Water treatment infrastructure at a Montana gold and silver mine is shown. Montana Environmental Quality Council

This story was originally published by the Center for Public Integrity.

The remnants of an abandoned gold and silver mine scar the Little Rocky Mountains just south of the Fort Belknap Indian Community in Montana, bleeding polluted orange water into streams that meander through the reservation. Warren Morin remembers drinking the once-pristine water while he was growing up in the 1970s. Now it’s so acidic it makes his skin burn and turn red on contact.

Pegasus Gold Corp., a Canadian company that owned that mine and several others in the state, went bankrupt and folded 20 years ago. That left a legacy of water pollution and a cleanup bill nearing $100 million—with no end in sight.

“They took the heart of the mountains away from us,” said Morin, chair of the tribal council’s natural resources committee.

Pegasus isn’t an isolated case. Especially in the drought-prone West, the outdated and opaque regulatory system meant to ensure money is available to restore water and land at gold, copper and other hardrock mines often falls short. Regulators with insufficient funding are tasked with cleaning up a mess left years ago by now-defunct companies. The agencies that required those firms to set aside money underestimated how much it would take, in some cases acquiescing to companies pressing for lower amounts.

Pollution seeping from these mines regularly contaminates waterways. There’s often no end date to treatment costs, billions of dollars of which have been shouldered by taxpayers.

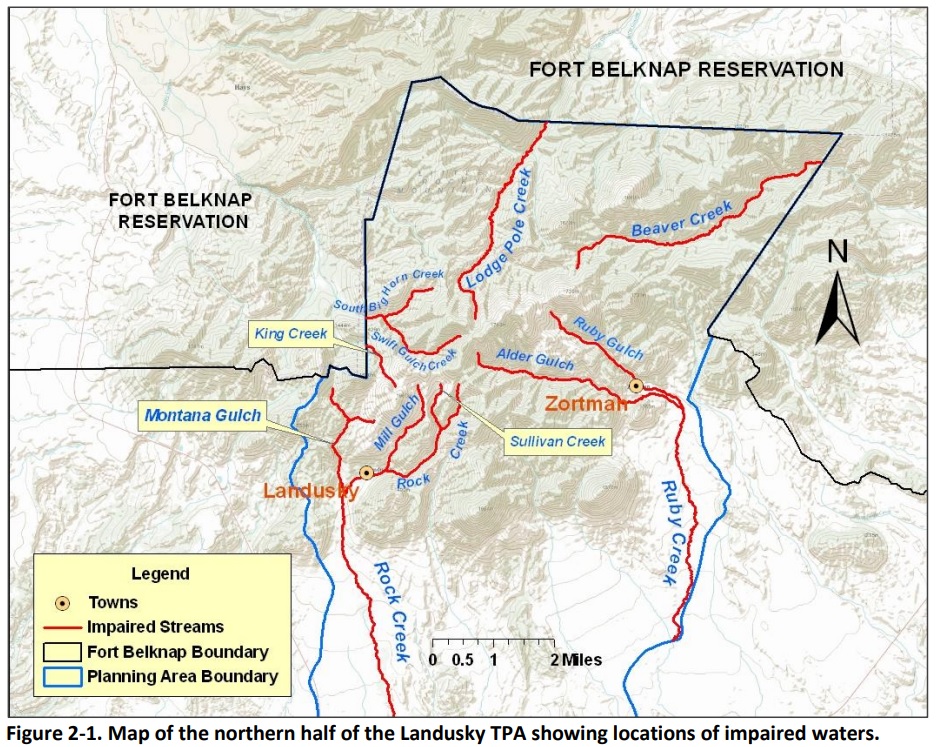

Contributing to this situation is Zortman-Landusky, the mine abutting the Fort Belknap reservation that’s the most troublesome of three former Pegasus operations. Brook trout began dying off when miners blasted the mountains to expose ore and have since disappeared from large swaths of the streams, locals said. Beavers and frogs are gone, too. Arsenic and other heavy metals stain water at a nearby treatment plant unnatural colors.

