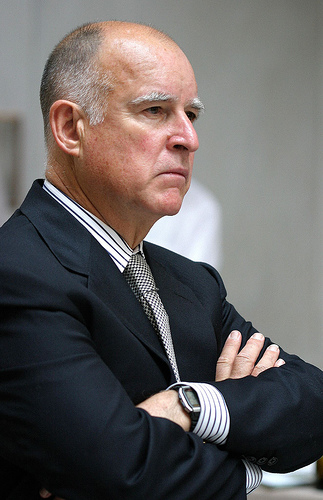

Flickr/<a href="http://www.flickr.com/photos/thomashawk/61077042/">Thomas Hawk</a>

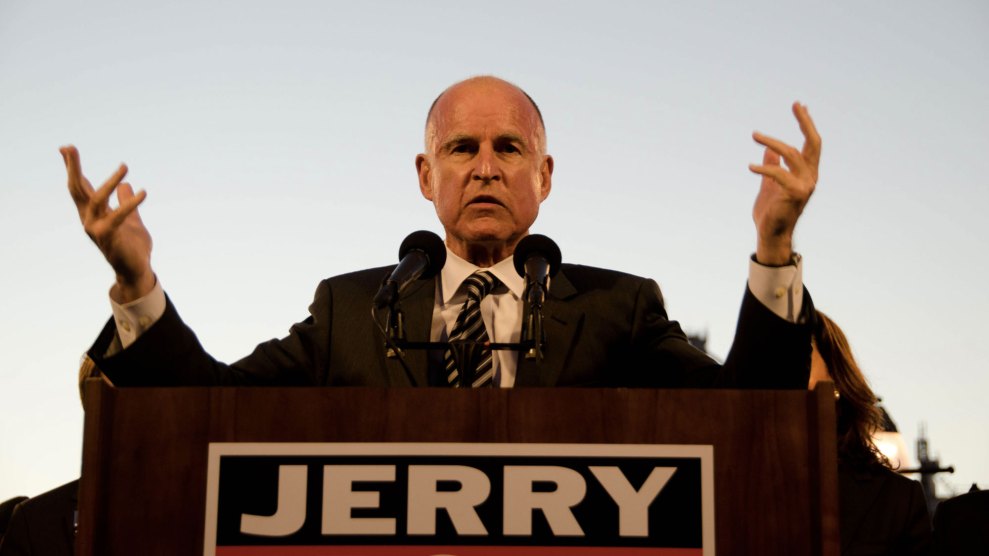

Here’s a takeaway from Arkansas Sen. Blanche Lincoln’s surprise primary victory last night: Taking a tough stance against Wall Street and big banks can pay dividends on election night. It looks like California Attorney General Jerry Brown has learned a thing or two from Lincoln, sending a letter to House Speaker Nancy Pelosi (D-Calif.) on election day yesterday exhorting her to include tough consumer protections and beefed up powers for state AGs in the final financial reform bill. Yesterday, Brown won the Democratic gubernational nomination for California in a blowout, with 84 percent of votes.

In his letter, Brown identifies two keys areas of financial reform that he sees as crucial to any reform bill. First, national banks and state-based banks should be subject to the same state consumer protection laws. (Right now, national banks are not subject to those state-based laws.) And second, Brown wants state AGs to have the power to enforce their state’s consumer protection laws against both national and state banks. Right now, national banks are preempted from state-based regulations, which allowed big banks in the past to escape predatory lending laws in states like Georgia. (Mike Konczal has a great post explaining this issue here.)

For Brown, prodding Pelosi to ensure strict consumer protection laws is a win-win scenario. As a veteran state attorney general, he gets to empower his position as much as possible. And as a gubernatorial candidate facing a wildly popular Republican opponent, Meg Whitman, he knows that backing financial reform is great for his optics. The question is, who’ll be the next candidate to jump on the Wall Street reform bandwagon?

Here’s Brown’s full letter:

Dear Speaker Pelosi:

In anticipation of a compromise on the House and Senate financial services reform bills, I urge you to press for the strongest possible language to protect consumers and our economy from another debilitating crisis caused by reckless Wall Street banking practices and complicit federal regulators.

Two elements of a compromise bill are key to that protection. One, national banks should be subject to the same state consumer protection laws as state banking institutions and virtually a! ll companies operating in industries other than financial services. And, two, state attorneys general should have the authority to enforce all applicable consumer protection laws against national banks.

The House language is preferable on both points, and I recommend that you push for its adoption. It would establish a higher burden for the OCC to preempt state consumer protection laws. It also would allow state attorneys general to enforce all federal consumer protection laws against national banks, not just regulations that may be adopted by the new Consumer Financial Protection Agency.

Sincerely,

EDMUND G. BROWN JR.