<a href="https://www.flickr.com/photos/proimos/5899300483/in/photolist-atCQJM-dcdUWd-ao7yAc-arS6uN-9Zisvi-arS1H1-awpbTv-auaqQ6-aA474V-atJg4g-au3zeW-aw4zvq-7EMCc-axdcES-aoJusS-aE6gg6-au3itQ-atFmCS-76vkzm-aC98ri-arRavo-arPhyX-aq5hjE-arm5jC-dCSMH7-aypAf5-oKGEH-auWUL5-4zA9Tx-auWVXJ-azBBUG-dUXr5P-au65ru-avmath-75WYfa-arLGQn-audq43-as2sVY-djfpBA-avn6eY-tRUu-db5eN3-arhdBF-asG9wQ-aoFPVT-arPqFN-aqZJaV-6cKNKJ-av2Z58-aET2pa">Alex Proimos</a>/Flickr

This story first appeared on the TomDispatch website.

George Baer was a railroad and coal mining magnate at the turn of the twentieth century. Amid a violent and protracted strike that shut down much of the country’s anthracite coal industry, Baer defied President Teddy Roosevelt’s appeal to arbitrate the issues at stake, saying, “The rights and interests of the laboring man will be protected and cared for… not by the labor agitators, but by the Christian men of property to whom God has given control of the property rights of the country.” To the Anthracite Coal Commission investigating the uproar, Baer insisted, “These men don’t suffer. Why hell, half of them don’t even speak English.”

We might call that adopting the imperial position. Titans of industry and finance back then often assumed that they had the right to supersede the law and tutor the rest of America on how best to order its affairs. They liked to play God. It’s a habit that’s returned with a vengeance in our own time.

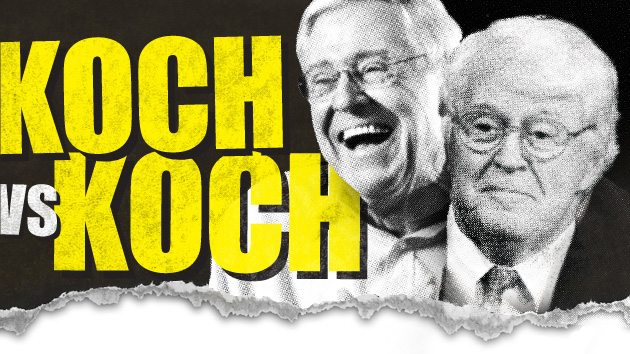

The Koch brothers are only the most conspicuous among a whole tribe of “self-made” billionaires who imagine themselves architects or master builders of a revamped, rehabilitated America. The resurgence of what might be called dynastic or family capitalism, as opposed to the more impersonal managerial capitalism many of us grew up with, is changing the nation’s political chemistry.

Our own masters of the universe, like the “robber barons” of old, are inordinately impressed with their ascendancy to the summit of economic power. Add their personal triumphs to American culture’s perennial love affair with business—President Calvin Coolidge, for instance, is remembered today only for proclaiming that “the business of America is business”—and you have a formula for megalomania.

Take Jeff Greene, otherwise known as the “Meltdown Mogul.” Back in 2010, he had the chutzpah to campaign in the Democratic primary for a Florida senate seat in a Miami neighborhood ravaged by the subprime mortgage debacle—precisely the arena in which he had grown fabulously rich. In the process, he rallied locals against Washington insiders and regaled them with stories of his life as a busboy at the Breakers Hotel in Palm Beach. Protected from the Florida sun by his Prada shades, he alluded to his wealth as evidence that, as a maestro of collateralized debt obligations, no one knew better than he how to run the economy he had helped to pulverize. He put an exclamation point on his campaign by flying off in his private jet only after securely strapping himself in with his gold-plated seat buckles.

Olympian entrepreneurs like Greene regularly end up seeing themselves as tycoons-cum-savants. When they run for office, they do so as if they were trying to get elected to the board of directors of America, Inc. Some will brook no interference with their will. Property, lots of it, in a society given over to its worship, becomes a blank check: everything is permitted to those who have it.

