You all know about California’s Proposition 13, don’t you? Good. So I’ll skip the details and just mention one thing it does: it limits the assessed value of your house from rising more than 2 percent per year.

Here’s an example. Marian and I bought our house in 1993 for about $300,000. Thanks to Prop 13, it is now officially valued at about $500,000, which means my property tax bill clocks in at roughly $5,000 per year. Needless to say, this bears no relationship to reality. In fact, our house is probably worth about $900,000 or so, which means I save $4,000 every year on property taxes.

But before you get too jealous, there’s a sad part to this story. What if I want to move to a new house? I don’t get to take my old, fake assessed value along with me. The new house is assessed at whatever I paid for it, which could be a million dollars or more! It’s outrageous. Why should I have to pay property taxes on the actual value of my home? After all, I’m old and pretty affluent. Paying high property taxes is for the little people.

But not to worry. Years ago, old people fought for an exemption to Prop 13 and they got it. There are some restrictions, but basically if they sell their house and buy a less expensive one when the kids move out they’re allowed to keep their old assessed value. So now everyone’s happy, right? Of course not. David Dayen explains further:

Proposition 5 says that’s not enough. So it cuts property taxes for those buying a less expensive property and for those who buy a more expensive new home, their taxes only go up on the difference in price between the home they sold and the one they buy. Proposition 5 also lets them repeat this exercise indefinitely.

This won’t expand the housing supply. It won’t even lubricate the housing market because the state has already removed any disincentive to downsizing. Proposition 5, if anything, could make prices shoot up, as senior home buyers who are saving $1,000 a month on property taxes bid up their offers.

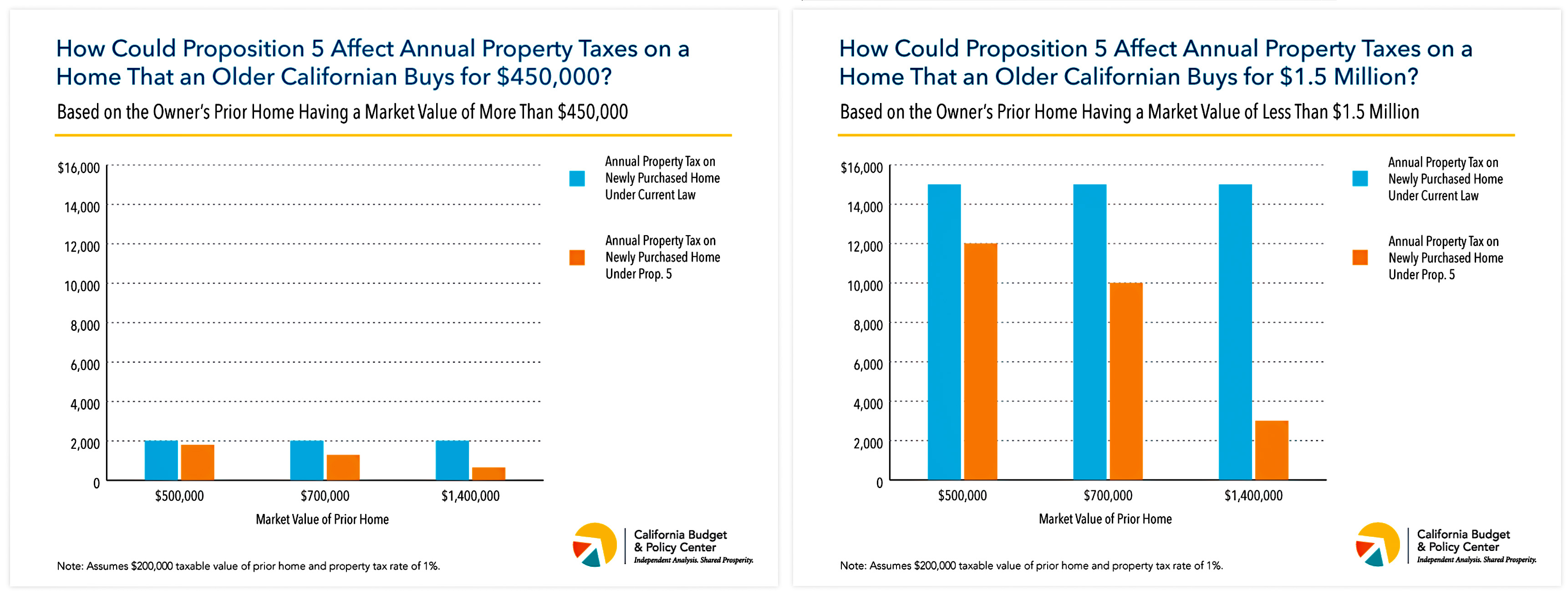

Figures from the California Budget Center show who truly benefits from this arrangement. Due to Proposition 5’s complicated formula, those selling the most expensive properties will reap far greater savings. For example, take two families who bought houses 20 years ago for $200,000. Both decide to move into $1.5 million condos. If the first family’s house is now worth $500,000, they would save $3,000 on their annual tax bill. If the second family’s home is worth $1.4 million, they would save a whopping $12,000 a year.

Forty years ago, Prop 13 was sold primarily as a matter of fairness to older property owners who were paying ever higher property taxes thanks to the red hot Southern California housing market of the 70s. The rising value of their homes was purely paper profit since they had no intention of selling them, but their rising property taxes were very real indeed.

There was some truth to this complaint, and the answer would have been some kind of narrow property tax reform that applied solely to retired folks on fixed incomes. Instead we got Prop 13, which applied to everyone. This destroyed California’s tax base and permanently moved political power to Sacramento, which ended up as the source of all decisions about how to divvy up tax revenue and how much state money to dole out to make up for the loss of local property tax revenue.

Long story short, though, old rich people still aren’t satisfied. What they really wanted in the first place was essentially an exemption from ever having to worry about the actual market value of their home. Prop 13 was only a first step. Prop 60 in 1986 allowed a one-time exemption from reassessment if you sold your house after the age of 55. Two years later, Prop 90 expanded the exemption a bit more. And now we have Prop 5, which for all practical purposes finally makes the exemption permanent no matter what. And as the CBPC points out, its benefits are massively tilted toward richer homeowners who have bigger exemptions in the first place and are more likely to move around multiple times. In other words, the people who least need it.

Prop 5 is a giveaway to the elderly rich, but that’s not all: it’s also yet another band-aid that keeps us from taking a serious look at Prop 13 and reforming it in the ways that are really needed. Here’s hoping that Californians are smart enough to vote it down.