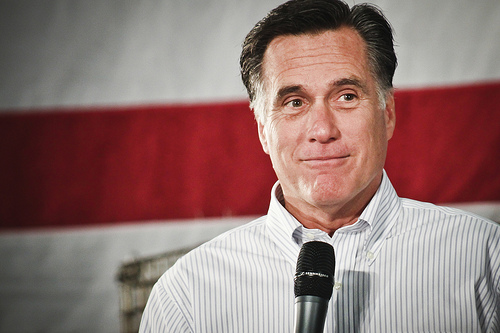

So this afternoon’s big news is that Mitt Romney finally released his 2011 taxes. He paid $1.9 million on $13.7 million in income, for an effective tax rate of 14.1%.

But there’s more! His tax rate would have been about 9% or so, but he decided not to deduct all of his charitable contributions in order to get his tax rate up to 14%. Why? Here’s the official statement:

“The Romneys [] limited their deduction of charitable contributions to conform to the governor’s statement in August, based upon the January estimate of income, that he paid at least 13 percent in income taxes in each of the last 10 years,” said R. Bradford Malt, Mr. Romney’s trustee.

Huh. So he did this specifically in order to fulfill his promise from August? Apparently so:

Campaign spokeswoman Michele Davis said in a statement that Romney “has been clear that no American need pay more than he or she owes under the law. At the same time, he was in the unique position of having made a commitment to the public that his tax rate would be above 13 percent. In order to be consistent with that statement, the Romneys limited their deduction of charitable contributions.”

This is….weird. Not that Romney would do this solely in order to avoid a single-digit tax rate that might be a political liability, but that he’d actually admit that he did it solely to avoid a single-digit tax rate that might be a political liability. Very odd. But I guess he felt like had no choice. There was no subtle way of increasing his tax bill that might go unnoticed, so that left only the charitable deduction dodge, something that reporters would obviously discover within minutes of paging through his return. He could hardly claim that he had done this out of the goodness of his heart, so he had to fess up that it was a purely cynical maneuver to avoid a politically dicey 9% tax rate.

But how much good will that do him? Won’t that 9% rate (or whatever it turns out to be) still get plenty of attention? I’ll bet it will.

Poor Mitt. He’s between a rock and a hard place. He either reveals that he paid only 9% in taxes, or else he publicly acknowledges that he fiddled with his returns to avoid looking like the tax-avoiding plutocrat he is. What a choice.

Nick Baumann and Adam Serwer have more on Romney’s tax returns here.

UPDATE: I’m actually seeing conflicting estimates about what Romney’s tax rate would have been if he’d taken his full charitable deduction. Maybe 9%, maybe 11%, maybe 12%. It’s a tricky bit of arithmetic because Romney’s taxes are so low that the AMT kicks in, and there’s no telling exactly how that affects his total tax liability. I’ll update this post if I see an authoritative estimate.