NPR’s Jim Zarroli reports something about the March stimulus bill that I didn’t know:

Tucked into the bill are a series of provisions that mostly cut taxes for rich people. For example, they can now reduce their tax bills by claiming bigger losses from previous years, even though the losses they suffered had nothing to do with COVID-19. The Joint Committee on Taxation says that provision alone will provide an average tax cut of $1.6 million for people in the top income bracket. That includes a lot of people in the real estate business, like the Trump family.

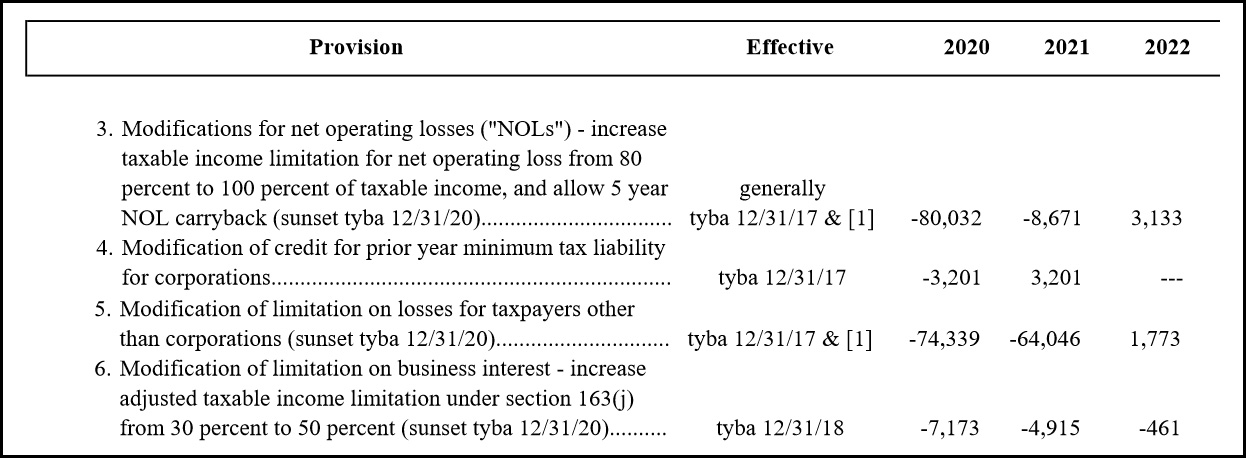

Hmmm. Here’s the JCT estimates of the benefits from various tax loss changes:

That adds up to a tidy sum, and needless to say, we non-rich people don’t really benefit much from more generous tax loss carryforward rules. I don’t, anyway. For rich people, however, it’s quite the nice little boon, and it’s hard to believe they really needed it.