Phototreat/Getty

This story originally appeared on ProPublica and was co-published with the Atlantic.

Novasha Miller pushed through the revolving doors of the black glass tower on Jefferson Avenue last December and felt a rush of déjà vu. The building, conspicuous in Memphis’ modest skyline along the Mississippi River, looms over its neighbors. Then she remembered: Years ago, as a teenager, she’d accompanied her mother inside.

Now she was 32, herself the mother of a teenager , and she was entering the same door, taking the same elevator. Like her mother before her, Miller was filing for bankruptcy.

She’d cried when she made the decision, but with three boys and one uneven paycheck, every month was a narrow escape. A debt collector had recently won a court judgment against her and, along with that, the ability to seize a chunk of her pay. Soon, she would be forced to decide between groceries or electricity.

Bankruptcy, she figured, despite its stink of shame and failure, would stop all that. She could begin anew: older, wiser, and with a job at a catering company that paid $10.50 an hour, a good bump from her last one. She could keep dreaming of a life where she had money left over at the end of each month, a chance of one day owning a home.

What Miller didn’t know when she swallowed her pride and called a local bankruptcy attorney is that she would probably end up right back where she started, with the same debts, in the same crisis. For the black debtors who, for generations, have made Memphis the bankruptcy capital of the U.S., the system delivers neither forgiveness nor renewal.

Up on the sixth floor of that tower where I met Miller last February, the U.S. Bankruptcy Court for the Western District of Tennessee appeared to be a well-functioning machine. Debtors, nearly all black like her, crowded the wedge-shaped waiting area as lawyers, paralegals and court staff, almost all white, milled about in front. Hundreds of cases are filed here every week, and those who oversee and administer the process all proudly note the court’s marvelous efficiency. Millions of dollars flow smoothly to creditors, to the court, to bankruptcy attorneys.

But the machine hides a harsh reality. When ProPublica analyzed consumer bankruptcy filings nationwide, the district stood out, both for the stunning number of cases in which debtors were unable to get relief, and for the reasons why. In Memphis, an entrenched legal culture has made bankruptcy a boon for attorneys while miring clients like Miller in a cycle of futility.

Under federal bankruptcy law, people overwhelmed by debt have a choice: They can either file under Chapter 7, which wipes out debts and, since most filers lack significant assets, allows them to keep what little they have. Or they can choose Chapter 13, which usually requires five years of payments to creditors before any debts are eliminated, but blocks foreclosures and car repossessions as long as debtors can keep up. In most of the country, Chapter 7 is the overwhelming choice. Only in the South, in a band of states stretching from North Carolina to Texas, is Chapter 13 predominant.

The responsibility of knowing which path to pick falls to those seeking relief. In Memphis, about three-quarters of filings are under Chapter 13. That’s how Miller filed. She thought the two chapters were “the same,” she told me.

Initially, they are. Upon filing, debtors are shielded from garnishments and debt collectors. But whereas under Chapter 7 those protections are generally made permanent after a few months, under Chapter 13 they last only as long as payments are made. Most Chapter 13 filers in Memphis don’t last a year, let alone five.

