<a href="http://www.shutterstock.com/cat.mhtml?lang=en&search_source=search_form&version=llv1&anyorall=all&safesearch=1&searchterm=oil+rig&search_group=#id=102974918&src=09adee7deedcd7a936b6d41b7a2e40ee-1-36">Elnur</a>/Shutterstock

This story first appeared on the TomDispatch website.

Last winter, fossil-fuel enthusiasts began trumpeting the dawn of a new “golden age of oil” that would kick-start the American economy, generate millions of new jobs, and free this country from its dependence on imported petroleum. Ed Morse, head commodities analyst at Citibank, was typical. In the Wall Street Journal he crowed, “The United States has become the fastest-growing oil and gas producer in the world, and is likely to remain so for the rest of this decade and into the 2020s.”

Once this surge in U.S. energy production was linked to a predicted boom in energy from Canada’s tar sands reserves, the results seemed obvious and uncontestable. “North America,” he announced, “is becoming the new Middle East.” Many other analysts have elaborated similarly on this rosy scenario, which now provides the foundation for Mitt Romney’s plan to achieve “energy independence” by 2020.

By employing impressive new technologies—notably deepwater drilling and hydraulic fracturing (or hydro-fracking)—energy companies were said to be on the verge of unlocking vast new stores of oil in Alaska, the Gulf of Mexico, and shale formations across the United States. “A ‘Great Revival’ in U.S. oil production is taking shape—a major break from the near 40-year trend of falling output,” James Burkhard of IHS Cambridge Energy Research Associates (CERA) told the Senate Committee on Energy and Natural Resources in January 2012.

Increased output was also predicted elsewhere in the Western Hemisphere, especially Canada and Brazil. “The outline of a new world oil map is emerging, and it is centered not on the Middle East but on the Western Hemisphere,” Daniel Yergin, chairman of CERA, wrote in the Washington Post. “The new energy axis runs from Alberta, Canada, down through North Dakota and South Texas… to huge offshore oil deposits found near Brazil.”

Extreme Oil

It turns out, however, that the future may prove far more recalcitrant than these prophets of an American energy cornucopia imagine. To reach their ambitious targets, energy firms will have to overcome severe geological and environmental barriers—and recent developments suggest that they are going to have a tough time doing so.

Consider this: while many analysts and pundits joined in the premature celebration of the new “golden age,” few emphasized that it would rest almost entirely on the exploitation of “unconventional” petroleum resources—shale oil, oil shale, Arctic oil, deep offshore oil, and tar sands (bitumen). As for conventional oil (petroleum substances that emerge from the ground in liquid form and can be extracted using familiar, standardized technology), no one doubts that it will continue its historic decline in North America.

The “unconventional” oil that is to liberate the U.S. and its neighbors from the unreliable producers of the Middle East involves substances too hard or viscous to be extracted using standard technology or embedded in forbidding locations that require highly specialized equipment for extraction. Think of it as “tough oil.”

Shale oil, for instance, is oil trapped in shale rock. It can only be liberated through the application of concentrated force in a process known as hydraulic fracturing that requires millions of gallons of chemically laced water per “frack,” plus the subsequent disposal of vast quantities of toxic wastewater once the fracking has been completed. Oil shale, or kerogen, is a primitive form of petroleum that must be melted to be useful, a process that itself consumes vast amounts of energy. Tar sands (or “oil sands,” as the industry prefers to call them) must be gouged from the earth using open-pit mining technology or pumped up after first being melted in place by underground steam jets, then treated with various chemicals. Only then can the material be transported to refineries via, for example, the highly controversial Keystone XL pipeline. Similarly, deepwater and Arctic drilling requires the deployment of specialized multimillion-dollar rigs along with enormously costly backup safety systems under the most dangerous of conditions.

All these processes have at least one thing in common: each pushes the envelope of what is technically possible in extracting oil (or natural gas) from geologically and geographically forbidding environments. They are all, that is, versions of “extreme energy.” To produce them, energy companies will have to drill in extreme temperatures or extreme weather, or use extreme pressures, or operate under extreme danger—or some combination of all of these. In each, accidents, mishaps, and setbacks are guaranteed to be more frequent and their consequences more serious than in conventional drilling operations. The apocalyptic poster child for these processes already played out in 2010 with BP’s Deepwater Horizon disaster in the Gulf of Mexico, and this summer we saw intimations of how it will happen again as a range of major unconventional drilling initiatives—all promising that “golden age”—ran into serious trouble.

All these processes have at least one thing in common: each pushes the envelope of what is technically possible in extracting oil (or natural gas) from geologically and geographically forbidding environments. They are all, that is, versions of “extreme energy.” To produce them, energy companies will have to drill in extreme temperatures or extreme weather, or use extreme pressures, or operate under extreme danger—or some combination of all of these. In each, accidents, mishaps, and setbacks are guaranteed to be more frequent and their consequences more serious than in conventional drilling operations. The apocalyptic poster child for these processes already played out in 2010 with BP’s Deepwater Horizon disaster in the Gulf of Mexico, and this summer we saw intimations of how it will happen again as a range of major unconventional drilling initiatives—all promising that “golden age”—ran into serious trouble.