Dream and Nightmare

This, then, is the indigenous romance of American capitalism. The man from nowhere becomes a Napoleon of business and so a hero because he confirms a cherished legend: namely, that it’s the primordial birthright of those lucky enough to live in the New World to rise out of obscurity to unimaginable heights. All of this, so the legend tells us, comes through the application of disciplined effort, commercial cunning and foresight, a take-no-prisoners competitive instinct, and a gambler’s sang froid in the face of the unforgiving riskiness of the marketplace. Master all of that and you deserve to be a master of our universe. (Conversely, this is the dark fairy tale that nineteenth century Gilded Age anti-capitalist rebels knew as “the Property Beast.”)

What makes the creation of the titan particularly confounding is that it seems as if it shouldn’t be so. Inside the colorless warrens of the counting house and factory workshop, a pedestrian preoccupation with profit and loss might be expected to smother all those instincts we associate with the warrior, the statesman, and the visionary, not to mention the tyrant. As Joseph Schumpeter, the mid-twentieth century political economist, once observed, “There is surely no trace of any mystic glamour” about the sober-minded bourgeois. He is not likely to “say boo to a goose.”

Yet the titan of capitalism overcomes that propensity. As Schumpeter put it, he transforms himself into the sort of man who can “bend a nation to his will,” use his “extraordinary physical and nervous energy” to become “a leading man.” Something happens through the experience of commercial conquest so intoxicating that it breeds a willful arrogance and a lust for absolute power of the sort for which George Baer hankered. Call it the absolutism of self-righteous money.

Sheldon Adelson, Charles and David Koch, Sam Walton, Rupert Murdoch, Linda McMahon, or hedge fund honchos like John Paulson and Steven Cohen all conform in one way or another to this historic profile. Powers to be reckoned with, they presume to know best what we should teach our kids and how we should do it; how to defend the country’s borders against alien invasion, revitalize international trade, cure what ails the health-care delivery system, create jobs where there are none, rejigger the tax code, balance the national budget, put truculent labor unions in their place, and keep the country on the moral and racial straight and narrow.

All this purported wisdom and self-assurance is home bred. That is to say, these people are first of all family or dynastic capitalists, not the faceless men in suits who shimmy their way up the greased pole that configures the managerial hierarchies of corporate America. Functionaries at the highest levels of the modern corporation may be just as wealthy, but they are a fungible bunch, whose loyalty to any particular outfit may expire whenever a more attractive stock option from another firm comes their way.

In addition, in our age of mega-mergers and acquisitions, corporations go in and out of existence with remarkable frequency, morphing into a shifting array of abstract acronyms. They are carriers of great power, but without an organic attachment to distinct individuals or family lineages.

Instead dynasts of yesteryear and today have created family businesses or, as in the case of the Koch brothers and Rupert Murdoch, taken over ones launched by their fathers to which they are fiercely devoted. They guard their business sanctuaries by keeping them private, wary of becoming dependent on outside capital resources that might interfere with their freedom to do what they please with what they’ve amassed.

And they think of what they’ve built up not so much as a pile of cash, but as a patrimony to which they are bound by ties of blood, religion, region, and race. These attachments turn ordinary business into something more transcendent. They represent the tissues of a way of life, even a philosophy of life. Its moral precepts about work, individual freedom, family relations, sexual correctness, meritocracy, equality, and social responsibility are formed out of the same process of self-invention that gave birth to the family business. Habits of methodical self-discipline and the nurturing and prudential stewardship that occasionally turns a modest competency into a propertied goliath encourage the instinct to instruct and command.

There is no Tycoon Party in the US imposing ideological uniformity on a group of billionaires who, by their very nature as übermensch, march to their own drummers and differ on many matters. Some are philanthropically minded, others parsimonious; some are pietistic, others indifferent. Wall Street hedge fund creators may donate to Obama and be card-carrying social liberals on matters of love and marriage, while heartland types like the Koch brothers obviously take another tack politically. But all of them subscribe to one thing: a belief in their own omniscience and irresistible will.