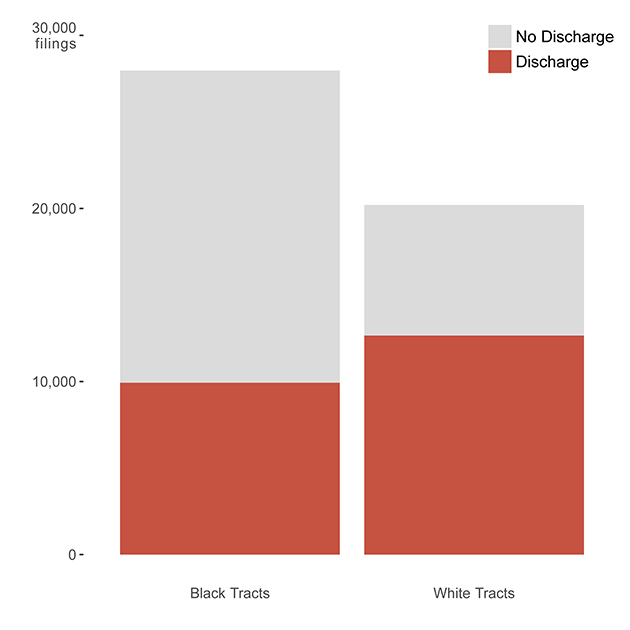

As efficiently as cases are opened, they are closed—usually because debtors fail to keep up with payments, according to a ProPublica analysis of court data. In 2015, over 9,000 cases in the district were dismissed—more cases than were filed in 22 other states that year. Less than a third of Chapter 13 cases in the district result in a discharge of debts. And when their cases are dismissed, debtors are often in worse straits, because as they struggled to make payments, the interest on their unpaid debts continued to mount. Once the refuge of bankruptcy is gone, the debt floods back larger than ever. They’ve borne the costs of bankruptcy—attorney and filing fees, a seven-year flag on their credit reports—without receiving its primary benefit. A system that is supposed to eliminate debt instead serves to magnify it.

Driving this tremendous churn of filings is a handful of bankruptcy attorneys with what sounds like an easy pitch: immediate relief, for free. In Memphis, it typically costs around $1,000 to hire an attorney to file a Chapter 7, but most attorneys will file a Chapter 13 for no money down. Ultimately, the fees for Chapter 13 filings are higher—upwards of $3,000—but the payments are stretched over time. For many people, this is the only option they can afford: debt relief on credit. For attorneys, they gain clients—and a regular flow of fees—they might not otherwise get, even if few of their clients get lasting relief.

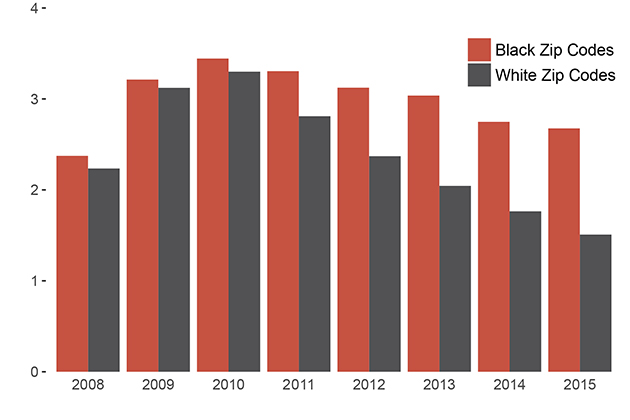

Chapter 7 Filing Rates Are Higher in Black Areas, With Patterns Similar to White Areas…

Chapter 7 Filings per 1,000 Residents—Majority Black Zip Codes vs. Majority White Zip Codes

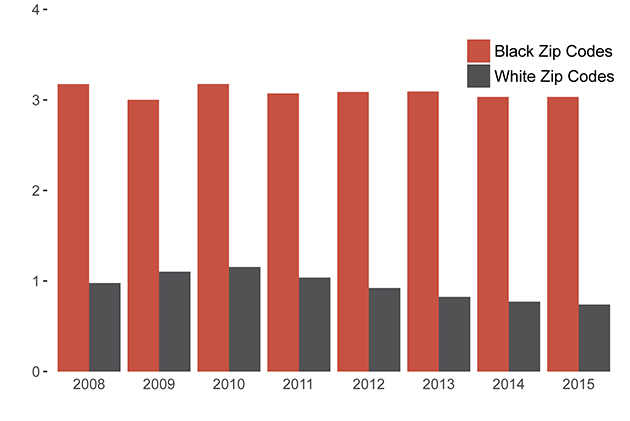

Chapter 13 Filings per 1,000 Residents—Majority Black Zip Codes vs. Majority White Zip Codes

For black filers in Memphis, relief is particularly rare. They are more likely than their white peers to file under Chapter 13 and less likely to complete a Chapter 13 plan. Because failure is so frequent in Memphis, many people file again and again. In 2015, about half of the black debtors who filed under Chapter 13 in the district had done so at least once before in the previous five years. Some had filed as many as 20 times over their lifetimes. Here, bankruptcy is often not the one-time rescue it was envisioned to be, but rather a way for the poor to hold on to basic necessities like electricity for a couple months.

“The way we have it set up, our culture, has a lot of unintended consequences,” said Judge Jennie Latta, one of five bankruptcy judges in the Western District of Tennessee. Since 1997, when she took the bench, the racial disparities in Memphis have been evident, she said. “It was troubling to me then, and it’s still troubling to me.”

