Photo: <a href="www.marcusbleasdale.com">Marcus Bleasdale</a>/<a href="www.viiphoto.com">VII</a>

IN 1890, A BEARDED YOUNG POLISH SEAMAN made a trip up the Congo River as a steamboat officer and was appalled by the lust for riches he saw among his fellow Europeans. A decade later he finally got the experience onto paper. “A stream of manufactured goods, rubbishy cottons, beads and brass-wire” flowed into the interior, wrote Joseph Conrad in Heart of Darkness, “and in return came a precious trickle of ivory…The word ‘ivory’ rang in the air, was whispered, was sighed. You would think they were praying to it.”

The trickle of ivory that Conrad described was highly visible: elephant tusks carried on the shoulders of exhausted porters from the African interior to the coast, where it could be shipped off to Europe to be carved into jewelry, piano keys, and false teeth. More than 100 years later, far more wealth flows out of this same territory, now the Democratic Republic of Congo, but today much of it can’t be seen. If, for example, you stand beside the washboard dirt road that winds out of the Ituri district of the country’s northeast, you will see a few vehicles, not more than five or 10 an hour: a dusty SUV, an army jeep, two men on a motorbike, an ancient truck with a precariously high load of fruits and vegetables and a layer of people hitching a ride on top. But you won’t see the treasure they are carrying, for it is too small. It will be in little plastic bags in someone’s pocket, or perhaps, better to be concealed from thieves and greedy policemen, sewn into a shirt seam or slipped under a shoe’s insole. In this part of the country the main source of wealth is gold. More than $1 billion worth is mined in Congo each year, and a good portion of it comes down this road.

Gold is only one of a half-dozen or more lucrative minerals to be found in Congo, and together they constitute what may be the worst case on Earth of what has come to be known as the “resource curse.” As inevitably as oil drew the United States into Iraq, it is the temptations of this wealth—more than ethnic rivalries, the legacy of colonialism, or anything else—that has turned Congo into the horrific battleground it has been in recent years. A country with a lavish array of natural riches and a dysfunctional government is like a child heiress without a guardian: Everyone schemes for a piece of what she’s got.

As far back as Congo’s history is recorded, the wealth from this vast natural treasure house has flowed almost entirely overseas, leaving some of the planet’s best-endowed land with some of its poorest people. I have often heard Congolese friends say, “We wouldn’t have so much trouble if we weren’t so rich.”

Dealers in mining towns buy diamonds, gold, and whatever else locals can wrest from the ground by hand.

Dealers in mining towns buy diamonds, gold, and whatever else locals can wrest from the ground by hand.

Of all the minerals to be found here, none has for so long lit up the eyes of foreigners as the yellow metal that has shaped the course of conquest on almost every continent. And today, with worldwide economic troubles and ever-rising demand from electronics manufacturing (see “The Scary Truth About Your iPhone“) sending its price to unimagined heights, a new gold rush is in the making in Congo. Some of the richest goldfields in all of Africa lie up this dirt road, which begins some 350 miles east of the turnaround point of Conrad’s nightmare steamboat trip up the Congo River. The journey there, I hope, will be a way of seeing some of this country’s tragic—for there is no other word for it—wealth at its point of origin, before it vanishes into jewelry stores and bank vaults and electronics plants in Europe and China, New York and California.

The road begins in war-battered Bunia, capital of the Ituri district. Driving up it, through the East African savanna toward the rainforest of the interior, is like a journey in time. Each bend takes you past reminders of the region’s long, unhappy history and of the successive waves of people who have sought wealth here, most recently in a dozen years of sporadic, bloody fighting that has largely fallen out of the headlines yet still continues, particularly in two provinces just south of Ituri.

From 1895 onward, Europeans eagerly reported traces of gold in Ituri, but only in 1903 did two Australian prospectors, hired by the colonial authorities, examine a riverbed near a village called Krilo and confirm that the find was potentially lucrative. Whites promptly mangled the name into Kilo, and a few years later the first leg of this road was built for bringing in mining equipment by oxcart. Congo was then the world’s only privately owned colony; its shrewd and ruthless proprietor, King Leopold II of Belgium, had early on in Europe’s great landgrab secured what he called “a slice of this magnificent African cake.” Belgium itself had not been interested in acquiring a colony, but for its business-minded king—a constitutional monarch with only limited powers at home—that presented an opportunity: He hired the explorer Henry Morton Stanley to stake out boundaries for him and then pulled off the lobbying coup of the century by persuading the United States and most of Europe to recognize this vast territory as his personal property.