Perhaps the most notable example of this was Shell Oil’s costly failure to commence test drilling in the Alaskan Arctic. After investing $4.5 billion and years of preparation, Shell was poised to drill five test wells this summer in the Beaufort and Chukchi Seas off Alaska’s northern and northwestern coasts. However, on September 17th, a series of accidents and mishaps forced the company to announce that it would suspend operations until next summer—the only time when those waters are largely free of pack ice and so it is safer to drill.

Shell’s problems began early and picked up pace as the summer wore on. On September 10th, its Noble Discoverer drill ship was forced to abandon operations at the Burger Prospect, about 70 miles offshore in the Chukchi Sea, when floating sea ice threatened the safety of the ship. A more serious setback occurred later in the month when a containment dome designed to cover any leak that developed at an undersea well malfunctioned during tests in Puget Sound in Washington State. As Clifford Krauss noted in the New York Times, “Shell’s inability to control its containment equipment in calm waters under predictable test conditions suggested that the company would not be able to effectively stop a sudden leak in treacherous Arctic waters, where powerful ice floes and gusty winds would complicate any spill response.”

Shell’s effort was also impeded by persistent opposition from environmentalists and native groups. They have repeatedly brought suit to block its operations on the grounds that Arctic drilling will threaten the survival of marine life essential to native livelihoods and culture. Only after promising to take immensely costly protective measures and winning the support of the Obama administration—fearful of appearing to block “job creation” or “energy independence” during a presidential campaign—did the company obtain the necessary permits to proceed. But some lawsuits remain in play and, with this latest delay, Shell’s opponents will have added time and ammunition.

Officials from Shell insist that the company will overcome all these hurdles and be ready to drill next summer. But many observers view its experience as a deterrent to future drilling in the Arctic. “As long as Shell has not been able to show that they can get the permits and start to drill, we’re a bit skeptical about moving forward,” said Tim Dodson of Norway’s Statoil. That company also owns licenses for drilling in the Chukchi Sea, but has now decided to postpone operations until 2015 at the earliest.

Extreme Water

Another unexpected impediment to the arrival of energy’s next “golden age” in North America emerged even more unexpectedly from this summer’s record-breaking drought, which still has 80% of U.S. agricultural land in its grip. The energy angle on all this was, however, a surprise.

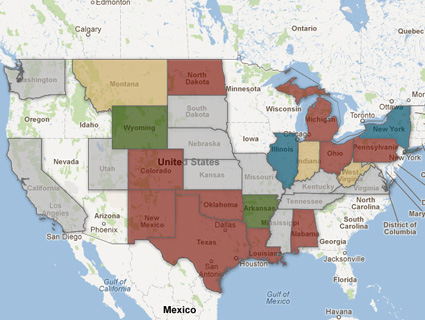

Any increase in U.S. hydrocarbon output will require greater extraction of oil and gas from shale rock, which can only be accomplished via hydro-fracking. More fracking, in turn, means more water consumption. With the planet warming thanks to climate change, such intensive droughts are expected to intensify in many regions, which means rising agricultural demand for less water, including potentially in prime fracking locations like the Bakken formation of North Dakota, the Eagle Ford area of West Texas, and the Marcellus formation in Pennsylvania.

The drought’s impact on hydro-fracking became strikingly evident when, in June and July, wells and streams started drying up in many drought-stricken areas and drillers suddenly found themselves competing with hard-pressed food-producers for whatever water was available. “The amount of water needed for drilling is a double whammy,” Chris Faulkner, the president and chief executive officer of Breitling Oil & Gas, told Oil & Gas Journal in July. “We&ssquo;re getting pushback from farmers, and my fear is that it’s going to get worse.” In July, in fact, the situation became so dire in Pennsylvania that the Susquehanna River Basin Commission suspended permits for water withdrawals from the Susquehanna River and its tributaries, forcing some drillers to suspend operations.

If this year’s “endless summer” of unrelenting drought were just a fluke, and we could expect abundant water in the future, the golden age scenario might still be viable. But most climate scientists suggest that severe drought is likely to become the “new normal” in many parts of the United States, putting the fracking boom very much into question. “Bakken and Eagle Ford are our big keys to energy independence,” Faulkner noted. “Without water, drilling shale gas and oil wells is not possible. A continuing drought could cause our domestic production to decline and derail our road to energy independence in a hurry.”

