Illustration: Christoph Hitz

At last count, Steven Katz owed $80,000 on his six credit cards, and he has no intention of paying any of it off. In fact, he’d like to show you how to be like him—a “credit terrorist” in open revolt against the banking system.

Katz is the founder of Debtorboards.com (“Sue Your Creditor and Win!”), a five-year-old online forum where he’s collected countless tricks and tactics for evading and repelling persistent creditors. He’s written how-tos on shielding your assets from seizure, luring collection agencies into expensive lawsuits, and frustrating private investigators looking for debtors on the run. He’s even infiltrated the bill collectors’ forums, where he’s been tagged a “credit jihadist” and his site’s been called a “credit terrorist training camp,” a label he embraces. “Debtorboards is one of the biggest and most successful temper tantrums ever,” the 59-year-old Katz boasts. The site has more than 10,000 members—double what it had in 2009.

Katz wants the millions of Americans buried in debt to stop feeling guilty about not honoring their obligations. “People are brainwashed to think that paying a credit card is more important than paying for the necessities of life,” he says. “Business and morality have nothing to do with each other, according to the bankers.” One of Katz’s mottos is “No one ever went to hell for not paying a debt.”

He wasn’t always an unrepentant debtor. When he first spoke to me from his tax and accounting business in a strip mall in Tucson, Arizona, he recalled how his first job in the ’70s was tromping through Brooklyn making collections for a small loan company. He once threatened to take a woman’s kids to an orphanage if she didn’t pay her bills. He wasn’t serious, but it worked.

The tables were turned in 2003, when a collection agency came after Katz for a debt that had been written off when he declared bankruptcy a few years earlier. The collector wouldn’t relent, and Katz’s credit score tanked. Outraged, he turned to the internet, where he learned how to go after debt collectors for violating consumer protection laws. Eventually, the collector paid him $1,000 in damages. Katz framed the check with the caption “The Steven Katz school of bill collector education is now open for business.”

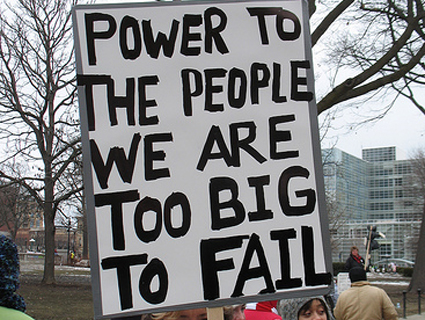

His tactics may be extreme, but Katz is not alone in his quest to evade the banking system. More Americans than ever are unable—or unwilling—to make good on their debts. Since 2008, banks have “charged off” a record $90 billion in credit card debt—taking it off their books as unlikely to ever be repaid. In the past two years, major banks charged off more than 10 percent of all consumer credit card accounts, on average—two times the pre-recession rate, and the highest in US history. The number of consumer lawsuits filed against collectors, like those Debtorboards encourages, has grown 122 percent since 2008. A backlash against the big banks is ballooning—from the California woman who made a popular YouTube video urging people to stop paying their credit card bills as part of a “debtors’ revolution” to the “Move Your Money” campaign, which encourages consumers to move their money to local banks or credit unions.

While it’s easy to hate the big banks and credit card companies, it can be hard to quit them cold turkey. Katz knows this well: After going bankrupt, he went back into debt to finance the growth of his tax business and renovate his home. By early 2010, he and his wife owed upwards of $40,000 on six credit cards. They diligently made their monthly payments. The 6 percent APR on his Wells Fargo Visa tripled; his other cards’ rates followed. (Banks surprised many customers with higher rates and new fees in response to 2009’s credit reform law, which limited rate hikes.) He called Wells Fargo to lower the rate; the bank refused. He says he started to pay down the balance, but then it looked like his wife was about to lose her job.

So Katz started planning his final escape. His wife found a job teaching English in Shijiazhuang, China, and he decided to join her. “I’d been fucked over by the banks,” he says. “I was treated like a deadbeat even though I wasn’t. And my attitude was, ‘If you’re going to treat me like a deadbeat, goddamn it, I might as well be one.'”

He stopped paying his bills and took out the largest cash advances possible, transferring $38,000 to an account in China, where it would be virtually out of reach from American banks. Of course, in the States he’d still be on the hook for his debts, and he could face fraud charges for taking the money with no intention of paying it back. But Katz says he has no plans to ever come back.

Last August, he began his new life as an “international deadbeat” by buying a first-class one-way ticket to China—with his credit card, of course. Talking on the phone from his new three-bedroom apartment, he recalls how his wife and son met him in Beijing, handing him two collection letters that had already arrived at his new address. He opened them on the spot. “In the middle of the airport, I’m laughing my head off, and I just take one of them and wipe my butt with it.”

Read more: Can You Mail a Brick to a Bank?