When I asked judges, trustees, who administer the cases, and debtor attorneys what could be done to reduce racial disparities and improve outcomes, I was mostly met with resignation. I heard a lot about the poverty in Memphis and a legal culture with deeply rooted traditions. But ProPublica’s analysis identified bankruptcy attorneys in Memphis who had much more success in getting their black clients out of debt. These attorneys had a different approach, preferring Chapter 7 to Chapter 13, and, crucially, allowing more flexibility in what clients paid upfront in fees.

Scrutiny of Memphis is important, because the racial differences we found there are present across the country. Nationally, the odds of black debtors choosing Chapter 13 instead of Chapter 7 were more than twice as high as for white debtors with a similar financial profile. And once they chose Chapter 13, we found, the odds of their cases ending in dismissal—with no relief from their debts—were about 50 percent higher.

Meanwhile, the $0-down style of bankruptcy practiced in Memphis, long common across the South, is quietly growing in popularity elsewhere. Chicago in particular has seen an explosion of Chapter 13 filings in recent years. A recent study found that the “no money down” model is becoming more prevalent, prompting concerns that it is snaring increasing numbers of unsuspecting debtors and ultimately keeping them in debt.

About 10 miles south of the black glass tower lies the community of Whitehaven. Famous as the site of Graceland, Elvis Presley’s mansion, its streets are lined with miles of humbler homes, mostly one- or two-bedroom bungalows. The houses reflect the range of financial security among Whitehaven’s almost exclusively black residents: Some lawns are immaculately kept in front of neat, pretty facades, while others run riot with weeds next to broken-down cars.

This is where Novasha Miller was born and raised. She went to Hillcrest High on Graceland Drive and still lives in the area. Here, bankruptcy has a startling ubiquity. Count the bankruptcies filed from 2011 through 2015 by residents of Whitehaven, and there is almost one for every three households.

Miller’s spiral downward began in late 2014, when she and her sons moved into a $545-per-month apartment in Highland Meadows, a complex pitched on its website as nestled in a “serene woodland setting.” Inside, roads wander around shaded clusters of two-story structures, some with boarded-up doors and windows.

Miller soon realized she’d made a mistake by signing the lease. Roaches emerged every time she cooked, she said. Underneath the kitchen sink, mold was spreading that seemed to aggravate her 10-year-old son’s asthma. The stove broke; then bedbugs arrived, leaving telltale marks up and down her and her boys’ arms.

Despite her calls and complaints, she said, management didn’t fix the mold issue and told her she’d have to pay for an exterminator herself. Finally, she decided to move. She wrote a letter saying she was breaking her lease and explaining why.

“My kids’ health is more important than anything, and I just had to leave,” she told me. (The company that manages Highland Meadows did not respond to requests for comment.)

A couple of months after she moved, Absolute Recovery Services, a collection agency, sent her a letter saying she owed $5,531—a total that seemed inflated to Miller. If she didn’t pay up immediately, the agency wrote, it might sue. It followed through the next month, tacking on a $1,844 attorney fee, for a total bill of $7,375.

Derek Whitlock, the attorney who represented Absolute Recovery Services in its suit against Miller, provided ProPublica with an accounting of Miller’s debt. Only $1,635 was due to back rent; the rest stemmed from eight different types of fees—all of which, Whitlock said, Miller had “contractually agreed to.” Miller’s lease had also stated that residents were “responsible for keeping the premises free from infestation of pest, etc.,” he said.

With no attorney to represent her, Miller went to court. Delayed by a search for parking, she missed her case, and Absolute Recovery won a judgment against her. A court employee told her the agency could soon move to garnish her paycheck, she said.

Under Tennessee law, debt collectors can seize up to a quarter of debtors’ take-home pay, and in Shelby County, which contains Memphis, they sought to do so in over 21,000 cases in 2015, according to a ProPublica analysis of court records. Such garnishments are far more common in black neighborhoods.

“I cried, stressing at work,” said Miller. “I couldn’t work, trying to figure out what to do.”

