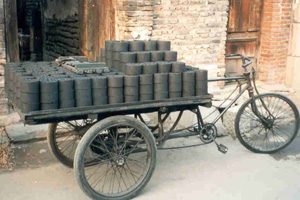

<a href="http://en.wikipedia.org/wiki/File:Coal_Bike,_China_1997.jpg">Brian Kelley</a>/Wikimedia

![]() This story first appeared on the TomDispatch website.

This story first appeared on the TomDispatch website.

If you want to know which way the global wind is blowing (or the sun shining or the coal burning), watch China. That’s the news for our energy future and for the future of great-power politics on planet Earth. Washington is already watching—with anxiety.

Rarely has a simple press interview said more about the global power shifts taking place in our world. On July 20th, the chief economist of the International Energy Agency (IEA), Fatih Birol, told the Wall Street Journal that China had overtaken the United States to become the world’s number one energy consumer. One can read this development in many ways: as evidence of China’s continuing industrial prowess, of the lingering recession in the United States, of the growing popularity of automobiles in China, even of America’s superior energy efficiency as compared to that of China. All of these observations are valid, but all miss the main point: by becoming the world’s leading energy consumer, China will also become an ever more dominant international actor and so set the pace in shaping our global future.

Because energy is tied to so many aspects of the global economy, and because doubts are growing about the future availability of oil and other vital fuels, the decisions China makes regarding its energy portfolio will have far-reaching consequences. As the leading player in the global energy market, China will significantly determine not only the prices we will be paying for critical fuels but also the type of energy systems we will come to rely on. More importantly, China’s decisions on energy preferences will largely determine whether China and the United States can avoid becoming embroiled in a global struggle over imported oil and whether the world will escape catastrophic climate change.

How to Rise to Global Preeminence

You can’t really appreciate the significance of China’s newfound energy prominence if you don’t first grasp the role of energy in America’s rise to global preeminence.

That the northeastern region of the young United States was richly endowed with waterpower and coal deposits was critical to the country’s early industrialization as well as to the North’s eventual victory in the Civil War. It was the discovery of oil in western Pennsylvania in 1859, however, that would turn the US into the decisive actor on the global stage. Oil extraction and exports fueled American prosperity in the early twentieth century—a time when the country was the planet’s leading producer—while nurturing the rise of its giant corporations.

It should never be forgotten that the world’s first great transnational corporation—John D. Rockefeller’s Standard Oil Company—was founded on the exploitation and export of American petroleum. Anti-trust legislation would break up Standard Oil in 1911, but two of its largest descendants, Standard Oil of New York and Standard Oil of New Jersey, were later fused into what is now the world’s wealthiest publicly traded enterprise, ExxonMobil. Another descendant, Standard Oil of California, became Chevron—today, the third richest American corporation.

Oil also played a key role in the rise of the United States as the world’s preeminent military power. This country supplied most of the oil consumed by Allied forces in both World War I and World War II. Among the great powers of the time, the US alone was self-sufficient in oil, which meant it could deploy massive armies to Europe and Asia and overpower the well-equipped (but oil-starved) German and Japanese militaries. Few realize this today, but for the architects of America’s victory in the Second World War, including President Roosevelt, it was the nation’s superior endowment of petroleum, not the atom bomb, that proved decisive.

Having created an economy and military establishment based on oil, American leaders were compelled to employ ever more costly and desperate measures to ensure that both always had an adequate supply of energy. After World War II, with domestic reserves already beginning to shrink, a succession of presidents fashioned a global strategy based on ensuring American access to overseas petroleum.

As a start, Saudi Arabia and the other Persian Gulf kingdoms were chosen to serve as overseas “filling stations” for US refiners and military forces. American oil companies, especially the descendants of Standard Oil, were aided and abetted in establishing a major presence in these countries. To a considerable extent, in fact, the great postwar strategic pronouncements—the Truman Doctrine, the Eisenhower Doctrine, the Nixon Doctrine, and especially the Carter Doctrine—were all tied to the protection of these “filling stations.”

