<a href="http://www.flickr.com/photos/rabih/203776564/">Rabih</a>/Flickr

![]() This story first appeared on the TomDispatch website.

This story first appeared on the TomDispatch website.

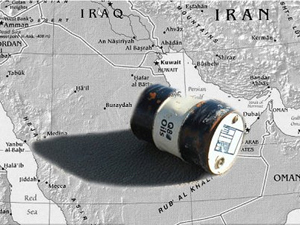

Whatever the outcome of the protests, uprisings, and rebellions now sweeping the Middle East, one thing is guaranteed: the world of oil will be permanently transformed. Consider everything that’s now happening as just the first tremor of an oilquake that will shake our world to its core.

For a century stretching back to the discovery of oil in southwestern Persia before World War I, Western powers have repeatedly intervened in the Middle East to ensure the survival of authoritarian governments devoted to producing petroleum. Without such interventions, the expansion of Western economies after World War II and the current affluence of industrialized societies would be inconceivable.

Here, however, is the news that should be on the front pages of newspapers everywhere: That old oil order is dying, and with its demise we will see the end of cheap and readily accessible petroleum—forever.

Ending the Petroleum Age

Let’s try to take the measure of what exactly is at risk in the current tumult. As a start, there is almost no way to give full justice to the critical role played by Middle Eastern oil in the world’s energy equation. Although cheap coal fueled the original Industrial Revolution, powering railroads, steamships, and factories, cheap oil has made possible the automobile, the aviation industry, suburbia, mechanized agriculture, and an explosion of economic globalization. And while a handful of major oil-producing areas launched the Petroleum Age—the United States, Mexico, Venezuela, Romania, the area around Baku (in what was then the Czarist Russian empire), and the Dutch East Indies—it’s been the Middle East that has quenched the world’s thirst for oil since World War II.

In 2009, the most recent year for which such data is available, BP reported that suppliers in the Middle East and North Africa jointly produced 29 million barrels per day, or 36% of the world’s total oil supply—and even this doesn’t begin to suggest the region’s importance to the petroleum economy. More than any other area, the Middle East has funneled its production into export markets to satisfy the energy cravings of oil-importing powers like the United States, China, Japan, and the European Union (EU). We’re talking 20 million barrels funneled into export markets every day. Compare that to Russia, the world’s top individual producer, at seven million barrels in exportable oil, the continent of Africa at six million, and South America at a mere one million.

As it happens, Middle Eastern producers will be even more important in the years to come because they possess an estimated two-thirds of remaining untapped petroleum reserves. According to recent projections by the US Department of Energy, the Middle East and North Africa will jointly provide approximately 43% of the world’s crude petroleum supply by 2035 (up from 37% in 2007), and will produce an even greater share of the world’s exportable oil.

To put the matter baldly: The world economy requires an increasing supply of affordable petroleum. The Middle East alone can provide that supply. That’s why Western governments have long supported “stable” authoritarian regimes throughout the region, regularly supplying and training their security forces. Now, this stultifying, petrified order, whose greatest success was producing oil for the world economy, is disintegrating. Don’t count on any new order (or disorder) to deliver enough cheap oil to preserve the Petroleum Age.

To appreciate why this will be so, a little history lesson is in order.

The Iranian Coup

After the Anglo-Persian Oil Company (APOC) discovered oil in Iran (then known as Persia) in 1908, the British government sought to exercise imperial control over the Persian state. A chief architect of this drive was First Lord of the Admiralty Winston Churchill. Having ordered the conversion of British warships from coal to oil before World War I and determined to put a significant source of oil under London’s control, Churchill orchestrated the nationalization of APOC in 1914. On the eve of World War II, then-Prime Minister Churchill oversaw the removal of Persia’s pro-German ruler, Shah Reza Pahlavi, and the ascendancy of his 21-year-old son, Mohammed Reza Pahlavi.

Though prone to extolling his (mythical) ties to past Persian empires, Mohammed Reza Pahlavi was a willing tool of the British. His subjects, however, proved ever less willing to tolerate subservience to imperial overlords in London. In 1951, democratically elected Prime Minister Mohammed Mossadeq won parliamentary support for the nationalization of APOC, by then renamed the Anglo-Iranian Oil Company (AIOC). The move was wildly popular in Iran but caused panic in London. In 1953, to save this great prize, British leaders infamously conspired with President Dwight Eisenhower‘s administration in Washington and the CIA to engineer a coup d’état that deposed Mossadeq and brought Shah Pahlavi back from exile in Rome, a story recently told with great panache by Stephen Kinzer in All the Shah’s Men.

