It’s no secret: The federal budget is expanding faster than tax revenues, a trend that’s been fueled by the rapid growth of entitlement programs and exacerbated by the recession. As a recent New York Times article documents, even as fiscally conservative lawmakers complain about deficit spending, their constituents don’t want to give up the Social Security checks, Medicare benefits, and earned income tax credits that provide a safety net for the struggling middle class.

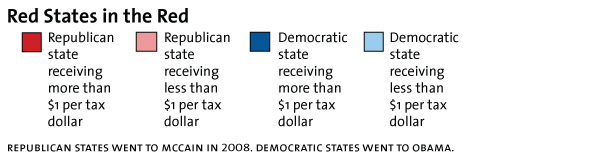

This gap between political perception and fiscal reality is also reflected in the distribution of tax dollars at the state level: Most politically “red” states are financially in the red when it comes to how much money they receive from Washington compared with what their residents pay in taxes.

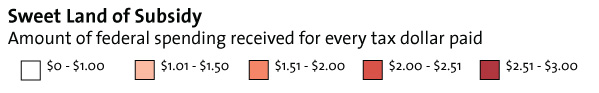

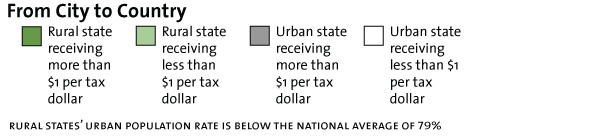

A look at 2010 Census and IRS data reveals that the 50 states and the District of Columbia, on average, received $1.29 in federal spending for every federal tax dollar they paid. That means that some states are getting a lot more than they put in, and vice versa. The states that contributed more in taxes than they got back in spending were more likely to have voted for Obama in 2008 and were more likely to be largely urban. (There are some clear exceptions: For instance, New Mexico, a rural, Democratic state, gets more federal money per tax dollar than any other state.)

These three interactive maps break down the split between the spenders and lenders. Click on any state for more detailed data, including each state’s per capita ratio of spending received versus taxes paid and where it ranked when the Tax Foundation ran the 2005 numbers.

Red states were more likely to get a bigger cut of federal spending. Of the 22 states that went to McCain in 2008, 86 percent received more federal spending than they paid in taxes in 2010. In contrast, 55 percent of the states that went to Obama received more federal spending than they paid in taxes. Republican states, on average, received $1.46 in federal spending for every tax dollar paid; Democratic states, on average, received $1.16.

This red-blue split may be partly explained by the difference between urban and rural states. Red states are more likely to be rural, and rural states were more likely to receive more federal spending than they paid in taxes in 2010. Among predominantly rural states, 81 percent received more federal spending than they paid in taxes. In contrast, 44 percent of urban states received more federal spending than they paid in taxes. Rural states, on average, received $1.40 in federal spending for every tax dollar paid; urban states, on average, received $1.10. (Rural states are defined as states whose urban population rate is below the national average of 79 percent.)

Note: Data has been adjusted to be deficit neutral using the method described by the Tax Foundation in its earlier analysis of federal spending versus federal taxes paid.

Sources: IRS (state tax data), Tax Foundation (2005 rank of spending vs. taxes), US Census (federal spending, urban/rural)

Front page image: Wikimedia Commons