Today, too, oil plays a critical role in Washington’s global plans and actions. The Department of State, for example, still maintains an elaborate, costly, and deeply entrenched military capability in the Persian Gulf to ensure the “safety” and “security” of oil exports from the region. It has also extended its military reach to such key oil-producing regions as the Caspian Sea basin and western Africa. The need to retain friendly ties and military relationships with key suppliers like Kuwait, Nigeria, and Saudi Arabia continues to dominate US foreign policy. Similarly, in a globally warming world, a growing American interest in the melting Arctic is being propelled by a desire to exploit the polar region’s untapped hydrocarbon reserves.

Planet Coal?

The fact that China has now overtaken the United States as the world’s leading energy consumer is bound to radically alter its global policies, just as energy predominance once did America’s. No doubt this will, in turn, alter the course of Sino-American relations, not to speak of world affairs. With the American experience in mind, what can we expect from China?

As a start, no one reading newspaper business pages could have any doubt that Chinese leaders view energy as a—possibly the—major concern of the country and have been devoting substantial resources and planning to the procurement of adequate future supplies. In addressing this task, Chinese leaders face two fundamental challenges: securing sufficient energy to meet ever-rising demand and deciding which fuels to rely on in satisfying these requirements. How China responds to these challenges will have striking implications on the global stage.

As a start, no one reading newspaper business pages could have any doubt that Chinese leaders view energy as a—possibly the—major concern of the country and have been devoting substantial resources and planning to the procurement of adequate future supplies. In addressing this task, Chinese leaders face two fundamental challenges: securing sufficient energy to meet ever-rising demand and deciding which fuels to rely on in satisfying these requirements. How China responds to these challenges will have striking implications on the global stage.

According to the most recent projections from the US Department of Energy (DoE), Chinese energy consumption will grow by 133% between 2007 and 2035—from, that is, 78 to 182 quadrillion British thermal units (BTUs). Think about it this way: the 104 quadrillion BTUs that China will somehow have to add to its energy supply over the next quarter-century equals the total energy consumption of Europe and the Middle East in 2007. Finding and funneling so much oil, natural gas, and other fuels to China is undoubtedly going to be the single greatest economic and industrial challenge facing Beijing—and in that challenge lays the possibility of real friction and conflict.

Although most of the country’s energy funds are still expended domestically, what it spends on imported fuels (oil, coal, natural gas, and uranium) and energy equipment (oil refineries, power plants, and nuclear reactors) will significantly determine the global price of these items—a role that, until now, has been largely filled by the United States. More important, however, will be the decisions China makes about the types of energy it will come to rely on.

If Chinese leaders were to follow their natural inclinations, they would undoubtedly avoid relying on imported fuels altogether, given how vulnerable foreign-energy dependence can make a country to overseas supply disruptions or, in China’s case, a possible US naval blockade (in the event, say, of a prolonged conflict over Taiwan). Li Junfeng, a senior Chinese energy official, was recently quoted as saying, “Energy supply should be where you can plant your foot on it”—that is, from domestic sources.

China does possess one kind of fuel in abundance: coal. According to the most recent DoE projections, coal will make up an estimated 62% of China’s net energy supply in 2035, only slightly less than at present. A heavy reliance on coal, however, will exacerbate the country’s environmental problems, dragging down its economy as health-care costs mount. In addition, thanks to coal, China is now the world’s leading emitter of climate-altering carbon dioxide. According to the DoE, China’s share of global carbon-dioxide emissions will jump from 19.6% in 2005, when it barely trailed the US at 21.1%, to 31.4% in 2035, when it will tower over all other countries in net emissions.

As long as Beijing refuses to significantly reduce its reliance on coal, ignore its rhetoric on global-warming negotiations. It simply won’t be able to take truly meaningful steps to address climate change. In this way, too, it will alter the face of the planet.