Until he was overthrown in 1979, the Shah exercised ruthless and dictatorial control over Iranian society, thanks in part to lavish US military and police assistance. First he crushed the secular left, the allies of Mossadeq, and then the religious opposition, headed from exile by the Ayatollah Ruhollah Khomeini. Given their brutal exposure to police and prison gear supplied by the United States, the shah’s opponents came to loathe his monarchy and Washington in equal measure. In 1979, of course, the Iranian people took to the streets, the Shah was overthrown, and Ayatollah Khomeini came to power.

Much can be learned from these events that led to the current impasse in US-Iranian relations. The key point to grasp, however, is that Iranian oil production never recovered from the revolution of 1979-1980.

Between 1973 and 1979, Iran had achieved an output of nearly six million barrels of oil per day, one of the highest in the world. After the revolution, AIOC (rechristened British Petroleum, or later simply BP) was nationalized for a second time, and Iranian managers again took over the company’s operations. To punish Iran’s new leaders, Washington imposed tough trade sanctions, hindering the state oil company’s efforts to obtain foreign technology and assistance. Iranian output plunged to two million barrels per day and, even three decades later, has made it back to only slightly more than four million barrels per day, even though the country possesses the world’s second largest oil reserves after Saudi Arabia.

Dreams of the Invader

Iraq followed an eerily similar trajectory. Under Saddam Hussein, the state-owned Iraq Petroleum Company (IPC) produced up to 2.8 million barrels per day until 1991, when the First Gulf War with the United States and ensuing sanctions dropped output to half a million barrels daily. Though by 2001 production had again risen to almost 2.5 million barrels per day, it never reached earlier heights. As the Pentagon geared up for an invasion of Iraq in late 2002, however, Bush administration insiders and well-connected Iraqi expatriates spoke dreamily of a coming golden age in which foreign oil companies would be invited back into the country, the national oil company would be privatized, and production would reach never before seen levels.

Who can forget the effort the Bush administration and its officials in Baghdad put into making their dream come true? After all, the first American soldiers to reach the Iraqi capital secured the Oil Ministry building, even as they allowed Iraqi looters free rein in the rest of the city. L. Paul Bremer III, the proconsul later chosen by President Bush to oversee the establishment of a new Iraq, brought in a team of American oil executives to supervise the privatization of the country’s oil industry, while the US Department of Energy confidently predicted in May 2003 that Iraqi production would rise to 3.4 million barrels per day in 2005, 4.1 million barrels by 2010, and 5.6 million by 2020.

Who can forget the effort the Bush administration and its officials in Baghdad put into making their dream come true? After all, the first American soldiers to reach the Iraqi capital secured the Oil Ministry building, even as they allowed Iraqi looters free rein in the rest of the city. L. Paul Bremer III, the proconsul later chosen by President Bush to oversee the establishment of a new Iraq, brought in a team of American oil executives to supervise the privatization of the country’s oil industry, while the US Department of Energy confidently predicted in May 2003 that Iraqi production would rise to 3.4 million barrels per day in 2005, 4.1 million barrels by 2010, and 5.6 million by 2020.

None of this, of course, came to pass. For many ordinary Iraqis, the US decision to immediately head for the Oil Ministry building was an instantaneous turning point that transformed possible support for the overthrow of a tyrant into anger and hostility. Bremer’s drive to privatize the state oil company similarly produced a fierce nationalist backlash among Iraqi oil engineers, who essentially scuttled the plan. Soon enough, a full-scale Sunni insurgency broke out. Oil output quickly fell, averaging only 2.0 million barrels daily between 2003 and 2009. By 2010, it had finally inched back up to the 2.5 million barrel mark—a far cry from those dreamed of 4.1 million barrels.

One conclusion isn’t hard to draw: Efforts by outsiders to control the political order in the Middle East for the sake of higher oil output will inevitably generate countervailing pressures that result in diminished production. The United States and other powers watching the uprisings, rebellions, and protests blazing through the Middle East should be wary indeed: whatever their political or religious desires, local populations always turn out to harbor a fierce, passionate hostility to foreign domination and, in a crunch, will choose independence and the possibility of freedom over increased oil output.

The experiences of Iran and Iraq may not in the usual sense be comparable to those of Algeria, Bahrain, Egypt, Iraq, Jordan, Libya, Oman, Morocco, Saudi Arabia, Sudan, Tunisia, and Yemen. However, all of them (and other countries likely to get swept up into the tumult) exhibit some elements of the same authoritarian political mold and all are connected to the old oil order. Algeria, Egypt, Iraq, Libya, Oman, and Sudan are oil producers; Egypt and Jordan guard vital oil pipelines and, in Egypt’s case, a crucial canal for the transport of oil; Bahrain and Yemen as well as Oman occupy strategic points along major oil sealanes. All have received substantial US military aid and/or housed important US military bases. And, in all of these countries, the chant is the same: “The people want the regime to fall.”