At the time, Miller earned $9 an hour working for a catering company where her hours were often cut without warning. Although she’d never had an extended stretch of unemployment, the last several years had been a struggle. She still carried $19,000 in student loans from a cosmetology program, and a $1,100 loan from a car title lender, TitleMax, which she’d used to cover one month’s shortfall. TitleMax routinely lends at annual interest rates above 150 percent in Tennessee, and every month Miller had to come up with about $100 in interest to keep the company from seizing her 2003 Pontiac Grand Prix. If Absolute Recovery garnished her wages, Miller stood to lose her apartment, her electricity or the car she drove to work.

The pressure, she said, pushed her into bankruptcy court. “It’s hard out here,” she said. “I hate that I had to go through it just to keep people from garnishing my check.”

She Googled “bankruptcy attorney” and landed on the website of Arthur Ray, who has been practicing in Memphis since the 1970s. His website was topped with “$0” in large type. “Most of our Chapter 13 bankruptcies are filed for $0 attorney’s fee up front.” She called and made an appointment.

Earlier this year, I headed to Memphis to meet people like Miller and find out why attorneys there kept funneling their black clients into Chapter 13 plans when so few could complete them. I came armed with what amounted to a score sheet for each attorney, showing how their black and white clients had fared. ProPublica had taken every case filed in the district over 15 years, paired it with census information and put it on a map. In a starkly segregated city like Memphis, we could deduce the race of their clients with confidence based on where they lived.

I caught up with Ray by phone. Like most of the higher volume lawyers in the district, Ray is white while most of his clients are black. About nine out of every 10 of his cases is a Chapter 13. And he was twice as likely to file under Chapter 7 for a white client as he was for a black client.

None of this troubles Ray in the least. If Chapter 13 has an evangelist, it’s Ray, who trumpets its attributes unapologetically. In his eyes, debtors need Chapter 13 to train them to get their financial houses in order and instill discipline on their unruly spending.“

“A Chapter 13 shows people how to live without buying things for that 60-month plan,” he said. “With a Chapter 7, wham bam it’s over, and they’re back to the same old thing, the bad habits that got them in trouble to begin with.”

When debtors squander Chapter 7’s power to erase debt, he argued, they are stuck—barred from filing again for eight years. Better to keep that option in reserve for something truly catastrophic, he said.

Ray conceded that most of his clients do not successfully complete their Chapter 13 plans, but he argued that wasn’t so bad. “It may be a long time before the creditors come after them,” he said. And when the phone calls and the legal notices do come back, “then they can file again.”

In Western Tennessee, More Bankruptcy Filings, But Less Debt Relief for Black Debtors

Filings by Disposition, 2008-2010, All Chapters, Majority Black Census Tracts vs. Majority White Census Tracts

I told Ray that Novasha Miller hadn’t understood the difference between the two chapters. Ray was not troubled by this either. As required by law, he said, he provides clients with documents explaining the difference, but any client who asks about Chapter 7 will get an argument from him. “They need to learn how to live not buying things on credit,” he said.

Few attorneys are likely to express this paternalistic view as bluntly as Ray, but the idea that bankruptcy courts should rehabilitate debtors instead of simply freeing them of their debts dates back to the 1930s, when, buoyed by creditors’ lobbying efforts, Chapter 13 first became law. It’s a form of bankruptcy that sprang from the South: Started as an experiment by the bankruptcy court in Birmingham, Alabama, it was added to the federal bankruptcy code through a bill authored by a Memphis congressman. To this day, many see Chapter 13 as the more honorable form of bankruptcy because it includes some attempt to repay debts.

But when I asked some of Ray’s colleagues why so many of their clients filed under Chapter 13, honor was rarely mentioned. Instead, they said it was about holding on.

“Chapter 13 is generally a ‘keep your stuff’ chapter,” is how Bert Benham, a Memphis bankruptcy attorney, put it.

Most people who end up filing in the district don’t own much. In 2015, 69 percent of those who filed under Chapter 13 didn’t own a home, and the median, or typical, income was less than $23,000 per year.

For many people, the most important thing is keeping their car, a necessity in Memphis, which has little public transportation. Used car lots abound, offering subprime credit. When borrowers fall behind and lenders threaten repossession, Chapter 7 won’t stop that from happening. But Chapter 13 allows secured debts to be repaid over the course of the plan. In theory, loan payments on a car or mortgage can be reduced to an affordable level, providing time to catch up without fear of repossession or foreclosure.