Recently, the country’s leaders seem to have become far more sensitive to the risks of excessive reliance on coal. Massive emphasis is now being placed on the development of renewable energy systems, especially wind and solar power. Already, China has become the world’s leading producer of wind turbines and solar panels, and has already begun exporting its technology to the United States. (Some economists and labor unions, in fact, claim that China is unfairly subsidizing its renewable-energy exports in violation of World Trade Organization rules.)

China’s growing emphasis on renewable energy would be good news, if it resulted in substantial reductions in coal use. At the same time, the country’s drive to excel at these techniques could push it into the forefront of a technological revolution, just as early American dominance of petroleum technology propelled it to the front ranks of world powers in the twentieth century. If the United States fails to keep pace, it could find the pace of its decline as a world power quickening.

Whose Saudis Are They?

China’s thirst for added energy could also lead quickly enough to friction and conflict with the United States, especially in the global competition for increasingly scarce supplies of imported petroleum. As its energy use ramps ever upward, China is using more oil, which can only lead to greater political economic, political, and someday possibly even military involvement in the oil-producing regions—areas long viewed in Washington as constituting America’s private offshore energy preserves.

As recently as 1995, China only consumed about 3.4 million barrels of oil per day—one-fifth the amount used by the United States, the world’s top consumer, and two-thirds of the amount burned by Japan, then number two. Since China pumped 2.9 million barrels per day from its domestic fields that year, its import burden was a mere 500,000 barrels per day at a time when the US imported 9.4 million barrels and Japan 5.3 million barrels.

By 2009, China was in the number-two spot at 8.6 million barrels per day, which still fell far below America’s 18.7 million barrels. At 3.8 million barrels per day, however, domestic production wasn’t keeping pace—the very problem the US had faced in the Cold War era. China was already importing 4.8 million barrels per day, far more than Japan (which had actually reduced its reliance on oil) and nearly half as much as the United States. In the decades to come, these numbers are guaranteed only to get worse.

According to the DoE, China will overtake the US as the world’s leading oil importer, at an estimated 10.6 million barrels per day, sometime around 2030. (Some experts believe this shift could occur far sooner.) Whatever the year, China’s leaders are already enmeshed in the same power “predicament” long faced by their American counterparts, dependent as they are on a vital substance that can only be acquired from a handful of unreliable producers in areas of chronic crisis and conflict.

At present, China obtains most of its imported oil from Saudi Arabia, Iran, Angola, Oman, Sudan, Kuwait, Russia, Kazakhstan, Libya, and Venezuela. Eager to ensure the reliability of the oil flow from these countries, Beijing has established close ties with their leaders, in some cases providing them with significant economic and military assistance. This is exactly the path once taken by Washington—and with some of the same countries.

China’s state-controlled energy firms have also forged “strategic partnerships” with counterpart enterprises in these countries and in some cases acquired the right to develop major oil deposits as well. Especially striking has been the way Beijing has sought to undercut US influence in Saudi Arabia and with other crucial Persian Gulf oil producers. In 2009, China imported more Saudi oil than the US for the first time, a geopolitical shift of great significance, given the history of US-Saudi relations. Although not competing with Washington when it comes to military aid, Beijing has been dispatching its top leaders to woo Riyadh, promising to support Saudi aspirations without employing the human rights or pro-democracy rhetoric usually associated with American foreign policy.

Much of this should sound exceedingly familiar. After all, the United States once wooed the Saudis in a similar way when Washington first began viewing the kingdom as its overseas filling station and turned it into an unofficial military protectorate. In 1945, while World War II still raged, President Roosevelt made a special trip to meet with King Abdul Aziz of Saudi Arabia and establish a protection-for-oil arrangement that persists to this day. Not surprisingly, American leaders don’t see (or care to recognize) the analogy; instead, top officials look askance at the way China is poaching on US turf in Saudi Arabia and other petro-states, portraying such moves as antagonistic.