There at the Creation

Business dynasts have enacted this imperial drama since the dawn of American capitalism—indeed, especially then, before the publicly traded corporation and managerial capitalism began supplanting their family capitalist predecessors at the turn of the twentieth century. John Jacob Astor, America’s first millionaire, whose offices were once located on Manhattan Island where Zucotti Park now stands, was the most literal sort of empire builder. In league with Thomas Jefferson, he attempted to extend that president’s “empire for liberty” all the way to the western edge of the continent and push out the British. There, on the Oregon coast, he established the fur-trading colony of Astoria to consolidate his global control of the luxury fur trade.

In this joint venture, president and tycoon both failed. Astor, however, was perfectly ready to defy the highest authority in the land and deal with the British when it mattered most. So when Jefferson embargoed trade with that country in the run-up to the War of 1812, the founder of one of the country’s most luminous dynasties simply ran the blockade. An unapologetic elitist, Astor admired Napoleon, assumed the masses were not to be left to their own devices, and believed deeply that property ought to be the prerequisite for both social position and political power.

Traits like Astor’s willfulness and self-sufficiency cropped up frequently in the founding generation of America’s “captains of industry.” Often they were accompanied by a chest-thumping braggadocio and thumb-in-your eye irreverence. Cornelius Vanderbilt, called by his latest biographer “the first tycoon,” was known in his day as “the Commodore.” Supposedly, he warned someone foolish enough to challenge his supremacy in the steamboat business that “I won’t sue you, I’ll ruin you.”

Or take “Jubilee” Jim Fisk. He fancied himself an admiral but wasn’t one, and after the Civil War, when caught plundering the Erie Railroad, boasted that he was “born to be bad.” Later on, when a plot he hatched to corner the nation’s supply of gold left him running from the law, Jim classically summed up the scandal this way: “Nothing lost save honor.”

More than a century before Mitt Romney and Bain Capital came along, Jay Gould, a champion railroad speculator and buccaneering capitalist, scoured the country for companies to buy, loot, and sell. Known by his many detractors as “the Mephistopheles of Wall Street,” he once remarked, when faced with a strike against one of his railroads, that he could “hire one half of the working class to kill the other half.”

George Pullman, nicknamed “the Duke” in America’s world of self-made royalty, wasn’t shy about dealing roughly with the rowdy “mob” either. As a rising industrialist in Chicago in the 1870s, he—along with other young men from the city’s new manufacturing elite—actually took up arms to put down a labor insurgency and financed the building of urban armories, stocked with the latest artillery, including a new machine gun marketed as the “Tramp Terror.” (This was but one instance among many of terrorism from above by the forces of “law and order.”)

However, Pullman was better known for displaying his overlordship in quite a different fashion. Cultivating his sense of dynastic noblesse oblige, he erected a model town, which he aptly named Pullman, just outside Chicago. There residents not only labored to manufacture sleeping cars for the nation’s trains, but were also tutored in how to live respectable lives—no drinking, no gambling, proper dress and deportment—while living in company-owned houses, shopping at company-owned stores, worshipping at company churches, playing in company parks, reading company-approved books in the company library, and learning the “three Rs” from company schoolmarms. Think of it as a Potemkin working class village, a commercialized idyll of feudal harmony—until it wasn’t. The dream morphed into a nightmare when “the Duke” suddenly began to slash wages and evict his “subjects” amid the worst depression of the nineteenth century. This, in turn, provoked a nationwide strike and boycott, eventually crushed by federal troops.

The business autocrats of the Gilded Age could be rude and crude like Gould, Vanderbilt, and Fisk or adopt the veneer of civilization like Pullman. Some of these “geniuses” of big business belonged to what Americans used to call the “shoddy aristocracy.” Fisk had, after all, started out as a confidence man in circuses and Gould accumulated his “start-up capital” by bilking a business partner. “Uncle” Daniel Drew, top dog on Wall Street around the time of the Civil War (and a pious one at that, who founded Drew Theological Seminary), had once been a cattle drover. Before bringing his cows to the New York market, he would feed them salt licks to make sure they were thirsty and then fill them with water so they would make it to the auction block weighing far more than their mere flesh and bones could account for. He bequeathed America the practice of “watered stock.”

