A multiple-exposure image of developer Jeb Allen at a construction site in Redding’s Salt Creek Heights

Justin Maxon

Standing on Shingletown Ridge and gazing west toward the setting sun, Bruce Miller eyes a rainbow of colors. He sees pink: the dusky sky blanketing a postcard-perfect valley 3,000 feet below. He sees gray: distant snow-capped mountains. He sees brown: century-old pine and oak trunks towering more than 100 feet above him. And he sees green: the profit he hopes to make by turning this 274-acre patch of forest into a subdivision for buyers looking for jaw-dropping views.

“This would be your high-dollar lot here,” the hearty 68-year-old tells me, halting our hike through a tangle of manzanita and poison oak to unfurl a map and point out the boundaries of a future home site. A sheer drop at the property’s rear reveals a stunning panorama. It also invites flames. “Fire,” Miller says, “burns uphill.”

For more articles read aloud: download the Audm iPhone app.

Wildfire’s lethal tendency to surge up slopes was driven home last summer, when an inferno called the Carr Fire ripped through Shasta County, a chunk of Northern California pocked by crests and canyons as gorgeous as they are combustible. Lit by a spark from the wheel rim of a flat tire scraping the ground, the fire raged for 39 days, destroying more than 1,000 homes, killing eight people, and requiring some 3,500 firefighters from around the world and more than a dozen planes dropping chemicals to finally quell it. In November came the Camp Fire, which incinerated the nearby town of Paradise, killing 85 people. Together, the fires caused at least $18 billion in damage; bankrupted California’s largest utility, Pacific Gas and Electric; and forced the liquidation of at least one insurer. For weeks, Northern Californians breathed smoky air.

The destruction ended any delusion that humans could keep Mother Nature in check. They were harbingers of a new kind of megafire being unleashed on a warming world.

In February, at California Gov. Gavin Newsom’s direction, state fire officials listed 35 spots at particularly severe risk—spots where crews would race to cut down trees, in part to create wider evacuation paths. “Climate change is acting as a force-multiplier that will increasingly exacerbate wildland fire issues over the coming decades,” the report concluded. It named as the state’s top priority for tree-thinning the stretch of highway that runs along Miller’s property, an area so overgrown that local fire officials call it “the brush belt.”

Just three weeks later, Shasta County’s planning commission unanimously endorsed Miller’s plan to build houses on that land. The commission had let him subdivide the property several years earlier, but he hadn’t found a developer who wanted to buy the property, and his development window was set to close this year. So last December, about four months after the Carr Fire, he applied for an extension. This March, the commission gave him another three years. Since 2016, when the commission had blessed Miller’s initial development proposal, there had been “no new information of substantial importance” about the advisability of developing the property, according to a document accompanying the commission’s decision. The document didn’t mention the Carr Fire. Nor did it cite the recent state report identifying the stretch of road along Miller’s acreage as the most urgent spot for fire-risk mitigation in all of California.

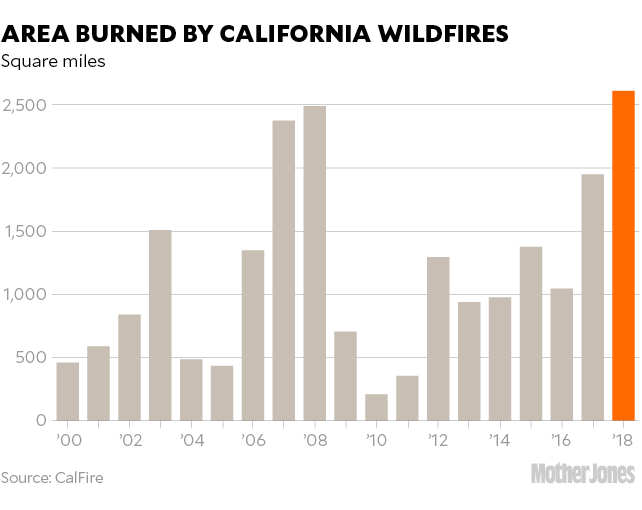

Today’s monster fires result largely from three human forces: taxpayer-funded fire suppression that has made the forest a tinderbox; policies that encourage construction in places that are clearly prone to burning; and climate change, which has worsened everything. In the latest piece of evidence, a study published in July by the American Geophysical Union concluded that climate change is “very likely” the main reason that, between 1972 and 2018, the acreage burned annually in California jumped fivefold and the acreage burned in summertime forest fires surged eightfold. A warming climate has dried the ground and the vegetation on it, the study found, leaving them readier to burn.