A map published in 2012 by Montana regulators shows the locations of polluted streams around the Zortman-Landusky mine’s pits.

Montana Department of Environmental Quality

While Pegasus set money aside for reclamation as legally obligated, it proved to be tens of millions of dollars less than the bill so far. Taxpayers remain on the hook for the shortfall. Every year, the state spends up to $2 million to contain water pollution at Zortman-Landusky—on top of what the cleanup already cost.

“That site’s an example of where we and the industry just didn’t maintain our full responsibilities, so we’ve taken that one on the chin, rightfully so,” said Chris Dorrington, administrator of the Montana environment department’s Air, Energy and Mining Division.

The cost of pollution

It’s difficult to put an exact number on the nationwide funding shortfall for hardrock mine cleanup. Each state manages its mining industry differently, and many don’t maintain a database of reclamation bonds—the funds meant to guarantee that cleanup costs are covered if a company walks away from its mine.

But the deficiency looks substantial.

Jim Kuipers, who runs a mining consulting firm in Montana, researches mine closure and previously studied reclamation for the US Environmental Protection Agency. He estimated, in a 2003 report by the Center for Science in Public Participation, that there was between $1 billion and $12 billion in unfunded cleanup liability at the country’s hardrock mines.

Kuipers said calculations of companies’ cleanup costs are improving, decreasing that gap as states base their bonding requirements on more accurate estimates. Even so, he said, as many as half of active hardrock mines could still hold inadequate reclamation bonds.

When the Pegasus mine near the Fort Belknap reservation was new in 1979, Kuipers said, “mines were permitted in a very nonchalant manner, and this whole financial assurance issue was not given a whole lot of concern.”

Uncontrolled mining pollution has a literal ripple effect. Mine waste, heavy metals and acidic water often end up in streams and rivers.

Mining has polluted the headwaters of more than 40 percent of Western watersheds, according to the EPA. In 2017, metals mines generated nearly 2 billion pounds of toxic waste. That’s roughly the same weight as 5,000 Boeing 747s, and it accounts for a full half of toxic waste generated by all industries across the country.

“The facts are incontrovertible,” said Jennifer Krill, executive director of Earthworks, an environmental advocacy group. “Mining is the nation’s largest source of toxic pollution. The costs have been counted and are only going to continue to grow.”

An Earthworks report studying the mines responsible for 93 percent of US gold production in 2013 found every site had at least one pipeline spill, such as diesel fuel or dangerous cyanide solutions used in gold processing. About three-quarters of the mines also harmed nearby groundwater or surface water, “including impacts to drinking water supplies for residential homes and businesses, loss of fish and wildlife habitat, and fish kills.” An estimated 50 million gallons of water polluted with toxic metals still flows from the country’s hardrock mines daily, the Associated Press revealed in February.

The National Mining Association, which represents the industry, contends that mines permitted today don’t cause the same level of pollution. New operations, according to the group’s factsheet on bonds, are constructed “and closed using state-of-the-art environmental safeguards and technology that minimize releases of hazardous substances to the environment.”

No end in sight

For the Aaniiih and Nakoda Nations, whose citizens live on the Fort Belknap reservation, the effects of mining are felt daily.

The area around Zortman-Landusky was carved out of the reservation by the Grinnell Agreement in 1895. The US government, which commissioned a trio of explorers to negotiate on its behalf, agreed to pay the tribes on the reservation $360,000—the equivalent of about $11 million today — in return for more than 40,000 acres known to be rich with minerals.

“The object of the negotiations with the Indians mentioned in the law was to secure the cession by them of the mountainous portions of their respective reservations supposed to contain valuable deposits of gold, silver, and copper,” the commissioner of Indian affairs reported at the time.

Notes from a meeting between the government’s surrogates and members of the tribe in 1895—taken by a stenographer for the surrogates—show mixed feelings about the deal, with many speaking against it despite a desperate need for aid. “I am thinking of the treaty that I made before with the whites,” one tribal member named Little Shield said. “It was just like they took the land away from us for nothing.”

