oil, by contrast, faces a grim future. During the 1960s, multinationals such as Mobil, BP, and Shell had access to more than 80 percent of global oil and natural gas reserves. These days, Western multinationals control just 10 percent of the world’s oil, while state-run firms, according to a November 2007 paper from Rice University’s James A. Baker III Institute for Public Policy, exercise exclusive domain over roughly 77 percent. America’s own oil production has been in a prolonged slide, and exploration prospects appear limited—Iraq, once the great Western hope, has barely recovered to prewar production levels.

The petrostates haven’t been shy about wielding their power. In addition to negotiating the Shell coup, the Kremlin pushed British energy giant BP to sell its stake in Kovykta, a major Russian gas field. In spring 2007, Venezuela, which ranks seventh in oil reserves, took control of projects owned by foreign companies in the rich Orinoco Belt, a move that cost America’s ConocoPhillips 10 percent of its oil holdings and nearly erased the firm’s profits for that quarter. “They won’t be missed,” president Hugo Chávez said of the Westerners. In nearby Bolivia, president Evo Morales nationalized his oil and gas fields in 2006, and Ecuador has forced foreign firms to cough up more in taxes. “They understand the way energy markets have changed, and they’re reinforced by Chávez’s success,” says Michael Shifter, vice president for policy at the Inter-American Dialogue, a Washington, D.C., nonprofit.

The state-run firms have exploded in size and number and now include 15 of the world’s top 25 oil companies, according to Petroleum Intelligence Weekly. Gazprom is the biggest natural gas company on earth, and Aramco and the National Iranian Oil Company may be the globe’s most powerful oil concerns. The United Arab Emirates has amassed so much oil wealth that it boasts a state-owned investment fund worth an estimated $1.3 trillion. Kazakhstan, where the world’s biggest new oil field was discovered in 2000, has also taken advantage of the power shift. After letting a consortium of multinationals develop the massive project, last fall the government began pressuring the firms to boost its stake. In December, the country’s deputy finance minister told the Financial Times that the days of Western dominance were “ancient times.”

Can’t muster sympathy for the captains of industry? Well, consider this. In the past, activists pushing for improvements from oppressive oil regimes such as Burma’s got leverage by launching PR campaigns to embarrass their Western oil partners. But those days are over. Given their waning power, the multinationals are more likely than ever to overlook the abuses. To get their hands on the petroleum of Libya, a nation with an abysmal human rights record, oil companies have offered dictator Moammar Qaddafi nearly all the proceeds from any partnership deals. Six months after the Kremlin took back Sakhalin-2, Putin met with a collection of leading CEOs at a forum in his hometown of St. Petersburg where they competed to suck up to him. “The president is very open and straightforward,” Christophe de Margerie, head of French oil giant Total, fawned to the press afterward. “We’d like to invest more.” And even as the Kremlin turned the screws on BP to muscle it out of a key project in Russia, chief executive Tony Hayward turned on the charm, declaring that BP was “pleased to be a minority shareholder in Rosneft,” another state-controlled oil firm.

If Big Oil is willing to overlook the petrostates’ abuses, there’s another global partner that can even protect them from international sanctions. China, after all, has veto power over United Nations Security Council resolutions. PetroChina, Beijing’s state-run behemoth, is the world’s most valuable company, and its parent firm, China National Petroleum Corporation, is trolling for oil around the globe. These firms share the multinationals’ hunger for oil investment but resemble Gazprom in their lack of accountability. Consumer campaigns in America mean little to autocratic regimes when China is knocking on the front door.

Most years, the triennial World Energy Congress plays out like a celebration of plutocracy.

Most years, the triennial World Energy Congress plays out like a celebration of plutocracy. Over several days in some global metropolis, the heads of the world’s biggest energy companies gather to talk business and schmooze with politicians. But last fall in Rome, the high rollers were feeling some trepidation. Facing an expectant audience was Rex Tillerson, head of the world’s largest multinational oil company. ExxonMobil inspires fear and admiration in the industry for its ruthlessness and success—in 2007, it recorded the most profitable year of any firm in American history, with net income of $40.6 billion. Yet world events had Tillerson worried. “At a time when we should open doors to trade, resource nationalism closes them,” he warned. “At a time when we should be building bridges of international partnership, resource nationalism builds walls.”

America’s political and military leaders are perhaps the most concerned they’ve been since the 1970s Arab oil embargo that exporters might use oil as a blunt instrument. In an internal study, the Pentagon’s Southern Command, responsible for Latin America, cautioned that the rise of state-dominated companies could threaten U.S. access to South American oil; Venezuela, for instance, is America’s fourth-biggest oil supplier, and president Hugo Chávez could damage the U.S. economy were he to make good on threats to cut off shipments. He roiled global oil markets in February with just such a threat after ExxonMobil won an injunction freezing up to $12 billion in Venezuelan oil assets in retaliation for the Orinoco takeover. The loss of Venezuelan oil, according to a 2006 study by the Government Accountability Office, would reduce U.S. gross domestic product by more than $20 billion and lead to an increase in gasoline prices. Meanwhile, at a 2006 closed-door Washington meeting sponsored by several government agencies, intelligence analysts fretted that the rapid entry of Chinese companies into Africa, a continent the United States has cultivated as an alternative to the Middle East, may undermine vital energy supplies there as well.

