Yesterday the Wall Street Journal said the stock market would be sucking if not for the tech sector:

Three technology titans have powered nearly half of the S&P 500’s advance this year, a worrying sign for investors expecting a strengthening economy to lift shares of manufacturers, oil companies and other firms whose fortunes typically improve with growth.

The S&P 500 technology sector has driven more than three quarters of the index’s gains, according to S&P Dow Jones Indices. The next biggest contributor is the consumer-discretionary sector—which includes tech-focused Amazon and Netflix—with more than a third of the advance.

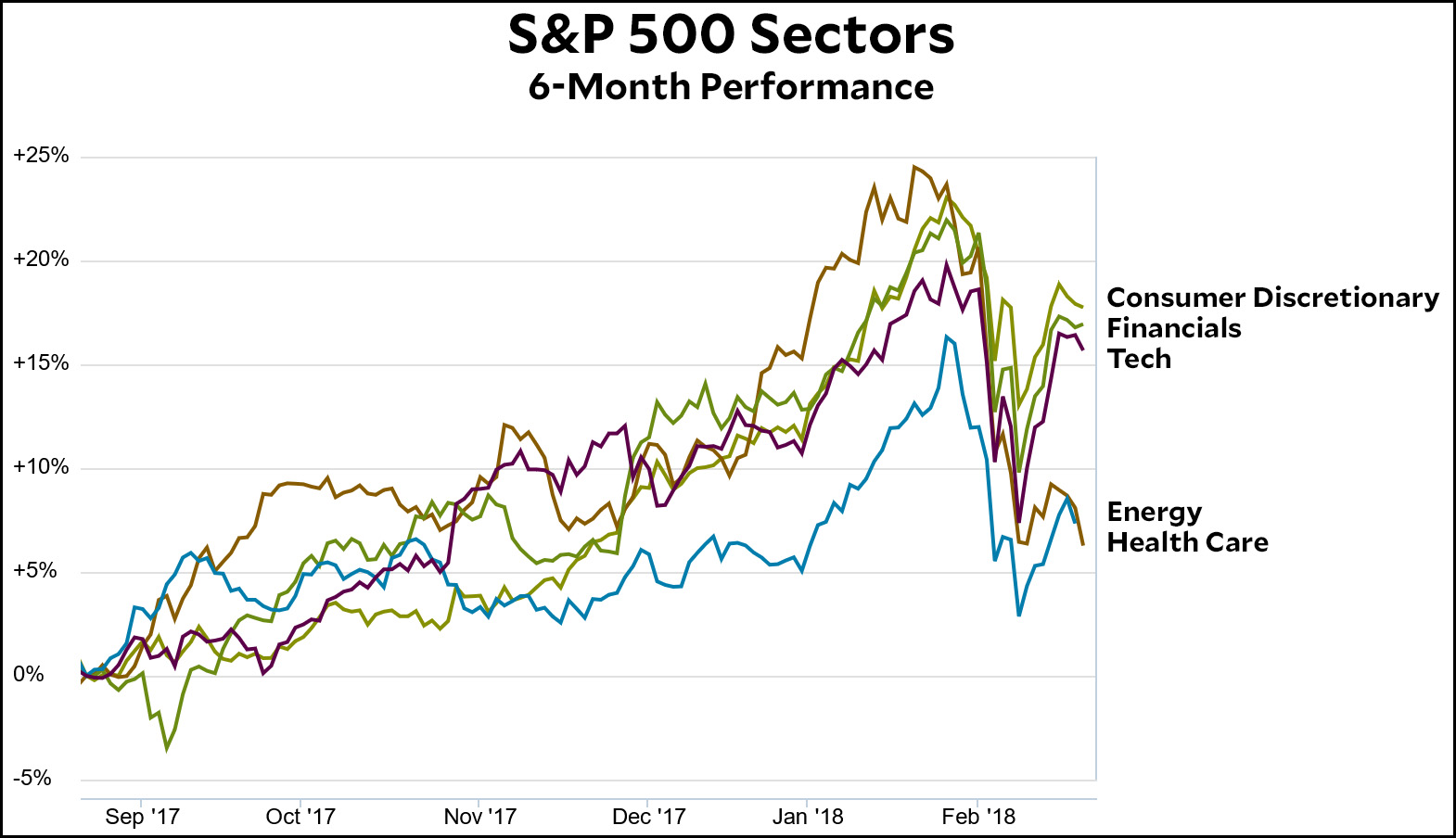

If you look at a few weeks of performance, you’ll always find something to worry about. Here’s what a few S&P sectors look like for the past six months:

Tech is doing great, but so are financials and the consumer discretionary sector—which does include Amazon, but is overwhelmingly standard consumer stuff like Disney and Comcast and McDonalds. And consumer durables have been kicking ass for the entire past year.

I don’t know how long this will keep up, but the market isn’t about to crater as soon as tech stocks come back down to earth. It’s going to crater if the Fed doesn’t allow middle-class earnings to rise and consumers stop spending. This is one sense in which the stock market really is a proxy for the entire economy.