Not all the founding fathers of our original tycoonery, however, were social invisibles or refugees from the commercial badlands. They could also hail from the highest precincts of the social register. The Morgans were a distinguished banking and insurance clan going all the way back to colonial days. J.P. Morgan was therefore to the manor born. At the turn of the twentieth century, he functioned as the country’s unofficial central banker, meaning he had the power to allocate much of the capital that American society depended on. Nonetheless, when asked about bearing such a heavy social responsibility, he bluntly responded, “I owe the public nothing.”

Not all the founding fathers of our original tycoonery, however, were social invisibles or refugees from the commercial badlands. They could also hail from the highest precincts of the social register. The Morgans were a distinguished banking and insurance clan going all the way back to colonial days. J.P. Morgan was therefore to the manor born. At the turn of the twentieth century, he functioned as the country’s unofficial central banker, meaning he had the power to allocate much of the capital that American society depended on. Nonetheless, when asked about bearing such a heavy social responsibility, he bluntly responded, “I owe the public nothing.”

This sort of unabashed indifference to the general welfare was typical and didn’t end in the new century. During the Great Depression of the 1930s, the managements of some major publicly owned corporations felt compelled by a newly militant labor movement and the shift in the political atmosphere that accompanied President Franklin Roosevelt’s New Deal to recognize and bargain with the unions formed by their employees. Not so long before, some of these corporations, in particular United States Steel, had left a trail of blood on the streets of the steel towns of Pennsylvania and Ohio when they crushed the Great Steel Strike of 1919. But times had changed.

Not so, however, for the adamantine patriarchs who still owned and ran the nation’s “little steel” companies (which were hardly little). Men like Tom Girdler of Republic Steel resented any interference with their right to rule over what happened on their premises and hated the New Deal, as well as its allies in the labor movement, because they challenged that absolutism. So it was that, on Memorial Day 1937, 10 strikers were shot in the back and killed while picketing Girdler’s Chicago factory.

The Great U-Turn

By and large, however, the middle decades of the twentieth century were dominated by modern concerns like US Steel, General Motors, and General Electric, whose corporate CEOs were more sensitive to the pressures of their multiple constituencies. These included not only workers, but legions of shareholders, customers, suppliers, and local and regional public officials.

Publicly held corporations are, for the most part, owned not by a family, dynasty, or even a handful of business partners, but by a vast sea of shareholders. Those “owners” have little if anything to do with running “their” complex companies. This is left to a managerial cadre captained by lavishly rewarded chief executives. Their concerns are inherently political, but not necessarily ideological. They worry about their brand’s reputation, have multiple dealings with a broad array of government agencies, look to curry favor with politicians from both parties, and are generally reasonably vigilant about being politically correct when it comes to matters of race, gender, and other socially sensitive issues. Behaving in this way is, after all, a marketing strategy that shows up where it matters most—on the bottom line.

Over the last several decades, however, history has done a U-turn. Old-style private enterprises of enormous size have made a remarkable comeback. Partly, this is a consequence of the way the federal government has encouraged private enterprise through the tax code, land-use policy, and subsidized finance. It is also the outcome of a new system of decentralized, flexible capitalism in which large, complex corporations have downloaded functions once performed internally onto an array of outside, independent firms.

Family capitalism has experienced a renaissance. Even giant firms are now often controlled by their owners the way Andrew Carnegie once captained his steel works or Henry Ford his car company. Some of these new family firms were previously publicly traded corporations that went private. A buy-out craze initiated by private equity firms hungry for quick turn-around profits, like Mitt Romney’s infamous Bain Capital, lent the process a major hand. This might be thought of as entrepreneurial capitalism for the short-term, a strictly finance-driven strategy.

But family-based firms in it for the long haul have also proliferated and flourished in this era of economic turbulence. These are no longer stodgy, technologically antiquated outfits, narrowly dedicated to churning out a single, time-tested product. They are often remarkably adept at responding to shifts in the market, often highly diversified in what they make and sell, and—thanks to the expansion of capital markets—they now enjoy a degree of financial independence not unlike that of their dynastic forebears of the nineteenth century, who relied on internally generated resources to keep free of the banks. They have been cropping up in newer growth sectors of the economy, including retail, entertainment, energy, finance, and high tech. Nor are they necessarily small-fry mom-and-pop operations. One-third of the Fortune 500 now fall into the category of family-controlled.