With America’s growing oil consumption, the rise of state-run companies, and booming competition for foreign oil, higher prices at the pump are all but inevitable. The U.S. government estimates that Americans will use more than 4 million additional barrels of liquid fuels per day by 2030—at which point gasoline could make organic milk seem like a bargain.

Given the political fallout of sky-high fuel costs, Congress and the White House have paid much lip service to improving the nation’s energy independence. (See “The Seven Myths of Energy Independence.”) President Bush has even set a goal to slash Middle Eastern oil imports some 75 percent by 2025. “The best way to break this addiction is through technology,” he proclaimed in his 2006 State of the Union speech. In reality, his budgets have called for cuts in renewable energy programs, and his administration has fought proposals to mandate energy-efficiency standards for utilities.

The Democratic Congress seems just as shortsighted. Like it or not, ethanol is being pushed as a major oil alternative, but rather than supporting research to produce it sustainably from agricultural waste, Congress has overwhelmingly subsidized corn-based ethanol production, which expends about as much energy as it produces and spews more greenhouse gases than it ultimately prevents.

In the meantime, an Iowa State University study concluded that importing cheap ethanol from democratic Brazil—whose sugarcane ethanol could be environmentally superior given land-use restrictions to prevent rainforest clearing—would prompt Americans to use some 300 million extra gallons of ethanol (and presumably less gasoline). But Midwestern legislators have convinced Congress to maintain massive tariffs on ethanol imports, protecting agriculture giants such as Archer Daniels Midland, which stand to gain significantly from the wasteful corn-fed process.

Of course, the ills of nationalized oil extend well beyond U.S. energy policy.

Of course, the ills of nationalized oil extend well beyond U.S. energy policy. That much was apparent during a walk through the streets of Mandalay last spring. Burma’s second-largest city felt tranquil at first glance. Crimson-robed monks padded through side alleys at dawn, begging for rice, while vendors stirred massive vats of bubbling oil and water to make thin rice noodles. But as the world recently witnessed, pent-up fury at Burma’s military regime percolates just under the surface. “This government, it’s nothing for us,” one middle-aged resident told me. “We have nothing.”

Those frustrations erupted last summer and fall after the government halted fuel subsidies, leading to a spike in food prices. Across the nation, monks swarmed into the streets to assail the policies of the ruling junta, which responded to the unrest with a violent crackdown. Subsequent sanctions imposed by the United States, the EU, and other democracies didn’t seem to trouble Burma’s leaders—they have “no major concerns,” one head of Burma’s national oil company told a trade publication in November, “as there are a lot of Indian, Chinese, Thai, and Malaysian companies operating in exploration and production.”

The country has discovered some of Southeast Asia’s largest natural gas deposits in recent years. Even as riot police beat and arrested protesters, India’s oil minister was on hand to witness the signing of a $150 million contract for further gas exploration. A new pipeline is planned to carry Burma’s gas to the southwestern Chinese province of Yunnan, raising the specter of brutality. “Areas of Burma that are subject to major development projects experience some of the most pervasive abuses,” Human Rights Watch reported last year. The planned pipeline likely “will involve the use of forced labor, and result in illegal land confiscation, forced displacement, and unnecessary use of force against villagers,” the group warned, and the sales windfall will further entrench the military regime.

But don’t expect any action from the United Nations. In January 2007, China vetoed a Security Council resolution pressuring the Burmese junta to release political prisoners and ease its repression. Mere days after the veto, Burma granted China resource-exploration rights to three areas off its coast.

Burma is not an isolated example: Governments in Venezuela, Russia, and many other oil-rich countries have become increasingly authoritarian and corrupt. The D.C.-based monitoring group Freedom House cited a trend of international “freedom stagnation” in its 2007 “Freedom in the World” report and has deemed energy-rich countries “among the world’s poorest performers in governance and democratic process.” Russia, by the group’s annual analyses, has declined from “partly free” in 2002 to “not free” last year. The Kremlin has become less responsive to American concerns, and it blocked Western election observers from monitoring Russia’s parliamentary vote this past December.

The Dirty Dozen: U.S. Oil Imports 2007

Total: 10,010,000 barrels per day

Source: Energy Information Administration

Look Who’s Got It: World Oil Reserves, January 2007

Total: 1,317 billion barrels

Source: Oil & Gas Journal

Freedom House ratings:

=free, =partly free, =not free

For its part, oil-rich Kazakhstan, once considered a leading democratic light in Central Asia, has devolved into a thugocracy where a prominent opposition leader was brutally murdered and longtime president Nursultan Nazarbayev, along with his oil minister, was accused of accepting $78 million in bribes in exchange for oil deals.