Growing up on the reservation, Morin heard stories from elders that many tribal members didn’t want to sign the agreement but were threatened with starvation if they declined. Notes from the 1895 meeting show a government negotiator saying hard times would befall the reservation without a deal.

One of the area’s highest peaks was among those ripped open in the process of digging the 1,200-acre Zortman-Landusky mine. The tribes called it Spirit Mountain, but miners renamed it “Gold Bug Butte.”

Reno Shambo is a tribal member who grew up hunting and camping in the mountains. As an adult, he was part of a crew that dug out piles of mine waste choking the area’s streams, and he now stays well clear for fear of the pollution.

Contaminated water also flows past the powwow and Sundance grounds used for community and spiritual gatherings.

That’s a “perpetual nightmare,” Morin said. His tribe believes “the land is who we are. We’re nothing without our land, and our mountains are sacred.”

Tribal members gather for community events at the Fort Belknap Indian Community. Polluted mine water has migrated into nearby streams.

Fort Belknap Indian Community

In October 2017, the then-president of the Fort Belknap Indian Community, Mark L. Azure, sent a letter to the state that called Pegasus’ bonds “woefully inadequate.” The failure to properly reclaim the nearby mine, Azure wrote, meant the tribes could no longer swim in or drink from the area’s streams.

“As a result, our community continues to suffer from the effects of water pollution and scars on the landscape,” Azure wrote, “and there is no end to that suffering in sight.”

Last year—in a shift in oversight—Montana invoked its 1989 “bad actor” statute in relation to the cleanup woes. The case is working its way through the courts, but it could bar Hecla Mining Company, a large player in the silver and gold sectors, from operating in Montana because its CEO, Phillips S. Baker Jr., was an executive at Pegasus in the 1990s. Baker also chairs the board of the National Mining Association.

“It can be argued mining built this state and minerals from Montana fueled the development of our nation,” Tom Livers, the former director of Montana’s Department of Environmental Quality, wrote in an August opinion column about the decision to invoke the statute. “It also left a legacy of pollution and cleanup we’re still addressing today.”

Hecla would not make Baker available for an interview with the Center for Public Integrity, but in its court filings and in a statement, company representatives dismissed the suit as meritless. Neither Baker nor Hecla were responsible for Pegasus’ failure, the company said, and Pegasus had put up all bonds requested by the state.

“Mr. Baker has been CEO of Hecla for some 15 years,” the company wrote in its statement. “Under his leadership, the company has proven its commitment to environmental stewardship.”

A broken system

Environmentalists face an uphill climb in addressing hardrock mining pollution.

In November, Montana voters considered a ballot measure prohibiting the state from permitting new mines if the companies disclosed that they expected the sites to pollute water indefinitely, even after cleanup. An Alaskan measure aimed to create new protections for salmon-spawning streams, a move that would restrict—perhaps halt—the permitting of large new mines.

Industry interests opposing the initiatives outspent environmental advocates more than twice over in Montana and six-to-one in Alaska. Voters rejected both measures by large margins.

Unlike with coal mining, which is also underfunded for proper cleanup, no central law or single federal agency oversees hardrock reclamation. A patchwork of state and federal legislation, beginning with a law barely updated since its passage in 1872, regulates hardrock mine closure. The Bureau of Land Management, the US Forest Service and state regulators oversee a system of governance unique to each state, managed by often-outdated memorandums of understanding.

States have fine-tuned their mining laws since they were stuck with cleanup costs after a rash of bankruptcies wiped out mining companies in the 1990s. But predicting future costs isn’t an exact science. States and mining companies often negotiate over the amount of money to set aside.

“We go back and forth with them on getting those costs to be realistic,” said Kyle Moselle, associate director at Alaska’s Department of Natural Resources.

Experts say that regulators can get played if they’re not wary. Companies’ consultants can massage subjective aspects of the calculations, like how much inflation might rise over time, to land on a more favorable amount.