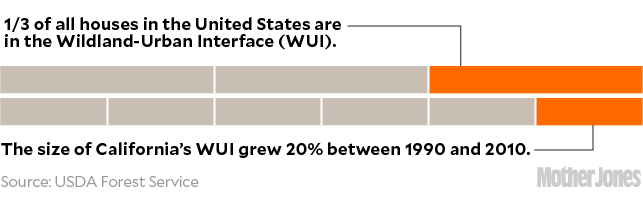

Behind these three forces is a massive economic perversity: Society masks the costs of building on the edges of the forest, a zone that planners call the “wildland-urban interface,” or the WUI. With its vast forests and penchant for sprawl, California is the epicenter of WUI wildfire damage. Between 2000 and 2013, fire destroyed more buildings in California’s WUI than in all similar areas in the United States combined, and more than 75 percent of all buildings destroyed by fire in California were in the WUI, according to a University of Wisconsin–Madison study.

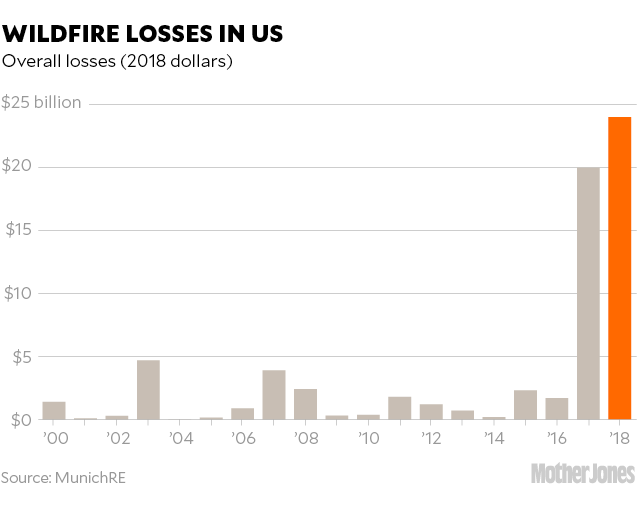

The costs of those fires are soaring. The federal government spent more than $3 billion suppressing wildfires in 2018—nearly five times what it spent 20 years ago, in inflation-adjusted terms. The US Forest Service accounts for the bulk of the spending; the portion of its total budget spent on firefighting ballooned from 16 percent in 1995 to 52 percent in 2015 and is expected to hit 67 percent in 2025. The California Department of Forestry and Fire Protection, or Cal Fire, estimates it spent $677 million on emergency fire suppression in 2018—ten times what it spent fighting fires 20 years ago. Beyond fire suppression, taxpayers are forking over large sums to help bail out people who lose homes, and communities that lose infrastructure. The Federal Emergency Management Agency puts the tab at $94.3 million for aid it provided in the wake of the Carr Fire. “In some instances, would it just be cheaper to buy the land and keep it from being developed? The answer’s clearly yes,” says Ray Rasker, executive director of Headwaters Economics, a Montana-based research group that focuses on disasters.

Salt Creek Heights development in Redding.

It seems harsh to blame the bear. But the fire-suppression campaign that helped create the conditions for today’s huge blazes got a crucial boost in 1944 with the creation of Smokey, whose motto, “Only you can prevent forest fires,” would be dutifully memorized by generations of American schoolchildren. Despite mounting science pointing to the contrary, the conviction that all wildfire is bad wildfire has guided decades of federal and state policy, perhaps nowhere more than in California. After a century of fire suppression, the accumulated vegetation in the forest is “like an explosion ready to happen,” says Eric Knapp, a research ecologist at the Forest Service’s office in Redding, Shasta’s county seat. “What climate change has done is make those fuels more volatile.”