The gold diggers the king put to work here were different from those mining gold at the same time in the Klondike, for they arrived in chains. Leopold’s entire colonial economy was based on forced labor, and the system continued after the king, in 1908, sold his slice of the African cake to the Belgian government (which finally saw how profitable a colony could be) and it became the Belgian Congo.

By the following year there were 1,400 African forced laborers at Kilo; within six years, as mining sites proliferated in the region, the number of people forced to work at them reached 7,500, and it would expand far more. As it happened, the arrival of miners was a boon for white ivory traders: They now had a market for the rest of the elephant, selling dried meat to the mines for their workers. The Belgians requisitioned laborers from local chiefs and supplied the chains and metal collars or yokes in which they were taken off to the mines. Chiefs were punished if they failed to provide their quota of men, and were required to supply food and building materials from their villages as well. The mining industry was hungry for labor, not just to dig for gold, but to carry supplies, firewood, and equipment in weeks-long caravans to the mine sites. Of the women I see now in long, brightly colored dresses eking out a living selling bananas spread on a piece of cloth at the roadside, how many, I wonder, are the granddaughters or great-granddaughters of those who were marched to the mines in chains? One eyewitness account from 1914 describes mothers nursing babies as they carried loads of up to 66 pounds.

Some Kilo miners were forced to work for a decade or more, and released only when they supplied sons to take their places. Repeated uprisings against the forced-labor regime were brutally suppressed and thousands of deserters were recaptured and put to work again. The mines paid bonuses to overseers based on the amount of gold mined by the Africans under their control, whose workday rose to 12 hours during World War I. Discipline was enforced by armed mine police and by the chicotte, a whip of sun-dried hippopotamus hide with razor-sharp edges, whose blows were meticulously tabulated: Records from one group of northeastern Congo gold camps register 26,579 lashes applied to miners during the first half of 1920 alone. Around that year, the Belgians realized that the harshness of their regime was shrinking the population so rapidly that they would eventually have no labor supply left—you can actually find colonial officials saying this on paper. The system then became less severe as control of the northeastern gold mines passed from the colonial government to a private corporation. Gradually, requiring Africans to pay taxes (for which they had to earn money) replaced outright coercion as a means of turning subsistence farmers into miners or industrial workers. Forced labor, however, remained an element of the economy here, as elsewhere in colonial Africa, until the 1940s, and the whip lasted even longer.

Despite having no political rights, the Congolese, ironically, enjoyed their highest standard of living in the decade or so before the colony won its independence in 1960. Belgians invested heavily in the gold mines, and although the profits continued to flow back to Europe, the colonizers came to understand that this industry and others would produce more if workers were well fed, healthy, and literate. Not too literate, mind you: The colony had one of the best elementary education systems on the continent, but virtually no Africans were trained for management positions. Schools for whites and blacks were segregated, of course, and no black schools in the gold mining towns went beyond 8th grade. As we drive further along the road, past trees with high green bunches of papayas, we can see aging brick health clinics and primary schools built during the late colonial era.

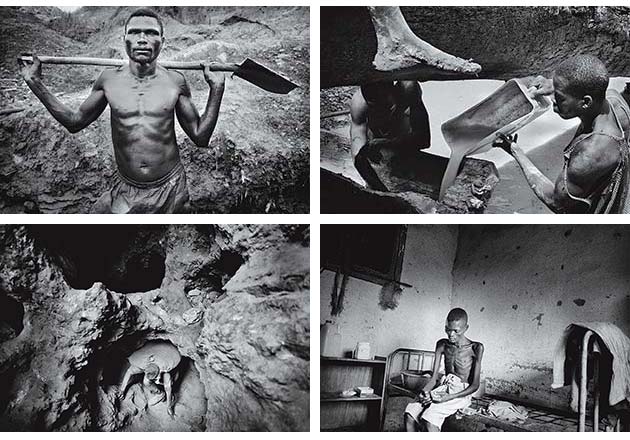

Clockwise from top left: A miner in Mongbwalu; men panning for gold by hand; a former miner now suffering from tuberculosis; bringing up ore from a hand-dug tunnel. See the detailed slideshow here.