Feet firmly anchored in their business fiefdoms, family patriarchs loom over the twenty-first-century landscape, lending it a back-to-the-future air. They exercise enormous political influence. They talk loudly and carry big sticks. Their money elects officials, finances their own campaigns for public office, and is reconfiguring our political culture by fertilizing a rain forest of think tanks, journals, and political action committees. A nation which, a generation ago, largely abandoned its historic resistance to organized wealth and power has allowed this newest version of the “robber baron” to dominate the public arena to a degree that might have astonished even John Jacob Astor and Cornelius Vanderbilt.

The Political Imperative

That ancestral generation, living in an era when the state was weak and kept on short rations, didn’t need to be as immersed in political affairs. Contacting a kept senator or federal judge when needed was enough. The modern regulatory and bureaucratic welfare state has extended its reach so far and wide that it needs to be steered, if not dismantled.

Some of our new tycoons try doing one or the other from off-stage through a bevy of front organizations and hand-selected candidates for public office. Others dive right into the electoral arena themselves. Linda McMahon, who with her husband created the World Wrestling Entertainment empire, is a two-time loser in senate races in Connecticut. Rick Scott, a pharmaceutical entrepreneur, did better, becoming Florida’s governor. Such figures, and other triumphalist types like them, claim their rise to business supremacy as their chief credential, often their only credential, when running for office or simply telling those holding office what to do.

Our entrepreneurial maestros come in a remarkable range of sizes and shapes. On style points, “the Donald” looms largest. Like so many nineteenth century dynasts, his family origins are modest. A German grandfather arriving here in 1885 was a wine maker, a barber, and a saloonkeeper in California; father Fred became the Henry Ford of homebuilding, helped along by New Deal low-cost housing subsidies. His son went after splashier, flashier enterprises like casinos, luxury resorts, high-end hotels, and domiciles for the 1%. In all of this, the family name, splashed on towers of every sort and “the Donald’s” image—laminated hair-do and all—became his company’s chief assets.

Famous for nothing other than being very rich, Trump feels free to hold forth on every conceivable subject of public import from same-sex marriage to the geopolitics of the Middle East. Periodically, he tosses his hat into the electoral arena. But he comports himself like a clown. He even has a game named after himself: “Trump—The Game,” whose play currency bears Donald’s face and whose lowest denomination is $10 million. No wonder no one takes his right-wing bluster too seriously. A modern day “Jubilee Jim Fisk,” craving attention so much he’s willing to make himself ridiculous, the Donald is his own reality TV show.

Rupert Murdoch, on the other hand, looks and dresses like an accountant and lives mainly in the shadows. Like Trump, he inherited a family business. Unlike Trump, his family pedigree was auspicious. His father was Sir Keith, a media magnate from Melbourne, Australia, and Rupert went to Oxford. Now, the family’s media influence straddles continents, as Rupert attempts—sometimes with great success—to make or break political careers and steer whole political parties to the right.

The News Corporation is a dynastic institution of the modern kind in which Murdoch uses relatively little capital and a complex company structure to maintain and vigorously exercise the family’s control. When the Ford Motor Company finally went public in 1956, it did something similar to retain the Ford family’s dominant position. So, too, did Google, whose “dual-class share structure” allowed its founders Larry Page and Sergey Brin to continue calling the shots. Murdoch’s empire may, on first glance, seem to conform to American-style managerial corporate capitalism, apparently rootless, cosmopolitan, fixed on the bottom line. In fact, it is tightly tethered to Murdoch’s personality and conservative political inclinations and to the rocky dynamics of the Murdoch succession. That is invariably the case with our new breed of dynastic capitalists.