The tragic irony is that, although fire suppression was designed to tamp down flames, it has ended up fanning larger ones. Between 1911 and 1924, California’s average fire season lasted from May to October, and only two fires burned more than 47 square miles each, according to a study that Knapp and his colleagues published this year. But between 2002 and 2015, the fire season lasted two months longer, with notably more fires as early as April and as late as November, and 25 fires burned more than 47 square miles each. The Carr Fire last year scorched 359 square miles.

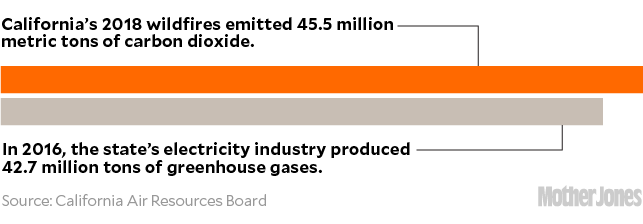

Wildfires don’t merely reflect climate change. They also intensify it. When trees burn, they release carbon. California’s wildfires emitted 45.5 million metric tons of carbon dioxide in 2018, roughly equivalent to putting 9.1 million cars on the road. That was more than twice the amount by which California’s annual emissions fell between 2013—when the state implemented its carbon cap-and-trade program—and 2016, the most recent year for which the state has numbers. California has provided $12 million in cap-and-trade proceeds to thin forests and mitigate the wildfire threat in Shasta County. Meanwhile, the county is seeking another $28 million in forest-thinning funds from FEMA. Despite these attempts at mitigation, much of the local population and the power structure is intent on maintaining the old paradigm even as the new reality closes in.

Bret Gouvea, the 48-year-old chief of Cal Fire’s Shasta County unit, started fighting fires before he could legally drink. A gas station owner’s son, he rose through Cal Fire’s ranks to direct the massive fight against the Carr Fire, which roared into a 17,000-foot-tall column of hot air and flames. Wind and low atmospheric pressure whipped the Carr flames into a blazing tornado that tossed a 40-foot-long shipping container into the sky, spinning it like a toy ball. “The kind of fire behavior we’re seeing now is historic,” Gouvea says. “It’s extreme.”

Gouvea threw everything he had at the Carr Fire. He directed airplanes, helicopters, bulldozers, and more than 60 teams of emergency responders, an effort that cost the state $149 million. (It would spend an additional $94 million battling the Camp Fire.) One morning in late May, Gouvea and I drive in his white Cal Fire–issued Chevy Tahoe through the burn zone, still barren and charred. When I ask about criticism of wildfire suppression, he says the dense forest vegetation fueling today’s megafires is a result not just of fighting essentially all fires but also of environmental rules against felling trees. “The environmental purists would tell you it should be left to do what nature would let it do,” but “when you don’t allow a large landowner to harvest timber and reduce fuel because it’s habitat for a frog or a spotted owl,” brush grows and fuels blazes. Gouvea looks me in the eye. “You just drove through it,” he says. “It’s a moonscape. It kills off a hundredfold of what you’re trying to protect.”

Around the time marketers created Smokey Bear, another force began to remake California’s forests: real estate development. Shasta County’s population grew by an average of 32 percent every decade between 1950 and 2010. Recently it’s flattened at about 180,000, but houses are being built ever closer to the forest’s edge.

Jeb Allen, who has been building houses in Redding for three decades, has facilitated that development and profited handsomely from it. A former car racer—he was recently inducted into the International Drag Racing Hall of Fame—he estimates that his company, Palomar Builders, has built some 3,000 houses. It’s been a good run: Today Allen owns a hilltop residence he bought for about $3 million in Tiburon, California, a wealthy enclave overlooking San Francisco Bay; a condo at Troon North Golf Club, in the shadow of Arizona’s Pinnacle Peak; a new 1,000-square-foot apartment on the 17th floor of the Ritz-Carlton in Honolulu, towering over Waikiki Beach; and a 2,500-square-foot house in the first subdivision he built in Redding.

Buenaventura Boulevard in Redding where a vehicle was scorched by the Carr Fire.

Dozens of houses that his company built were destroyed in the Carr Fire. Several were in a subdivision called Salt Creek Heights, a collection of ridgetop lots on Redding’s western edge. Among them was the development’s model home, which is where Allen and I meet on a recent afternoon. The 2,400-square-foot model, which sells for about $940,000, has been rebuilt since the fire.