Clockwise from top left: A miner in Mongbwalu; men panning for gold by hand; a former miner now suffering from tuberculosis; bringing up ore from a hand-dug tunnel. See the detailed slideshow here.

OTHER BUILDINGS, abandoned, tell the next phase of the story. With strong American encouragement, an army officer named Joseph Mobutu seized power in a military coup in 1965. For 32 years he maintained a repressive, disastrous dictatorship, changing his name to Mobutu Sese Seko and his country’s to Zaire. Delighted to have an anti-communist ally who was friendly to American investors and helpful in covert military operations, the United States enthusiastically supported him, providing more than $1 billion in aid over the decades. President George H.W. Bush welcomed Mobutu to the White House as “one of our most valued friends.” Sucking his country’s economy dry, the dictator amassed a personal fortune estimated at $4 billion, spending it on assorted palaces, a huge yacht, two private ambulances, an airport near his Congo birthplace, Concorde rentals to pick him up there for trips to Europe, and elegant villas on the French Riviera and in other pleasure spots.

Plum executive positions like those at the Ituri mines Mobutu passed out to members of his clan and to political allies, who knew little about mining, pocketed profits, and let machinery wear out. By the mid-1970s, gold output was declining every year, and by the end of Mobutu’s reign most industrial gold mining had come to a halt. One town we pass, formerly a depot for mining vehicles, is filled with empty workshops, garages, and jumbles of rusted old machinery. We spot the gray concrete bottom of what was once an Olympic-size swimming pool. The ladder into the pool and the iron framework of two high-dive platforms are still there. Some old men sitting in the shade tell us that this was a club for European skilled workers and company officials. The whites all left soon after independence, they say; the pool closed some years later.

Since Mobutu’s overthrow and death in 1997, Congo has been in the grips of a fiendishly complex and brutal war whose exact toll no one knows. It may well be in the millions if you count those who died because fleeing their homes or living in packed, disease-ridden refugee camps cut them off from adequate food and medical care. Women and girls by at least the tens of thousands have been gang-raped by government soldiers and rebel militias, who have found this a chillingly effective method of terrorizing the civilian population of areas they occupy.

Refugees flee a warlord’s attack on Ituri in 2003. Fighting in this West Virginia-size district, most of it driven by competition to control the goldfields, displaced more than half a million people and killed more than 60,000.

Refugees flee a warlord’s attack on Ituri in 2003. Fighting in this West Virginia-size district, most of it driven by competition to control the goldfields, displaced more than half a million people and killed more than 60,000.

This has not been a civil war driven by ideology, but rather a multisided free-for-all driven by plunder. No fewer than two dozen armed groups signed the most recent of several shaky peace deals, for example. Among the warring parties have been the ineffectual national government, an array of feuding local ethnic warlords, and nearby African countries hungering for a share of Congo’s great natural wealth. Here in Ituri, most of the combat has been between two shifting coalitions of militias, each of them intermittently supported by neighboring Rwanda or Uganda. Both countries have eagerly eyed Congo’s gold—and its wealth of other metals necessary to make everything from computers to cell phones, including tin ore, coltan, and tungsten.

Today, with some help from a United Nations peacekeeping force, the northeastern goldfields are back under the Congolese national government’s military control, but the evidence of fighting is everywhere you look. We pass the town of Bambu, once the administrative center for the network of Belgian mines in the region. A guidebook from some 60 years ago recommends the company-run hotel—now long defunct—to the white visitor. Palm trees shade the dirt streets; the firs that line one were obviously imported from Europe. A spacious white plaster and brick villa on a hilltop above town was once the home of the mines’ Belgian managing director. When rival warlords and their Ugandan and Rwandan backers battled for control of the area, each side occupied it. “They always liked these buildings high on a hill, especially if the Belgians once had them,” explains my traveling companion, Anneke Van Woudenberg. She is a longtime Congo specialist for Human Rights Watch and has written a report on exploitation by the mining industry in this region, The Curse of Gold, well known here in its French translation.