Lured by this promise, desperate Chapter 13 filers can spend years caught in a loop. One Whitehaven resident told me how, in order to hold on to her car, she’d filed under Chapter 13 four times since 2011. The first time, she lost her job a year and a half after filing, and her case was dismissed after she fell behind. She immediately filed again to keep the car for job interviews, using unemployment benefits to make the payments until she couldn’t. She then filed a third time. Finally in 2014, after her third dismissal, she got a new part-time job paying $11 an hour and filed again.

She still has two years of payments to go and will have spent most of her 30’s trying to hold on to her car. “If I’d known,” she said, “I just would have let my car go.”

Bernise Fulwiley, 60, filed for Chapter 13 in 2014 to avoid foreclosure on her home, a brick bungalow with a large maple in the yard on a corner in Whitehaven. The following year, she lost her warehouse job when she required foot surgery and couldn’t keep up her payments. She got another warehouse job, earning $9.50 an hour, and filed again. She has kept up the payments for two years, and is determined to make it for three more.

“‘God, go before me. Open this door! Help me, Lord!’ That’s been my prayer,” she said. “I ain’t gonna never give up.”

For decades, the most prolific bankruptcy firm in Memphis has been Jimmy McElroy’s, known for its long-running TV commercials featuring the now-deceased Ruby Wilson, a legendary blues and gospel singer dubbed the Queen of Beale Street. At the end of 30-second spots, she exclaimed, “Miss Ruby sings the blues, and you don’t have to!”

McElroy, a mild-mannered white man in his 70s with a genteel lilt to his speech, told me that “the ultimate success” for a Chapter 13 filing is “to pay it out, get a discharge, get out of debt. And then learn to live within your means.” From 2011 through 2015, McElroy’s firm filed over 8,000 Chapter 13 cases and fewer than 900 Chapter 7 cases. About 80 percent of his clients come from predominantly black neighborhoods.

But “ultimate success” is rare at his firm. Only about one in five of the Chapter 13 cases filed by his black clients reached discharge, a rate typical for the district. When I asked why, McElroy, whose office is in the same tower as the bankruptcy court, said clients generally “get the temporary relief they needed,” but then things just happen: “They lose their job. They get sick. They get a divorce.”

Sometimes Chapter 7 does seem like a better choice, he said, but the client can’t afford to pay the attorney fee, which, at his firm, is about $1,000. In those cases, he’ll advise them to start with a Chapter 13, since it’s “more affordable to get into,” he said. “I tell them … ‘If you get in a better situation, we can convert later.'”

Debtors are, indeed, allowed to switch from Chapter 13 to Chapter 7 after their cases have begun, although it typically requires paying an additional attorney fee. But this rarely happens in the district. Only about 5 percent of Chapter 13 filings since 2008 converted to Chapter 7, according to our analysis. For McElroy’s firm’s cases, it was 2 percent.

Often in Memphis, the whole goal of bankruptcy is just to address basic needs, even if only for a month or two.

Last year, Memphis Light, Gas and Water cut off customers’ electricity for nonpayment 98,000 times. It’s an “astoundingly high” number given that Memphis provides electricity to fewer than 400,000 customers and “far higher than any other large urban utility that I’ve seen,” said John Howat, senior energy analyst with the National Consumer Law Center.

Nearly half the Chapter 13 cases filed by black residents in the district had utility debt, our analysis of 2010 filings found. The typical debt with the utility company was $1,100. For customers with poor credit, the utility has a policy of disconnecting service within a couple months if the arrears grow beyond $200.

MLGW does offer programs for low-income customers and installment plans for those who fall behind. “We have probably some of the most liberal customer assistance programs of any utility in the country,” said Gale Carson, spokeswoman for MLGW.

But that assistance is limited to just a few thousand households. And the installment plans require customers to make the payments in addition to their normal monthly bills.

By declaring bankruptcy, debtors can start a monthly Chapter 13 plan tied to their income and get the power turned back on within a month or so.

In February, I visited Michael Baloga, an attorney at Long, Umsted, Jones & Kriger, at the firm’s downtown storefront, just down the street from the Shelby County Jail and next door to a bail bond agent.