What’s most striking about Allen’s company isn’t how hard it was hit by the fire. It’s how hard it’s cranking out houses in the WUI again. Several of its Redding buyers under contract for houses at the time of the fire backed out, Allen estimates, but in the months since, many more people have bought in. When Palomar began selling 14 houses in a newly developed section of Salt Creek Heights in early May, it sold nine in just a week. Regulations haven’t been a concern. When I ask if Allen has faced tougher building restrictions since the fire, he answers flatly, “Not really.”

Sitting in a front room of the model home, beside a table set with a stack of business cards and a bowl of mints, Allen looks out a picture window facing northwest, where the Carr Fire roared in. The once-wooded hillsides are pocked with singed stumps. Allen, wearing a black bomber jacket, a black T-shirt, and jeans, figures the land’s contours are now easier to admire. “My opinion,” he says, “is it’s got more character to it than it did before.”

A Redding ordinance prohibits building houses on slopes whose grade is greater than 20 percent, primarily because the steeper the slope, the faster fire scales it. But the rules don’t ban building on the ridges above steep inclines. The economic incentive to build there is strong: Houses high up have better views.

“For me, it was all about the view,” says Renee Rand, a home health care executive who bought a lot in Salt Creek Heights a month after the Carr Fire. She needed a new house because the fire burned down her old one less than 24 hours after she evacuated it. At Rand’s new house, the backyard plunges into charred hills. She tells me she’s tussling with Palomar over whether she or the company will pay to clean up the blackened wood in the yard. (Allen says he can’t recall this dispute, but if there’s a problem he’s willing to fix it.) “I’m like, ‘This was your lot,’” she says. “‘It burned before I bought it. Will you remove it?’ But if they won’t, I will. Or maybe I’ll just let it sit.”

Developer Jeb Allen at a construction site in Redding’s Salt Creek Heights

Renee Rand bought a house in Salt Creek Heights after her old house burned down

The suburbanization of the WUI didn’t just happen. Years of deliberate policymaking have encouraged and subsidized it. A 1978 California law makes it nearly impossible to raise property tax rates on longtime residents, pushing local officials to broaden their tax bases by wooing new development. That policy has led to a general permissiveness in land-use regulations. California has some of the toughest building codes in the country, but even its codes have cracks. Rand, for example, planted several trees close to her old home. Whatever the rules say about new construction, they don’t force people to maintain their houses in ways that resist fire.

The gaps in the building codes become clear on my drive through the fire zone with Gouvea, the local Cal Fire chief. At one point he stops his SUV next to an unremarkable tract house overlooking an area in which the fire burned so hot that it melted two metal power-line poles and charred a swath of thick forest down to bare dirt. A Redding firefighter whom Gouvea knew well was killed while working to rescue people who hadn’t followed evacuation orders, when the inferno lifted his truck off the ground and threw it about 150 feet. Today, a shrine consisting of a fire hydrant, an American flag, a coiled yellow fire hose, and a half-dozen fire department ball caps marks the spot where he perished.

The house where we’re stopped is enclosed by a wood fence with shrubs planted against it. Gouvea shrugs. “It’s flammable, but that’s the choice they make,” he says. California and Shasta County fire codes have nothing to say about fences. And shrub rules often go unenforced.

Redding City Manager Barry Tippin has shrubs against his house too—although this year he trimmed them more than he had before. Under his leadership, the city has invited a group of wildfire experts to study its fire ordinances. The group’s recommendations are due this year. Whether locals do what the outsiders suggest remains to be seen. “We need to up our game in terms of requirements for safety,” Tippin says.

But when I ask Tippin whether the city is considering restrictions on where people build—for instance, making it harder to rebuild where houses burned down—Tippin resists the idea. “God no,” he says. “That’s the last thing we’d want to do.”

Far from cracking down on building, Redding and Shasta County officials have expedited approvals for post-fire reconstruction, reflecting a culture of resilience that comes down to three words: fire be damned. “From these ashes, we are rebuilding,” declares a sign in a neighborhood where many homes burned. “My God is greater than the Carr Fire,” says another.