Today the Congolese army has taken over the villa as its local headquarters, and several dark-green military trucks are parked outside. Like the rebel warlords before them, many army officers have profited from gold, sometimes by directly controlling mines and forcing soldiers or villagers to work in them, and sometimes by brazenly insisting that anyone who wants to mine gold nearby has to buy permits from the army. The desirability of senior army posts is determined not by how many troops you command, but by which mining areas the position controls. In half a dozen larger Congolese cities, you can find luxurious houses, surrounded by high walls and security guards, owned by generals whose nominal pay is less than $100 a month.

THE BIG MINES may be closed, but that does not mean mining in Ituri has stopped. Along the side of the road walk men in gum boots and sweaty T-shirts, balancing heavy sacks of rocks on their heads. They will put the rocks in a metal bucket and pound them into dust with an iron bar. Then they will combine the dust with water and mercury—which attracts the specks of gold—and, trying not to breathe the toxic fumes, will heat the gold-mercury mix in a pot over an open wood fire to evaporate the mercury.

At one point our car is suddenly waved to a stop by two sentries at a checkpoint. “Du thé! Un sucré!” (some tea, something sweet—slang for bribes) they say through the car window, each rubbing thumb and forefinger together. Van Woudenberg, undaunted, gets out to deal with them and a superior, with a brimmed military cap and red braid, who emerges sternly from a little guardhouse. Anywhere you travel in Congo, uniformed men demand money; soldiers and police are paid little to begin with, and much of that vanishes into the pockets of higher-ups before it ever reaches them. But this time a curious thing happens. When the chief of this little extortion post examines Van Woudenberg’s passport, he looks up and says, “You’re the woman who wrote The Curse of Gold! I’ve read it three times!” He sends us on our way with a smile. There is something moving about this: a petty thief applauding someone who has exposed grand theft.

Some three hours up the road, we reach the town of Mongbwalu, which sits next to a gold deposit so coveted that the town changed hands five times in the battling between rival ethnic militias in the last decade, leaving some 2,000 people in the vicinity dead during one seven-month period. Warlords wanted the gold to buy weapons—often from the corrupt national army that supposedly was trying to suppress them. The old refinery here is now a rusted skeleton, destroyed by fighting in 2002. Some eerie video footage taken here that year provides a microcosm of the entire war. Civilians are seen fleeing, carrying rolled-up mattresses on their heads. Meanwhile, officers in berets, boots, and camouflage fatigues from the militia group Union des Patriotes Congolais, which had taken the town a few days before, are carefully examining still-intact refining machinery, a crushing mill, and football-size chunks of gold ore. A Ugandan TV correspondent, doubtless at the request of the militiamen who’ve invited him along, goes on camera to urge “foreign investors” to help get the mines working again. The warring militias assumed that multinational corporations would have few scruples about dealing with warlords if the stakes were high enough. They turned out to be right.

We spend the night under mosquito nets at the town’s Catholic mission, where a priest was tortured and murdered during the war. The colonial-era guidebook describes Mongbwalu as having “hospitals for Europeans and natives,” but today the grandest relic of those times is a spacious cathedral, built by the Belgians in the 1930s, with arched windows and a dark-stained wood ceiling within which other priests hid during the last round of massacres. From the cathedral’s front steps is a lovely view of green hills that are the western edge of the great equatorial rainforest.

Above the altar hangs another glimpse into the colonial past: a huge, mural-like painting. Madonna and child float on a golden cloud; on the ground below, offering flowers in adoration, are nine or 10 African adults and children, several carrying a flag emblazoned with the name of the old Belgian mining company. In a bottom corner, a frightened-looking witch doctor, with feather headdress and necklace of shells, is fleeing the scene, vanquished by the combination of corporate power and the Virgin Mary.

In Mongbwalu, family members wash and bury eight-month-old Sakura Lisi, daughter of a gold miner, who died of malaria. Congo has virtually no public health system, and AngloGold Ashanti, a multinational company spending millions prospecting for gold in the desperately poor community, has largely ignored pleas for help.

In Mongbwalu, family members wash and bury eight-month-old Sakura Lisi, daughter of a gold miner, who died of malaria. Congo has virtually no public health system, and AngloGold Ashanti, a multinational company spending millions prospecting for gold in the desperately poor community, has largely ignored pleas for help.

