The Senate banking committee’s talks on crafting a comprehensive financial-reform bill are still slogging along this week, with no bill in sight despite expectations we’d see a draft this week. So what’s holding up the negotiations? Top of the list of stumbling blocks involves the creation of a new consumer-protection agency—and, more specifically, the independence of that new agency.

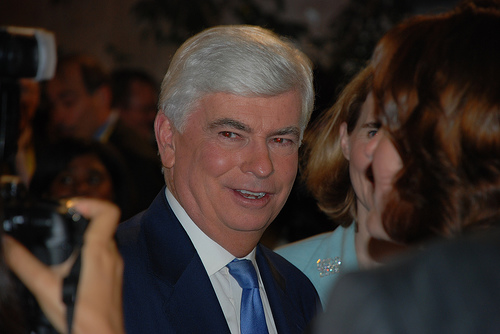

Back in November, Sen. Chris Dodd (D-Conn.), chair of the banking committee, unveiled an early draft of financial reform that notably contained an independent Consumer Financial Protection Agency (CFPA). The CFPA would be a watchdog with its own budget and rule-writing and enforcement power to protect consumers against predatory lending, abusive credit-card practices, hidden overdraft fees, and the like. There were two watchwords for the CFPA back then: One was “standalone,” meaning the new agency would look like the EPA and wouldn’t be housed within an existing organization. The other was “independen.” Unlike regulators like the Office of Thrift Supervision or financial gatekeepers like the credit ratings agencies, all of which became captive to the people they were supposed to regulate before the crisis, independence meant the agency wouldn’t rely on fees from the people they were supposed to be regulating, letting them rein in banks and non-banks freely and effectively.

Today, creating a consumer agency that’s standalone isn’t nearly as important—or controversial—as one that’s independent. Indeed, independence has turned out to be the lightning-rod issue. As Dodd recently explained, he doesn’t care all that much where a consumer agency is housed—the Treasury, the Fed—so long as it has the independence to do its job. “We’re talking about an agency…that has the autonomous ability to craft rules and to be directly involved in the enforcement of those rules,” he said. “Now where that’s located is less relevant.”

Consumer advocates, who’ve been openly critical of several of Dodd’s proposals, agree that independence is paramount. “There is a difference between a standalone agency and an agency that is independent but might be within another agency,” says Heather Booth with Americans for Financial Reform. “We don’t necessarily need it to stand alone, but we’re still fighting for an independent consumer protection agency that has real teeth.”

Senate Republicans, however, aren’t so keen on that independence. Sen. Bob Corker (R-Tenn.), Dodd’s main negotiating partner, and Sen. Richard Shelby (R-Ala.), the banking committee’s ranking member, recently pitched a watered-down version of a consumer agency within the Fed that would report to the Fed chairman—a death blow to the agency’s independent power. They also don’t want a consumer agency to have the kind of enforcement and rule-writing power that Dodd and other Democrats do. All of which is to say, in the coming days keep your eye on the issue of independence for a new consumer-protection agency. With it, consumers stand to gain from Dodd’s new reforms; without it, any attempt at protecting consumers is merely window dressing.