Bruce Miller

The problem of lax rebuilding rules is compounded by a powerful economic subsidy that encourages homebuilding despite rising wildfire risk: state policies that help keep insurance rates far lower in California than in other hazard-prone parts of the country. The state Department of Insurance has to approve every proposed rate change. Insurers can ask to raise rates but must justify the request by averaging insurance losses from the prior 20 years—which makes it less likely that the recent spike in fire-related claims will boost rates. Despite threats of earthquakes, fires, and mudslides, the average California homeowner spends only about $1,000 annually in homeowners insurance. That’s about half the average premium in Florida or Texas, where natural disasters linked to climate change are also surging.

Struggling from their wildfire losses, insurers in Shasta County recently filed claims against Redding, arguing that the city contributed to private property losses from the Carr Fire. Citing a 2010 city document that warned of fire risk and recommended a regimen of thinning, insurers alleged that public lands had not been adequately thinned. Tippin, the city manager, rejects those allegations. He says the thick vegetation that fueled the fire “was natural growth,” that the city did as much thinning as it could afford, and that “there’s a level of personal responsibility” at play, meaning property owners could have cut more brush on their own land.

Insurers also are hiking premiums for Shasta County property owners, partly by pressuring companies that develop fire-risk maps—on which insurance rates depend—to update the maps. That has bumped more homeowners into higher-risk categories—with no need for a state-approved rate increase. Insurers are also revoking coverage altogether for customers they now deem too risky.

Insurance agent Matthew Iles sees the crisis from his office in a strip mall in the Shasta County community of Palo Cedro. His customers include about 2,000 households and 300 businesses. He has watched wildfire premiums inch up for more than a decade, triggered by a series of fires in San Diego in 2007. But “it got really bad about three months ago,” he says. I ask how many of his clients have experienced rate hikes this spring. “Every single one,” he says. “It’s not normal. But these fires aren’t normal.”

Brian Fleischaver cuts a dead tree in Redding, clearing potential fire hazards.

Brian Butler was one of the first people in the area to return to living on his property after the Carr Fire.

Over the past year and a half, Jon and Cindy Shaw, who live in a thickly wooded community called Oak Run, have seen their annual premium triple because of fire risk, from $1,600 to $4,800. They’ve installed four water tanks on their land, together holding more than 5,000 gallons, to fight a potential blaze. If their premium rises again, says Jon, a retired construction worker, he and his wife will opt out of fire insurance altogether. If fire burns their home, they’ll rely on help from FEMA and other public sources. “I’m going to wait until the government comes and bails my ass out,” he tells me, sitting at his dining table and sipping from a metal travel mug filled with Jack Daniel’s and water over ice. That’s “not the way I am,” he emphasizes, but he sees little choice. He figures he too might as well exploit the system.

Oak Run is one of many small Shasta County communities nestled along ridgetops under trees. Another is Shingletown, named for its onetime economic focus: slicing trunks into shingles. It’s the site of the stretch of Highway 44 that California recently named its highest priority for tree-thinning. Gouvea, the Cal Fire chief, had proposed that designation. The Shingletown ridge is “just straight drop-off cliff,” he says, so a wildfire would “throw spots” of flame onto the road, wreaking havoc on an evacuation. The tree-thinning is intended to widen the evacuation route and give Cal Fire “a place to fight from, from the air and the ground.”

Given the scarlet letter the state report slapped on Shingletown, Miller, the rancher who wants to develop his Shingletown Ridge property into a high-end subdivision, was pleasantly surprised when county officials reaffirmed their approval for his plan in March. “You would have thought that there would have been some hesitation on that,” he says. “It didn’t faze anybody. They just approved my extension.”

Standing on his property on a recent evening, his dog Jake at his side, Miller says he’s not concerned by the looming threat of wildfire. Natural disasters can strike anywhere, he says: “Pick your poison.” But he acknowledges that no one who builds a house on this property should underestimate a wildfire’s deadliness. As he talks, the sun is setting over the ridge. A fire crew has started thinning trees along the highway. And the 2019 Shasta fire season has officially begun.

Fire hydrant in a Redding housing development

Renee Rand looks out at the hills behind her house in Redding