ALTHOUGH corporate mining has reaped billions from Ituri over the decades, during the war it was largely on hold. Multinational corporations prefer a government weak enough not to tax and regulate heavily but strong enough to guarantee order. Today the fighting in the goldfields area has subsided, the price of gold is soaring, and the conveniently weak Congolese government is back in control. Industrial mining is about to begin again, big-time.

Just as Australian prospectors set off the first scramble for Ituri gold a century ago, an Australian is chief prospector in Mongbwalu today. Geologist Adrian Woolford, who is 30 “and getting older by the minute,” is exploration manager for a subsidiary of South Africa-based AngloGold Ashanti, the world’s third-largest gold mining company. Tall, thin, bearded, in khaki shorts and khaki shirt with the sleeves rolled up, Woolford draws the good pay necessary to lure highly trained specialists to this remote spot. He gets two weeks off for every six he works. On his last two-week break, he vacationed in Cambodia; on the next he will go to Brazil. Several hundred yards away people are living in dirt-floored huts lit by candles or kerosene lanterns, but in the mining company’s hilltop compound we are in a little Western island of flush toilets and working electricity. On his computer monitor Woolford shows us a three-dimensional image, which he can rotate so we can see it from any side or from above or below, of what’s underground at Mongbwalu. Bodies of gold ore in brilliant red and yellow are separated by thin green lines of other rock. The image also shows some of the more than 500 sampling holes that have been sunk in the ground with diamond-bit drills, some of them extending nearly 2,000 feet down.

The drilling has confirmed a treasure trove. Beneath less than one square kilometer of ground, next to the hill we’re on, Woolford says, are more than 2.5 million ounces of gold, worth about $3 billion at current prices. And it is found at the rate of about three grams per ton of rock—an extraordinarily high batting average for a deposit this big—all of it within an easy 800 feet of the surface.

The company has about 250 employees on this site. Mostly they work inside the compound, tightly protected by guards who include Nepalese Gurkha veterans of the British army. (These are provided by a subsidiary of ArmorGroup, the security firm whose guards at the US Embassy in Afghanistan were at the center of a hazing scandal disclosed last September.) The compound’s gates, floodlights, and high razor-wire fence prompt Joel Bisubu, a Congolese human rights activist traveling with us, to call it “Guantánamo.”

AngloGold Ashanti recently finalized a series of agreements with the government under which it will begin mining here and at another major site in the northeast. At Mongbwalu, it will have an 86 percent share of the operation; the near-bankrupt former state mining company, now being privatized, will have the remainder. Four other multinationals—based in London, Canada, and South Africa—have likewise concluded closed-door agreements over mining rights. No one will ever know what Congolese government officials may have reaped from these deals in the way of quietly promised jobs, favors, or money under the table, in a country where such rewards are routine. Representatives of local communities, meanwhile, found it hard to get a seat at the negotiating table.

Seldom, in fact, do local communities gain much from such agreements; that is part of the resource curse. This pattern is all the stronger in a place where the national government has as fragmentary a hold as it does here. A failed state fails its people in many ways, and one of them is that, in a world of powerful corporate players, a weak and corrupt government has no bargaining power. For industrial mining that could create new skilled jobs, Congo desperately needs the expertise and investment capital that, for better or worse, only a multinational can offer. But a company like AngloGold Ashanti, with more than 60,000 employees at work on four continents, can easily invest elsewhere if the terms in Congo are not to its liking.

The company would not score high in any social-responsibility sweepstakes. During the war years, lucrative mining concessions changed hands many times between companies eager for future profits and warlords happy to sign contracts. Despite a United Nations embargo on dealings with rebel groups, AngloGold Ashanti made payments to the warlord who controlled Mongbwalu some six years ago, also providing him and his entourage rides in company planes and vehicles, and a house on its concession. While spending millions of dollars prospecting, it has made only small contributions to a local hospital, schools, a soccer tournament, and the like, keeping at arm’s length a coalition of local groups and churches lobbying for this desperately poor community. “Of everything we’ve put in our list of demands and grievances,” says Richard Magabusini, an elected chief who is a member of the coalition, “nothing has been done. They keep saying, ‘We’re just prospecting. We’ll look at all this later.'” AngloGold Ashanti prefers to deal instead with a collection of more pliable community representatives it has assembled, rather like a company union.

