A few weeks ago the New York Times got hold of the first page of Donald Trump’s 1995 tax return. It showed a net operating loss of $916 million, which Trump was able to use to offset his income over the next 20 years, thus avoiding millions of dollars in income taxes. But while solving one mystery, it opened another: Just exactly how did Trump manage to declare such a big loss? Several theories made the rounds, but the Times now thinks it has the answer, thanks to a cache of “newly obtained documents.” Here’s the nutshell version of the Times’ explanation:

- Trump was a terrible businessman and lost a huge amount of money on his casino operations in the early 90s.

- As part of his bankruptcy negotiations in 1991, he persuaded banks to forgive hundred of millions of dollars in loans.

- Forgiven loans count as “Cancellation of Debt” income, which should have offset his huge operating losses. But somehow they didn’t. Why?

- The Times says it was because Trump used a legally dubious “equity-for-debt” swap. Basically, he swapped the bonds he couldn’t pay for new bonds that he classified as equity shares in the casino partnership.

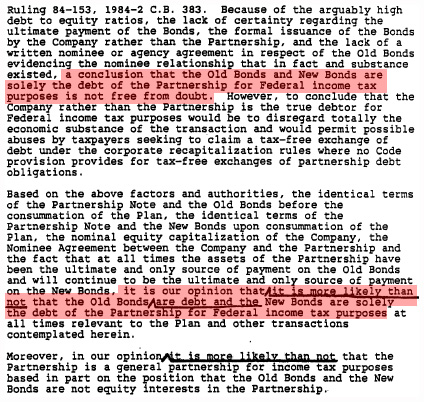

The Times makes a good case that Trump’s own tax lawyers told him this plan was extremely risky (see the excerpt from the official tax opinion on the right) and would most  likely be disallowed by the IRS. But we don’t know if it was. The trail stops cold in 1995.

likely be disallowed by the IRS. But we don’t know if it was. The trail stops cold in 1995.

If I’m reading this right, the basic story is that Trump gave his banks “New Bonds” in place of their old bonds and classified the new bonds as equity shares in the casino partnership. Trump then valued the equity as equal to the old debt, thus showing no net loan forgiveness and therefore no COD income. This despite the fact that, in reality, the equity was close to worthless.

So Trump then had $916 million in operating losses, but no debt forgiveness to offset it. “Even in the opaque, rarefied world of gaming impenetrable tax regulations,” says the Times, “this particular maneuver was about as close as a company could get to waving a magic wand and making taxes disappear.”

At this point, the question of how Trump gamed the tax system is mostly a matter of academic interest. Still, I’ve written about this before, and figured I should follow up with the latest theory. And this is it.