In Venezuela, which ranks near the bottom of Transparency International’s annual index of perceived corruption, Chávez uses his state oil company as a private purse to fund pet projects. Some, such as literacy programs, promote social improvement and allow Chávez to appear the good guy, while others, like oil-funded purchases of arms and helicopters, help consolidate his power domestically.

Chávez also wields his nation’s oil for regional influence. He has spread subsidized petroleum to his allies, bought up billions’ worth of Argentine bonds, and helped other countries build up their own national oil firms, thereby gaining the loyalties of leaders from Argentina to Cuba. He has even used it to gain public sympathy while thumbing his nose at the Bush administration: Since 2005, Citgo, the U.S. subsidiary of Venezuela’s state petroleum company, has doled out tens of millions of gallons of heavily discounted heating oil to low-income Americans, touting the giveaways—and the recipients’ gratitude—in splashy print and television ads.

Where Chávez has used the carrot, Russia has wielded the stick. In late 2005, a year after Ukraine’s Orange Revolution swept a more democratic government into power, Gazprom jacked up the price of natural gas to its neighbor. During the dispute that followed, Gazprom briefly cut off gas supplies midwinter, forcing Ukraine to pay more. The following winter, the firm used the same strategy against Georgia, another neighbor that had elected pro-Western leaders. This February, Russia and Ukraine reached a settlement after Gazprom again threatened to cut off gas to Ukraine, where average winter temperatures in the capital are below freezing.

On the environmental front, state-run oil companies make Shell and ExxonMobil look like Greenpeace.

On the environmental front, state-run oil companies make Shell and ExxonMobil look like Greenpeace. The multinational firms may cozy up to nasty regimes, but they are at least obligated to respond to public criticism. Shell releases detailed annual reports about its sustainability efforts, and most of its peers have signed on to the Extractive Industries Transparency Initiative, a voluntary compact designed to reduce corruption in countries with oil and gas investments. Embracing some environmental issues helps the firms win favor from shareholders and the public, which is why BP, for one, has put a huge PR push behind its modest initiatives to combat global warming. (See “Scrubbing King Coal.”)

The national concerns, by contrast, behave with near impunity. A lengthy study by Matthew Chen, a researcher at Rice University’s Baker Institute, found that some of these firms provide virtually no information about their corporate citizenship. Two of China’s top three oil companies, in fact, have been implicated in serious ecological mishaps, including a massive spill of carcinogenic benzene in 2005 that poisoned water supplies in northeast China and across the border in Russia. In its 2007 ranking of the world’s largest firms by their commitment to business and social responsibility, Fortune rated China National Petroleum Corporation 80th out of 100 companies. Gazprom ranked worse at 86th. Clustered at the top of the list, meanwhile, were several multinational oil companies, including Shell, Total, Marathon, and in the No. 1 slot, BP. It may be greenwashing, but at least these firms care about their image.

There’s also the efficiency factor to consider. Generally speaking, Western companies use the latest technology to reduce waste and maximize oil-field output. But with corrupt leaders bleeding money from state oil coffers—cash that might have been invested in better equipment—the national firms tend to extract less oil from the ground and expend far more energy doing so. Despite vast deposits, oil-field production has been dropping in Mexico, Iran, and Venezuela. In Kazakhstan, where the government recently negotiated a larger stake in its vast oil field, state-run firm KazMunaiGaz “doesn’t have the expertise to take over the project, or the environmental expertise,” says Global Insight’s Andrew Neff.

To some in Russia, Gazprom’s December 2006 takeover of Sakhalin-2 signaled a new era of global influence for Moscow. But locals of Sakhalin Island, home to vast virgin forests and a critical spawning ground for salmon, see nothing to celebrate. “I wouldn’t say that anything is changed in environmental or social matters,” says Dmitri Lisitsyn, head of Sakhalin Environmental Watch.

Photos taken by his nongovernmental organization reveal massive erosion around the pipeline, barren plains and landslides where woods used to stand; others show huge earthmovers dumping crushed stone into a riverbed where salmon normally breed. When Shell was in charge, environmentalists might have used such photos to shame the company into concessions—when the greens blasted the company’s plan to run part of the Sakhalin undersea pipeline through a critical whale habitat, Shell postponed the project. And after the World Wildlife Fund criticized Shell’s management of the island’s environment, the company responded in detail.

Despite its diminished stature, Shell still plays a role in managing Sakhalin-2. But since the Gazprom takeover, according to Russian news agency Interfax, the state-run firm has ignored instructions from Rosprirodnadzor, Russia’s version of the EPA, to address “gross violations” of environmental protection laws. And why not? During this era of petro-nationalism, Gazprom and other state-run companies finally have the world at their command. Says Michael Shifter of the Inter-American Dialogue, “Right now what’s driving this is, ‘This is our turn.'”