Two of these regimes have already fallen, three are tottering, and others are at risk. The impact on global oil prices has been swift and merciless: on February 24th, the delivery price for North Brent crude, an industry benchmark, nearly reached $115 per barrel, the highest it’s been since the global economic meltdown of October 2008. West Texas Intermediate, another benchmark crude, briefly and ominously crossed the $100 threshold.

Why the Saudis are Key

So far, the most important Middle Eastern producer of all, Saudi Arabia, has not exhibited obvious signs of vulnerability, or prices would have soared even higher. However, the royal house of neighboring Bahrain is already in deep trouble; tens of thousands of protesters—more than 20% of its half million people—have repeatedly taken to the streets, despite the threat of live fire, in a movement for the abolition of the autocratic government of King Hamad ibn Isa al-Khalifa, and its replacement with genuine democratic rule.

These developments are especially worrisome to the Saudi leadership as the drive for change in Bahrain is being directed by that country’s long-abused Shiite population against an entrenched Sunni ruling elite. Saudi Arabia also contains a large, though not—as in Bahrain—a majority Shiite population that has also suffered discrimination from Sunni rulers. There is anxiety in Riyadh that the explosion in Bahrain could spill into the adjacent oil-rich Eastern Province of Saudi Arabia—the one area of the kingdom where Shiites do form the majority—producing a major challenge to the regime. Partly to forestall any youth rebellion, 87-year-old King Abdullah has just promised $10 billion in grants, part of a $36 billion package of changes, to help young Saudi citizens get married and obtain homes and apartments.

Even if rebellion doesn’t reach Saudi Arabia, the old Middle Eastern oil order cannot be reconstructed. The result is sure to be a long-term decline in the future availability of exportable petroleum.

Three-quarters of the 1.7 million barrels of oil Libya produces daily were quickly taken off the market as turmoil spread in that country. Much of it may remain off-line and out of the market for the indefinite future. Egypt and Tunisia can be expected to restore production, modest in both countries, to pre-rebellion levels soon, but are unlikely to embrace the sorts of major joint ventures with foreign firms that might boost production while diluting local control. Iraq, whose largest oil refinery was badly damaged by insurgents only last week, and Iran exhibit no signs of being able to boost production significantly in the years ahead.

The critical player is Saudi Arabia, which just increased production to compensate for Libyan losses on the global market. But don’t expect this pattern to hold forever. Assuming the royal family survives the current round of upheavals, it will undoubtedly have to divert more of its daily oil output to satisfy rising domestic consumption levels and fuel local petrochemical industries that could provide a fast-growing, restive population with better-paying jobs.

From 2005 to 2009, Saudis used about 2.3 million barrels daily, leaving about 8.3 million barrels for export. Only if Saudi Arabia continues to provide at least this much oil to international markets could the world even meet its anticipated low-end oil needs. This is not likely to occur. The Saudi royals have expressed reluctance to raise output much above 10 million barrels per day, fearing damage to their remaining fields and so a decline in future income for their many progeny. At the same time, rising domestic demand is expected to consume an ever-increasing share of Saudi Arabia’s net output. In April 2010, the chief executive officer of state-owned Saudi Aramco, Khalid al-Falih, predicted that domestic consumption could reach a staggering 8.3 million barrels per day by 2028, leaving only a few million barrels for export and ensuring that, if the world can’t switch to other energy sources, there will be petroleum starvation.

In other words, if one traces a reasonable trajectory from current developments in the Middle East, the handwriting is already on the wall. Since no other area is capable of replacing the Middle East as the world’s premier oil exporter, the oil economy will shrivel—and with it, the global economy as a whole.

Consider the recent rise in the price of oil just a faint and early tremor heralding the oilquake to come. Oil won’t disappear from international markets, but in the coming decades it will never reach the volumes needed to satisfy projected world demand, which means that, sooner rather than later, scarcity will become the dominant market condition. Only the rapid development of alternative sources of energy and a dramatic reduction in oil consumption might spare the world the most severe economic repercussions.

Michael T. Klare is a professor of peace and world security studies at Hampshire College, a TomDispatch regular, and the author, most recently, of Rising Powers, Shrinking Planet. A documentary film version of his previous book, “Blood and Oil,” is available from the Media Education Foundation. To listen to Timothy MacBain’s latest TomCast audio interview in which Klare explains how resource scarcity is driving protest and much else on our planet, click here, or download it to your iPod here.