Sheldon Adelson, the CEO of the Las Vegas Sands Corporation and sugar daddy to right-wing political wannabes from city hall to the White House, lacks Murdoch’s finesse but shares his convictions and his outsized ambition to command the political arena. He’s the eighth richest man in the world, but grew up poor as a Ukrainian Jew living in the Dorchester neighborhood of Boston. His father was a cab driver and his mother ran a knitting shop. He went to trade school to become a court reporter and was a college drop-out. He started several small businesses that failed, winning and losing fortunes. Then he gambled and hit the jackpot, establishing lavish hotels and casinos around the world. When he again lost big time during the global financial implosion of 2007-2008, he responded the way any nineteenth century sea dog capitalist might have: “So I lost twenty-five billion dollars. I started out with zero… [there is] no such thing as fear, not to any entrepreneur. Concern, yes. Fear, no.”

A committed Zionist, Adelson was once a Democrat. But he jumped ship over Israel and because he believed the party’s economic policies were ruining the country. (He’s described Obama’s goal as “a socialist-style economy.”) He established the Freedom Watch’s dark-money group as a counterweight to George Soros’s Open Society and to MoveOn.org. According to one account, Adelson “seeks to dominate politics and public policy through the raw power of money.” That has, for instance, meant backing Newt Gingrich in the Republican presidential primaries of 2012 against Mitt Romney, whom he denounced as a “predatory capitalist” (talk about the pot calling the kettle black!), and not long after, funneling cash to candidate Romney.

Free Markets and the Almighty

Charles and David Koch are perfect specimens of this new breed of family capitalists on steroids. Koch Industries is a gigantic conglomerate headquartered in the heartland city of Wichita, Kansas. Charles, who really runs the company, lives there. David, the social and philanthropic half of this fraternal duopoly, resides in New York City. Not unlike George “the Duke” Pullman, Charles has converted Wichita into something like a company city, where criticism of Koch Industries is muted at best.

The firm’s annual revenue is in the neighborhood of $10 billion, generated by oil refineries, thousands of miles of pipelines, paper towels, Dixie cups, Georgia Pacific lumber, Lycra, and Stainmaster Carpet, among other businesses. It is the second largest privately owned company in the United States. (Cargill, the international food conglomerate, comes first.) The brothers are inordinately wealthy, even for our “new tycoonery.” Only Warren Buffett and Bill Gates are richer.

While the average businessman or corporate executive is likely to be pretty non-ideological, the Koch brothers are dedicated libertarians. Their free market orthodoxy makes them adamant opponents of all forms of government regulation. Since their companies are among the top 10 air polluters in the United States, that also comports well with their material interests—and the Kochs come by their beliefs naturally, so to speak.

Their father, Fred, was the son of a Dutch printer who settled in Texas and started a newspaper. He later became a chemical engineer and invented a better method for converting oil into gasoline. In one of history’s little jokes, he was driven out of the industry by the oil giants who saw him as a threat. Today, Koch Industries is sometimes labeled “the Standard Oil of our time,” an irony it’s not clear the family would appreciate. After a sojourn in Joseph Stalin’s Soviet Union (of all places), helping train oil engineers, Fred returned stateside to set up his own oil refinery business in Wichita. There, he joined the John Birch Society and ranted about the imminent Communist takeover of the government. In that connection he was particularly worried that “the colored man looms large in the Communist plan to take over America.”

Father Fred raised his sons in the stern regimen of the work ethic and instructed the boys in the libertarian catechism. This left them lifelong foes of the New Deal and every social and economic reform since. That included not only predictable measures like government health insurance, social security, and corporate taxes, but anything connected to the leviathan state. Even the CIA and the FBI are on the Koch chopping block.

Dynastic conservatism of this sort has sometimes taken a generation to mature. Sam Walton, like many of his nineteenth-century analogs, was not a political animal. He just wanted to be left alone to do his thing and deploy his power over the marketplace. So he stayed clear of electoral and party politics, although he implicitly relied on the racial, gender, and political order of the old South, which kept wages low and unions out, to build his business in the Ozarks. After his death in 1992, however, Sam’s heirs entered the political arena in a big way.