Another point of tension with people here is whether the company will dig a large open-pit mine or sink shafts to tunnel underground. For gold deposits nearer the surface, the company almost certainly will do the first, which is far cheaper; people who live here want it to do the second, for open-pit mining strips away fertile topsoil, leaves a huge gouge in the landscape, and can pollute rivers and streams. Here, it would also require moving an entire village. “We have our ancestral secrets in our communities that must not be disturbed,” says Chief Magabusini. “We are categorically demanding that they not move people.”

As the company takes its slice of the African cake, only a tiny percentage of the proceeds from those 2.5 million ounces of gold is likely to stay in Congo—and even then, much of what does will probably leak into high officials’ private bank accounts. AngloGold Ashanti mined more than $1.5 billion worth of gold in neighboring Tanzania between 2000 and 2007, but only 9 percent of that money has remained in the country as taxes or royalties. Where do the profits go instead? A good chunk comes to the United States, for even though the company is based in South Africa, its largest single shareholder—hedge fund billionaire John Paulson—lives on the Upper East Side and summers in the Hamptons. He owns 12 percent of the company, and a number of other Americans have shares.

THE BIG MONEY in gold mining comes to those who can afford to dig massive mines and build refineries to process the ore. But those who cannot, an estimated 70,000 to 100,000 people in Congo’s northeast—including some 10,000 children—dig for gold literally by hand, much the way men did in California in 1849. Sometimes, risking great danger in the hope of richer ore, these freelance miners slip into abandoned, partly flooded underground mines with rotted roof supports and hack out new tunnels. Health and safety regulations are in long-forgotten law books only, and no one even records the number of miners maimed or killed each year. Many of them will be thrown out of work as industrial mining starts up again.

Gold miners in Mongbwalu pound rocks to dust in metal buckets; nearby, a South Africa-based company is gearing up for mining on a much grander scale.

Gold miners in Mongbwalu pound rocks to dust in metal buckets; nearby, a South Africa-based company is gearing up for mining on a much grander scale.

Even at 8:30 on a Sunday night, the dirt streets of Mongbwalu, bordered by open sewage ditches with small plank bridges across them, are filled with rubber-booted miners and lined with people and businesses wanting a share of whatever pittance they have earned: gaudily dressed prostitutes, cafés, a bar with a picture of Jesus on the wall, and dozens of shops that buy gold and sell miners what they need—a raindrop-size silvery globule of mercury in a plastic baggie goes for the equivalent of 75 cents.

We enter one shop, which a sign proclaims as La Grâce à Dieu—Chez Johnny. A big man in his late 30s chewing a toothpick, Johnny sits behind the dimly lit counter dealing with a procession of men coming in to sell gold. On a handheld scale he can weigh gold flakes, the occasional tiny nugget, and amalgame, the gold dust separated by mercury from crushed rocks that is 80 to 90 percent pure. From here the gold will quietly find its way across Congo’s porous border with Uganda, on to refining in Dubai, and into the voracious world market. More than 97 percent of Congo’s gold leaves the country without ever being taxed, according to one recent estimate by the Ministry of Mines.

The weights Johnny uses to measure gold are kitcheles—penny-size coins that date from 40 or 50 years ago, when Congo still used coins. Now, after decades of headlong inflation, only bills are in circulation. Each seller is paid with a big brick of them, since even the very largest bill is worth less than $1. The person Johnny is buying from when we come in, a stocky, silent man of perhaps 40 who doesn’t want to say where his gold came from, looks too old to have mined the metal himself, Van Woudenberg and Bisubu think; he’s probably a middleman who spent the day buying from miners. He walks off with a wad of bills about three inches thick, worth some $60.

Most of the men who sell gold to Johnny spend some of their earnings in his store, buying soft drinks, rice, biscuits, toilet paper, sardines, flour, or lanterns, all arrayed on shelves behind him. He also sells mining supplies, of which the most important, for the equivalent of $5 apiece, are shovel blades—you cut your own handle in the rainforest. A blade lasts two months, less if you’re digging in rocky soil. But, as always seems to be the case in Congo, the shop’s profits are going elsewhere, for this is not Johnny’s own business, he explains; its patron, or owner, is in Butembo, many hours away. He calls Johnny every morning on his cell phone—there are no landlines here—to tell him the price to pay for gold that day.