Ann Maest, a mining consultant who often works on contract for government agencies and environmental advocacy organizations, researches the impacts of resource extraction on water. To secure permits, mining companies frequently underestimate their potential for long-term water pollution, she said, which leads to insufficient bonds.

“It’s rare to find a mine that’s really accurately estimated how much it’s going to cost to do hydrologic reclamation when they have an acid-producing mine,” Maest said.

In Arizona, roughly $500 million of the more than $600 million worth of hardrock reclamation bonds overseen by the state’s Department of Environmental Quality sit in corporate guarantees and self-assurances. These forms of bonds allow the mining firm or a related entity such as a parent company to guarantee reclamation against its own financial strength.

Because regulators don’t call on bonds until a company is in dire straits, experts say these guarantees are effectively worthless. “In Arizona, I’d have a hard time suggesting that if a company goes bankrupt, anybody should expect anything more than zero,” said Kuipers, the mining consultant.

Arizona Department of Environmental Quality spokeswoman Erin Jordan said the state’s regulations were strengthened in 2016 and keep the cleanup liability with mining companies. The agency, which helps oversee the state’s approximately 20 active copper mines, has never faced a situation where a mining firm went under and it needed to spend the company’s bond for cleanup, Jordan said.

Other states may be moving away from self-assurances. New Mexico’s legislature is considering a bill that would close a loophole left by earlier efforts to stop the practice. Legislation that its supporters believe will be signed into law this year in Colorado would also institute a ban on self-bonds—and strictly limit when permits can be issued for mines expected to pollute water indefinitely.

Mining’s legacy

In December 2017, the EPA reversed nascent attempts by the Obama administration to mandate a separate source of mine cleanup funds. Earthworks and others are suing to compel the agency to implement the rule, which a federal judge in 2016 ruled is required by the same 1980 law that created the Superfund program to clean up hazardous waste sites.

“Holding mining companies accountable for cleaning up their pollution is an idea that’s heading backwards under the Trump administration,” Earthworks’ Krill said.

The US has some of the world’s more developed environmental regulations governing mining, and the industry argues these are sufficient. The National Mining Association celebrated the EPA halting its proposed rule in a 2017 press release, calling the regulations “crippling financial and regulatory burdens on the mining industry.”

The Forest Service is also planning to overhaul its regulations governing mine cleanup funds. It’s unclear whether the rulemaking process will strengthen or weaken existing environmental protections.

The cost of all this reclamation doesn’t include sites shuttered prior to regulations passed in the 1970s and 1980s mandating cleanup funds.

As many as 500,000 abandoned hardrock and coal mines are scattered across the country, according to a Bureau of Land Management estimate. Many are small, and the exact number is unknown. While fees from operational coal mines help pay for cleanup of legacy coal sites, no such system exists in the hardrock industry, and federal agencies estimated they spend more than $80 million on abandoned hardrock cleanup annually.

These abandoned mines, as well as modern mines that hold inadequate bonds, can become the responsibility of the taxpayer-funded Superfund program. EPA figures show it could take an additional $50 billion to reclaim the hardrock operations that were abandoned in the West prior to the rules governing mines like Zortman-Landusky in Montana.

The Superfund program doesn’t have enough money to clean them all. At a November mine closure summit in Colorado, Victor Ketellapper, who handles Superfund implementation in the Mountains and Plains Region for the EPA, said private capital and environmental groups are increasingly key to plugging funding gaps.

“The environmental cleanup is so high and the land value is so low that it’s difficult to do without outside support,” Ketellapper said.

He highlighted two gold mines, one in Colorado and the other in South Dakota—which each fell to the Superfund program—as emblematic of the failure to properly calculate bonds. “In both of those cases, the reclamation bonds didn’t even come close to addressing the cost of cleanup,” he said.

At the Fort Belknap reservation, that failure means a never-ending flow of Montana tax revenue is diverted to fight the pollution.

“The sickening thing about it is the people that did this, they raped the land, they took the money and they ran off,” said Morin, with the tribal council. “And they stuck the taxpayer with it.”

The Center for Public Integrity is a nonprofit, nonpartisan investigative news organization in Washington, DC.