In other respects Sam Walton conformed to type. He was impressed with himself, noting that “capital isn’t scarce; vision is” (although his “one stop shopping” concept was already part of the retail industry before he started Walmart). His origins were humble. He was born on a farm in Kingfisher, Oklahoma. His father left farming for a while to become a mortgage broker, which in the Great Depression meant he was a farm re-possessor for Metropolitan Life Insurance. Sam did farm chores, then worked his way through college, and started his retail career with a small operation partly funded by his father-in-law.

At every juncture, the firm’s expansion depended on a network of family relations. Soon enough, his stores blanketed rural and small-town America. Through all the glory years, Sam’s day began before dawn as he woke up in the same house he’d lived in for more than 30 years. Then, dressed in clothes from one of his discount stores, off he went to work in his red Ford pick-up truck.

Some dynasts are pietistic and some infuse their business with religion. Sam Walton did a bit of both. In his studiously modest “life style,” there was a kind of outward piety. Living without pretension, nose to the grindstone, and methodically building up the family patrimony has for centuries carried a sacerdotal significance, leaving aside any specific Protestant profession of religious faith. But there was professing as well. Though not a fundamentalist, he was a loyal member of the First Presbyterian Church in Bentonville, Arkansas, where he was a “ruling elder” and occasionally taught Sunday school (something he had also done in college as president of the Burall Bible Class Club).

Christianity would play a formative role in his labor relations strategy at Walmart. His employees—”associates,” he dubbed them—were drawn from an Ozark world of Christian fraternity which Walmart management cultivated. “Servant leadership” was a concept designed to encourage workers to undertake their duties serving the company’s customers in the same spirit as Jesus, who saw himself as a “servant leader.”

This helped discourage animosities in the work force, as well as blunting the—to Walton—dangerous desire to do something about them through unionizing or responding in any other way to the company’s decidedly subpar working conditions and wages. An aura of Christian spiritualism plus company-scripted songs and cheers focused on instilling company loyalty, profit-sharing schemes, and performance bonuses constituted a twentieth century version of Pullman’s town idyll.

All of this remained in place after Sam’s passing. What changed was the decision of his fabulously wealthy relatives to enter the political arena. Walton lobbying operations now cover a broad range of issues, including lowering corporate taxes and getting rid of the estate tax entirely, as his heirs subsidize mainly Republican candidates and causes. Most prominent of all have been the Walton efforts to privatize education through vouchers or by other means, often enough turning public institutions into religiously affiliated schools.

Wall Street has never been known for its piety. But the tycoons who founded the Street’s most lucrative hedge funds—men like John Paulson, Paul Tudor James II, and Steve Cohen, among others—are also determined to up-end the public school system. They are among the country’s most powerful proponents of charter schools. Like J.P. Morgan of old, these men grew up in privilege, went to prep schools and the Ivy League, and have zero experience with public education or the minorities who tend to make up a large proportion of charter school student bodies.

No matter. After all, some of these people make several million dollars a day. What an elixir! They are joined in this educational crusade by fellow business conquistadors of less imposing social backgrounds like Mark Zuckerberg, who has ensured that Facebook will remain a family domain even while “going public.” Another example would be Bill Gates, the most celebrated of a brace of techno-frontiersmen who—legend would have it—did their pioneering in homely garages, even though the wonders they invented would have been inconceivable without decades of government investment in military-related science and technology. What can’t these people do, what don’t they know? They are empire builders and liberal with their advice and money when it comes to managing the educational affairs of the nation. They also benefit handsomely from a provision in the tax code passed during the Clinton years that rewards them for investing in “businesses” like charter schools.

Our imperial tycoons are a mixed lot. They range from hip technologists like Zuckerberg to heroic nerds like Bill Gates, and include yesteryear traditionalists like Sam Walton and the Koch brothers. What they share with each other and their robber baron ancestors is a god-like desire to create the world in their image.

Watching someone play god may amuse us, as “the Donald” can do in an appalling sort of way. It is, however, a dangerous game with potentially deadly consequences for a democratic way of life already on life support.

Steve Fraser is the author of Wall Street: America’s Dream Palace, among other works, and a TomDispatch regular. His next book, The Age of Acquiescence: The Life and Death of American Resistance to Organized Wealth and Power, will be published by Little Brown in February. He is a writer, historian, and co-founder of the American Empire Project.