What’s the best measure of inflation? The answer depends a lot on what you’re doing. Predicting future inflation? Figuring out how much we really spend on defense? Comparing physician salaries around the world? There are different measures of inflation that work best for all of them.

But let’s assume we just want “ordinary” inflation. That is, the average price rise experienced by the average family for a basket of average goods (food, gasoline, clothing, rent, etc.). The two main contenders are CPI—the Consumer Price Index—which you see on the news every month when they tell you how much “inflation” rose, and PCE—Personal Consumption Expenditures—which you never see. However, PCE is widely used in various professional contexts.

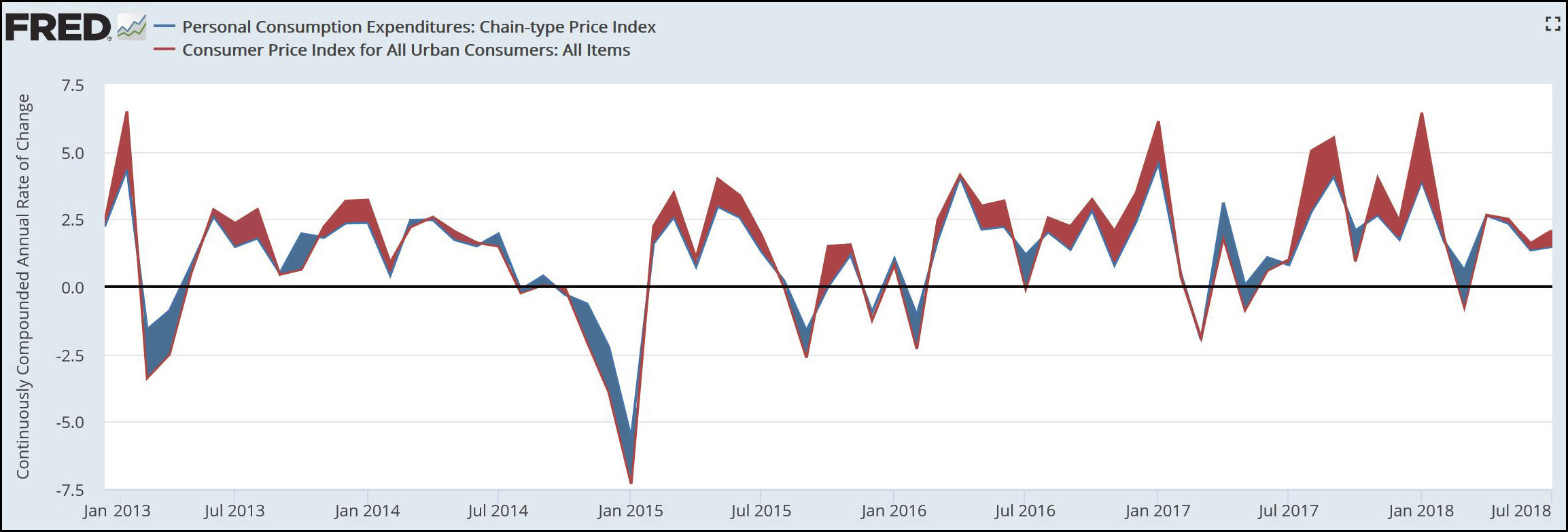

There is, generally, not much difference between the two. This chart from FRED covers the past five years and shows periods when CPI was higher (red) and periods when PCE was higher (blue). The differences mostly wash out, but over time PCE produces a slightly lower inflation rate than CPI.

Why does this matter? Consider an example. Suppose workers’ wages are up 2 percent but CPI is running at 2.5 percent. Prices are rising faster than wages, which means that in real terms workers are experiencing a 0.5 percent decline in purchasing power—in other words, a pay cut—not a 2 percent increase.

But suppose PCE shows inflation running at a lower rate of 1.5 percent. Now, wages are rising faster than prices, and in real term workers are seeing a 0.5 percent increase in purchasing power—in other words, a pay increase. It’s still not 2 percent, but at least 0.5 percent up is better than 0.5 percent down.

So which is it really? Speaking for myself, I prefer CPI. Its basket of goods is weighted based on household surveys, and it includes only medical expenses that households actually pay, not expenses paid by your employer or the federal government. These two things account for nearly all of the differences in the two indexes, and I think CPI is therefore more accurate if your goal is to measure the lived experience of average families.

For example, here’s a chart showing what blue-collar wages looked like over the past two years:

Over the past two years, CPI measured the inflation rate at 4.7 percent. This ate away nearly the entire gain in wages, which means that real wage gains were close to zero.

But PCE measured the inflation rate at only 3.8 percent. According to the PCE index, prices didn’t go up as much, which means that wages really did gain some purchasing power. In this scenario, the real hourly wage increased from $21.58 to $22.65.

Blah blah blah. So which one is it really? Sorry. There’s just no firm answer to that. On a technical basis, there are experts who make a case for both. On a gut basis, there’s simply no way for any of us to “feel” a two-year difference of 1.1 percent vs. 0.27 percent. But one thing is clear: you need to decide which one you think is more accurate and stick with it. You can’t just pick whichever one happens to help your argument at the moment. For example, if you’re measuring something in the first half of 2017 and you really really want a high inflation rate to prove your point, you’d be tempted to choose PCE: it’s generally running higher than CPI during that period (look at the blue areas in the top chart). But in the second half of 2017, you’d be tempted to choose CPI since it’s generally running higher (red areas). Obviously you can’t do this. And you can’t do it between posts, using CPI one time and PCE another, unless you have a concrete reason for doing so and you explain it.

In the end, all I can do is repeat my preference: CPI has had some problems over the years, but they’ve nearly all been corrected and I think the current version is both admirably accurate and more household-oriented than PCE. Plus there’s the fact that government statistics almost universally use CPI. If you routinely use PCE, you’re routinely going to have to explain why your figures are a little bit different from the official BLS and BEA figures. Bottom line: when you net it all up, you’re really better off using CPI on a regular basis unless you’re a professional economist with a serious reason for using something else.