As China’s reliance on these overseas suppliers grows, it is likely to bolster its ties with their leaders, producing further strains in the international political environment. Already, Beijing’s reluctance to jeopardize its vital energy links with Iran has frustrated US efforts to impose tough new economic sanctions on that country as a way of forcing it to abandon its uranium-enrichment activities. Likewise, China’s recent loan of $20 billion to the Venezuelan oil industry has boosted the status of President Hugo Chávez at a time when his domestic popularity, and so his ability to counter US policies, was slipping. The Chinese have also retained friendly ties with President Omar Hassan Ahmad al-Bashir of Sudan, despite US efforts to paint him as an international pariah because of his alleged role in overseeing the massacres in Darfur.

Arms-for-Oil Diplomacy on a Dangerous Planet

Already, China’s efforts to bolster its ties with its foreign-oil providers have produced geopolitical friction with the United States. There is a risk of far more serious Sino-American conflict as we enter the “tough oil” era and the world supply of easily accessible petroleum rapidly shrinks. According to the DoE, the global supply of oil and other petroleum liquids in 2035 will be 110.6 million barrels per day—precisely enough to meet anticipated world demand at that time. Many oil geologists believe, however, that global oil output will reach a peak level of output well below 100 million barrels per day by 2015, and begin declining after that. In addition, the oil that remains will increasingly be found in difficult places to reach or in highly unstable regions. If these predictions prove accurate, the United States and China—the world’s two leading oil importers—could become trapped in a zero-sum great-power contest for access to diminishing supplies of exportable petroleum.

What will happen under these circumstances is, of course, impossible to predict, especially since the potential for conflict abounds. If both countries continue on their current path—arming favored suppliers in a desperate bid to secure long-term advantage—the heavily armed petro-states may also become ever more fearful of, or covetous of, their (equally well-equipped) neighbors. With both the US and China deploying growing numbers of military advisers and instructors to such countries, the stage could be set for mutual involvement in local wars and border conflicts. Neither Beijing nor Washington may seek such involvement, but the logic of arms-for-oil diplomacy makes this an unavoidable risk.

It is not hard, then, to picture a future moment when the United States and China are locked in a global struggle over the world’s remaining supplies of oil. Indeed, many in official Washington believe that such a collision is nearly inevitable. “China’s near-term focus on preparing for contingencies in the Taiwan Strait… is an important driver of its [military] modernization,” the Department of Defense noted in the 2008 edition of its annual report, The Military Power of the People’s Republic of China. “However, analysis of China’s military acquisitions and strategic thinking suggests Beijing is also developing capabilities for use in other contingencies, such as a conflict over resources…”

Conflict over planetary oil reserves is not, however, the only path that China’s new energy status could open. It is possible to imagine a future in which China and the United States cooperate in pursuing oil alternatives that would obviate the need to funnel massive sums into naval and military arms races. President Obama and his Chinese counterpart, Hu Jintao, seemed to glimpse such a possibility when they agreed last November, during an economic summit in Beijing, to collaborate in the development of alternative fuels and transportation systems.

At this point, only one thing is clear: the greater China’s reliance on imported petroleum, the greater the risk of friction and conflict with the United States, which relies on the same increasingly problematic suppliers of energy. The greater its reliance on coal, the less comfortable our planet will become. The greater its emphasis on alternative fuels, the more likely it may make the twenty-first century China’s domain. At this point, how China will apportion its energy needs among the various candidate fuels remains unknown. Whatever its choices, however, China’s energy decisions will shake the world.

Michael T. Klare is a professor of peace and world security studies at Hampshire College and the author, most recently, of Rising Powers, Shrinking Planet. His previous book, Blood and Oil, was made into a documentary film and is available at bloodandoilmovie.com. To catch Klare discussing China’s energy superpowerdom on Timothy MacBain’s latest TomCast audio interview, click here or, to download it to your iPod, here.