For the past couple of years economists have been arguing about whether our high unemployment level is cyclical or structural. The best evidence, I think, suggests that it’s some of both: perhaps two-thirds cyclical and one-third structural. But even if it were more like 50-50, who cares? It still means that we have a huge amount of cyclical unemployment on our hands, and we ought to be doing something about it.

However, there’s an aspect of this debate that I’ve never really taken the time to flesh out on the blog: if we are suffering partly from a structural unemployment problem, when did it begin? One of the most persuasive arguments against a significant role for structural unemployment is that it simply doesn’t make much sense to think that, in the fall of 2008, American workers (and Greek workers, Irish workers, Italian workers, etc.) suddenly became ill suited in mass numbers to the rigors of the modern world. It just doesn’t make much sense.

But if you look at an array of economic indicators, something a bit less sudden has always seemed to be lurking in the data: a structural change that started around 2000 but was masked first by the dotcom bubble and then by the housing bubble. So when the 2008 banking crisis touched off the Great Recession, a decade’s worth of structural change suddenly became apparent all at once. No more masks.

I don’t know for sure how much there is to this, but it’s definitely been rolling around in the back of my mind for some time. The economy of the aughts was just too lousy to explain without something going on. Bush’s economic policies may have been misguided in the long term, after all, but in the short term a bunch of big tax cuts, a housing bubble, and lots of war spending should have been fairly stimulative.

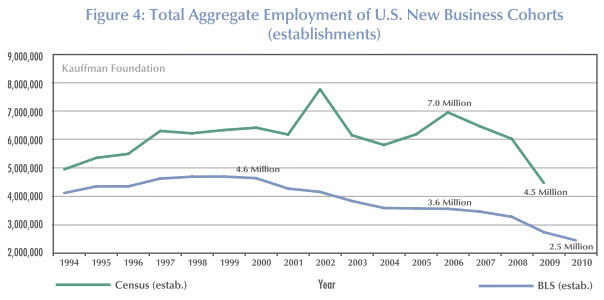

Which leads to the chart below, from a study released by the Kauffman Foundation. It shows that using two different measures, new businesses have been creating fewer jobs than usual over the past decade:

“While the recession certainly deepened the jobs deficit, the U.S. economy stopped producing enough new jobs well before the downturn,” said Robert Litan, Kauffman Foundation vice president of research and policy and study co-author.

….The study […] found that historically, new firms in the United States have generated about 3 million new jobs every year, but that recent cohorts have performed much worse, creating only 2.3 million jobs in 2009….”Not only are these businesses starting out smaller than their predecessors, they are staying smaller,” said E.J. Reedy, Kauffman Research Fellow and study co-author. “Cohorts of businesses rarely add jobs in the aggregate as they age. A cohort’s initial level of employment is likely the maximum number of jobs it will provide over its lifetime. Thus, falling contributions of jobs at new businesses will be felt in the U.S. economy for years.”

This is just one data point, and it doesn’t (or shouldn’t) diminish the need for monetary and fiscal action to reduce the cyclical chunk of our current unemployment problem. At the same time, it does suggest that there are structural issues at work too, and they’ve been at work for a while. We just didn’t notice them so much when the good times were rolling.