I’m trying to better understand what would happen if CSR subsidies are eliminated, and I’m making a bit of progress. Two folks have made contributions to my understanding today.

First, though, a brief bit of background. Obamacare plans are grouped by actuarial value: bronze = 60 percent, silver = 70 percent, gold = 80 percent, and platinum = 90 percent. This means, for example, that bronze plans are designed to pay 60 percent of your total medical costs, while you have to pay the other 40 percent out of pocket. The higher metal levels pay a larger share of your costs and are more expensive.

For the poor, there’s an extra bump at the silver level thanks to cost-sharing subsidies. Depending on your income, silver plans with CSR have an actuarial value of 94 percent, 87 percent, or 73 percent. This extra value costs money, of course, so the federal government pays CSR subsidies directly to insurance companies who sell these plans. It amounts to about $8 billion this year. These are the subsidies that President Trump keeps threatening to take away.

So what happens if CSR subsidies go away? David Anderson says the basic state of play is this: Insurers are still required to maintain higher actuarial values for the poor, so they’ll raise the premiums of silver plans to cover the cost. However, they can’t charge different prices to people with different incomes, so the premiums for silver plans will go up across the board. But here’s the catch: federal tax credits are benchmarked on the cost of silver plans. If the cost of a silver plan goes up, so do the tax credits. That is, the tax credits go up for everyone. Four things happen:

- The increased tax credits make up for the higher silver premiums. The net cost of silver policies will stay the same.

- The tax credits go up enough that bronze plans become free for some people. This will attract more people into the Obamacare marketplaces.

- The net cost of a gold plan is less than a silver plan. For many people, this means they can switch to gold plans with a higher actuarial value and actually save money compared to silver.

- Outside of Obamacare, insurance companies will offer different policies that don’t include CSR. So for folks who don’t use Obamacare, the cost of insurance won’t change.

Anderson complains that this is, overall, an inefficient use of the extra money we’d be spending, but I’m OK with that. At the moment, extra money is not on the table in any way, efficient or otherwise, so I’ll take what I can get. If Republicans want to put something better on the table, I’m all ears.

On the less bright side, Stan Dorn tweets about a few problems (note that I’ve de-tweeted all abbreviations):

It’s mixed. Some get better subsidies. Some lose employer coverage. Some lose access to all individual plans….People < 200% of poverty lose because tax credits run into index limits. >200% poverty people gain, from higher tax credits and low gold premiums….Plus disruption. 3 million lose employer coverage by 2022. Those >200% of poverty leave silver plans; that’s about 1.5 million….Biggest problem: 5% of US in areas with no indiv mkt plans, unless CSRs cut after carriers set rates. If so, ENTIRE STATES have no qualified health plans.

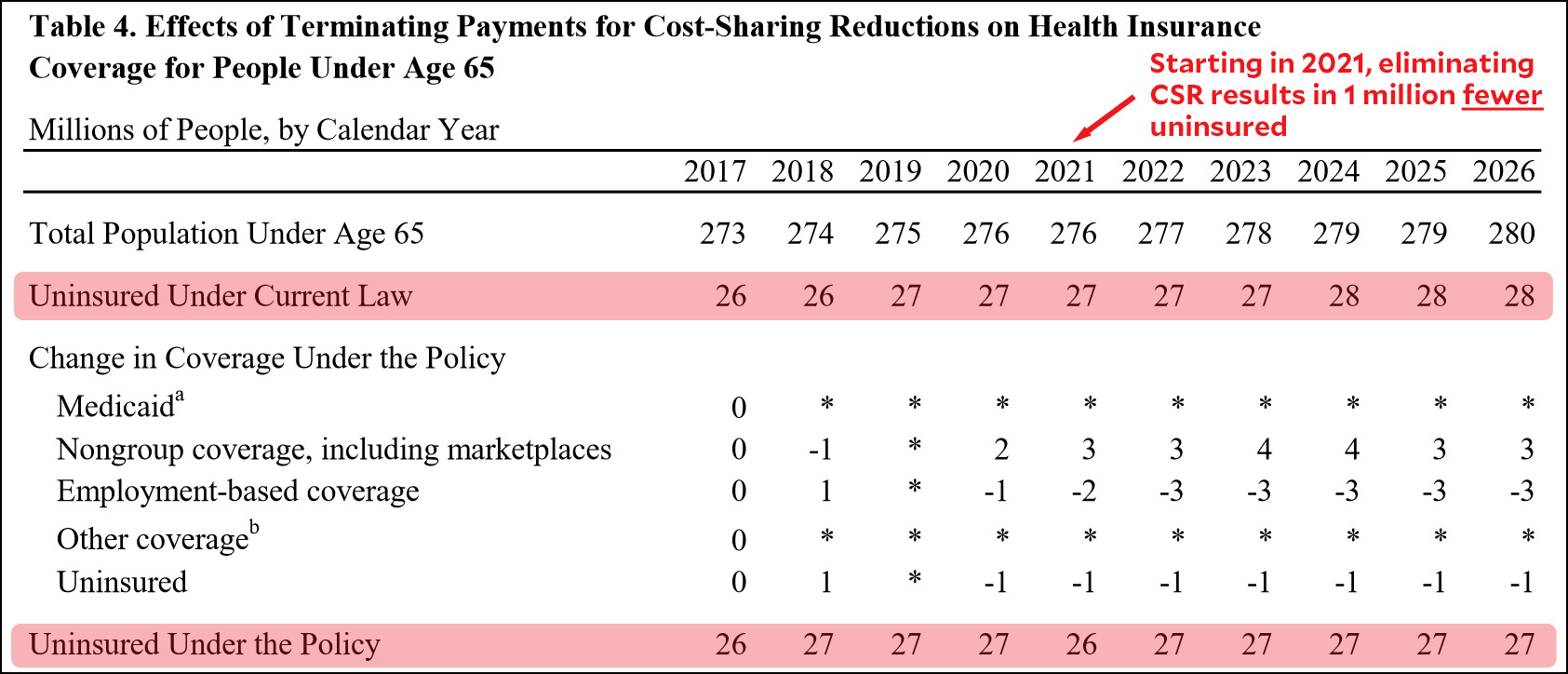

This could really use a very detailed deep dive from a qualified analyst. My take is this: total federal spending on tax credits would go up, which means that the net result of all this would be positive. More people would get more subsidies. However, the benefits would be spread sort of haphazardly, and there would be both winners and losers. Some of the losers, however, would be temporary. The CBO report, for example, suggests a small reduction in the number of people covered and a small increase in the number of regions with no insurance carriers. However the effects are minor, and go away by 2020. In fact, after 2021 CBO estimates that eliminating CSR subsidies would lead to an extra million people being covered by Obamacare.

For the moment, then, I’ve tentatively changed my mind about CSR subsidies. I hope Trump lets them lapse. As Anderson says, it wouldn’t be the best possible use of an extra $194 billion (over ten years), but it’s still extra money. Let it rip, Mr. President.