And then there are those Canadian tar sands. Turning them into “oil” also requires vast amounts of water, and climate-change-related shortages of that vital commodity are also likely in Alberta, Canada, their heartland. In addition, tar sands production releases far more greenhouse gas emissions than conventional oil production, which has sparked its own fiercely determined opposition in Canada, the United States, and Europe.

In the U.S., opposition to tar sands has until now largely focused on the construction of the Keystone XL pipeline, a $7 billion, 2,000-mile conduit that would carry diluted tar sands oil from Hardisty, Alberta, to refineries on the U.S. Gulf Coast, thousands of miles away. Parts of the Keystone system are already in place. If completed, the pipeline is designed to carry 1.1 million barrels a day of unrefined liquid across the United States.

Keystone XL opponents charge that the project will contribute to the acceleration of climate change. It also exposes crucial underground water supplies in the Midwest to severe risk of contamination by the highly corrosive tar-sands fluid (and pipeline leaks are commonplace). Citing the closeness of its proposed route to the critical Ogallala Aquifer, President Obama denied permission for its construction last January. (Because it will cross an international boundary, the president gets to make the call.) He is, however, expected to grant post-election approval to a new, less aquifer-threatening route; Mitt Romney has vowed to give it his approval on his first day in office.

Even if Keystone XL were in place, the golden age of Canada’s tar sands won’t be in sight—not without yet more pipelines as the bitumen producers face mounting opposition to their extreme operations. As a result of fierce resistance to Keystone XL, led in large part by TomDispatch contributor Bill McKibben,—the public has become far more aware of the perils of tar sands production. Resistance to it, for example, could stymie plans to deliver tar sands oil to Portland, Maine (for transshipment by ship to refineries elsewhere), via an existing pipeline that runs from Montreal through Vermont and New Hampshire to the Maine coast. Environmentalists in New England are already gearing up to oppose the plan.

If the U.S. proves too tough a nut to crack, Alberta has a backup plan: construction of the Northern Gateway, a proposed pipeline through British Columbia for the export of tar sands oil to Asia. However, it, too, is running into trouble. Environmentalists and native communities in that province are implacably opposed and have threatened civil disobedience to prevent its construction (with major protests already set for October 22nd outside the Parliament Building in Victoria).

Sending tar sands oil across the Atlantic is likely to have its own set of problems. The European Union is considering adopting rules that would label it a dirtier form of energy, subjecting it to various penalties when imported into the European Union. All of this is, in turn, has forced Albertan authorities to consider tough new environmental regulations that would make it more difficult and costly to extract bitumen, potentially dampening the enthusiasm of investors and so diminishing the future output of tar sands.

Extreme Planet

In a sense, while the dreams of the boosters of these new forms of energy may thrill journalists and pundits, their reality could be expressed this way: extreme energy = extreme methods = extreme disasters = extreme opposition.

There are already many indications that the new “golden age” of North American oil is unlikely to materialize as publicized, including an unusually rapid decline in oil output at existing shale oil drilling operations in Montana. (Although Montana is not a major producer, the decline there is significant because it is occurring in part of the Bakken field, widely considered a major source of new oil.) As for the rest of the Western Hemisphere, there is little room for optimism there either when it comes to the “promise” of extreme energy. Typically, for instance, a Brazilian court has ordered Chevron to cease production at its multibillion-dollar Frade field in the Campos basin of Brazil’s deep and dangerous Atlantic waters because of repeated oil leaks. Doubts have meanwhile arisen over the ability of Petrobras, Brazil’s state-controlled oil company, to develop the immensely challenging Atlantic “pre-salt” fields on its own.

While output from unconventional oil operations in the U.S. and Canada is likely to show some growth in the years ahead, there is no “golden age” on the horizon, only various kinds of potentially disastrous scenarios. Those like Mitt Romney who claim that the United States can achieve energy “independence” by 2020 or any other near-term date are only fooling themselves, and perhaps some elements of the American public. They may indeed employ such claims to gain support for the rollback of what environmental protections exist against the exploitation of extreme energy, but the United States will remain dependent on Middle Eastern and African oil for the foreseeable future.

Of course, were such a publicized golden age to come about, we would be burning vast quantities of the dirtiest energy on the planet with truly disastrous consequences. The truth is this: there is just one possible golden age for U.S. (or any other kind of) energy and it would be based on a major push to produce breakthroughs in climate-friendly renewables, especially wind, solar, geothermal, wave, and tidal power.

Otherwise the only “golden” sight around is likely to be the sun on an ever hotter, ever dirtier, ever more extreme planet.

Michael T. Klare is a professor of peace and world security studies at Hampshire College, a TomDispatch regular, and the author, most recently, of The Race for What’s Left. A movie based on one of his earlier books, Blood and Oil, can be ordered at http://www.bloodandoilmovie.com. Klare’s other books and articles are described at his website. You can follow Klare’s work on Facebook. To stay on top of important articles like these, sign up to receive the latest updates from TomDispatch.com here.