THE NEXT MORNING we jounce and bump a half-hour farther into the hills, past the village of round thatched huts that will vanish if AngloGold Ashanti digs its open-pit mine, to the small town of Pili-Pili. From its one sweltering, sunbaked street we descend another half-hour, on foot now, steeply downward into a valley, past flame trees with red blossoms, butterflies flitting about blue flowers, and grass that reaches higher than our heads. On a patch of land most of the way down is a camp where hundreds of miners live, divided into teams of up to 15 men, in huts whose walls are reddish mud packed around interwoven sticks. The overhanging roofs are grass thatch; sometimes a blue plastic sheet with a UNICEF emblem—from aid supplies to refugee camps—is thrown on top for additional rainproofing. All food, drinking water, and mining tools are carried in. On the walls of the camp chief’s dirt-floored hut are two large Inauguration Day posters of Barack Obama.

It’s only about 10 in the morning, but the tropical sun is already broiling. Farther down the trail we stop to talk to a young miner with a gentle smile and intelligent eyes, walking back uphill to Pili-Pili. His name is Alex, and he is 22. He says he had to drop out of high school two years ago for lack of money, and has been mining ever since. “There is no work in Congo. We suffer a lot.” He and the friend who is with him, he explains, are cascadeurs—a word that normally, as French film buffs know, means movie stuntman, but here it means someone working odd corners, who does not belong to one of the teams. Alex shows us a small plastic bag of sand, with tiny flecks of gold in it, which, he estimates, the two of them can sell in Pili-Pili for the equivalent of $1. That’s their usual take for an entire day, and they are delighted to have found this much so early. They bid us a warm goodbye and continue up the trail.

The bottom of the valley and the side of the opposite slope are dotted with clusters of men in their teens and 20s. Miners usually have to buy their places on these 15-man teams, often going into debt to do so. We talk to one group, whose members say they started work by lantern light at 3 a.m., to get as much as possible done before the midday heat. Shovels are their only visible hand tools, and with them they have gouged an indentation perhaps 20 feet wide and 20 deep out of the side of the hill. At the bottom of it, they’ve also dug a tunnel about 3 feet high, with just enough room to enter on hands and knees, extending 12 or 15 feet into the earth, as far as you can go without danger of the tunnel collapsing, for they believe the dirt farther back has a higher concentration of gold. A man-high mound of red dirt from all their digging is piled up next to the stream that runs along the valley bottom, and now two of the men turn to another task: one tossing shovel-loads of dirt and the other pouring pans of stream water into the upper end of a homemade chute of boards. Mud flows down the chute, across a patch of woolen blanket crossed by leafy twigs, which slow down the flow and give the heavier gold a chance to sink to the blanket, where the specks will stick and can be carefully removed.

A majority of these men, they tell us, with smiles and laughs as we ask each in turn, are former militia fighters from rival groups. But now this past seems forgotten as they all focus on finding enough gold to survive. They say that on an average day the team finds $30 to $50 worth to divide 15 ways. Off the top, 30 percent (plus a hefty initial fee before the team could even start working here) has to be given to the patron who has the mining rights to this site, plus gold miners face a bewildering variety of other fees, the largest of which is about $3 per week per miner in payoffs to the army or police, as protection against harassment. What’s left, for the average Ituri miner and his family, is roughly $40 to $60 a month.

Finally we head up the trail again, wanting to climb back to Pili-Pili before the sun reaches its zenith. A miner coming down who passes us wears a T-shirt that has found its way here from somewhere; across the chest is printed STAYTRUEDREAMTRUE. Passing back through the miners’ camp, we stop to chat for a moment about how hard the work looks and how meager the rewards. One man says simply, “We’re on automatic.”

Back in Pili-Pili, on the street we run into Alex and his friend, the cascadeurs. They’ve sold their dollar’s worth of gold from this morning, he says, and with it bought a breakfast of green beans. Now they’re about to head back down to the valley again to try to find enough gold to buy dinner.