“Chapter 13 bankruptcy can be a necessary evil at times,” he told me. “Like, for today, there are people who are coming in because it’s cold, and they don’t have electricity.”

Baloga said he didn’t like to file cases just for that reason. “But on the other hand, am I going to let them sit and freeze in their home because they don’t have it? … I know that they’re going to file the bankruptcy and that they’re not going to stay in it very long. In the alternative, am I just going to turn them away and say, ‘No, you’re not going to get a chance at all?'”

For the firm’s predominantly poor and black clientele, the chances are remarkably low: Only one in 10 of the cases result in a discharge. Most don’t last six months.

Using bankruptcy this way “seems like using a sledgehammer to hang a picture,” said Judge Latta. But she understands why debtors do it. “I think bankruptcy, in Memphis anyway, is very much part of the social safety net,” she said, “and all these problems fall down into it.”

About 18,000 times each year, Tennessee suspends the driver’s license of a Shelby County resident for failing to pay a traffic fine, according to state data obtained by Just City, a Memphis nonprofit advocacy organization. About 84 percent are black drivers, although only half of Shelby County’s residents are black.

In 2010, about a quarter of black residents filing Chapter 13 had outstanding debt with the Shelby County General Sessions Criminal Court, which handles mostly misdemeanors and traffic offenses, our data shows. Their typical debt was around $1,600.

Court officials said licenses are only suspended if defendants fail to pay fines within 12 months. The court offers installment plans, including one called the Driver’s Assistance Program that allows drivers to regain their licenses. But only about 230 people were enrolled in the program as of March, they said.

For those who can’t afford or don’t qualify for the court’s programs, Chapter 13 provides an answer. They can get their licenses reactivated within a matter of months and stretch payments over five years, if they make it that long. Such fines can’t be eliminated through Chapter 7.

In Chicago, similar pressures have led to a recent boom in Chapter 13 filings. Chapter 13 filings by black residents in the Northern District of Illinois rose 88 percent from 2011 to 2015, we found. There, the issue is mostly parking tickets, according to ProPublica’s analysis and a recent academic study of filings in Cook County. But, like Memphis, it’s overwhelmingly black debtors who file for Chapter 13 to forestall license suspensions or car seizures.

Black households are particularly vulnerable to financial difficulties like these. They have less income, fewer assets, and less financial stability than white ones—all deficits with deep roots. When they are hit with financial emergencies (a cut in pay, a needed car repair), they are less likely to have the resources to withstand them. The same vulnerabilities that make black Americans more likely to file for bankruptcy make them less likely to succeed in bankruptcy.

In Memphis, that means the debtors who use the bankruptcy system the most—low-income black debtors—fare the worst.

“I say all the time that in Memphis, debtors don’t earn a living wage,” said Sylvia Brown, one of the two trustees for Chapter 13 cases in Memphis.

A few floors above the bankruptcy court are the offices of Cohen & Fila, a firm with a mostly poor clientele and one of the highest volume practices in the district. I asked Tom Fila, a Yankee transplant who has practiced bankruptcy law in Memphis for more than 20 years, about one of his clients: The firm had filed 17 cases on her behalf, all but two under Chapter 13. She was one of at least 465 people who had filed for bankruptcy 10 or more times in the district between 2001 and 2015, ProPublica’s analysis found. These repeat filers tend to be among the poorest.

Fila bristled at the implication that his firm had filed the cases for any reason but the best interest of the client. “I’m not making money on these cases, and I probably shouldn’t file them,” he told me. “I often tell my clients that repeated filings aren’t doing them any good. They are ending up in the same spot they started in, only now they have multiple bankruptcy cases on their credit report…but at the end of the day I’m not the one living without utilities or being evicted or being without transportation.”

Of course, most of the time attorneys in the district do get paid something. When we analyzed the Chapter 13 cases filed in 2010, we found that, on average, attorneys in the district collected $1,340 per case out of their full $3,000 fee. Some firms, like Fila’s, collected much less (about $700), and some collected more.

But what has made bankruptcy a viable business for the biggest firms in Memphis for so long is the sheer volume. From the 12,000-plus Chapter 13 cases they filed in 2010, we estimate that attorneys reaped at least $16 million in attorney fees over the next five years. McElroy’s firm, the largest, collected at least $2 million.

Things have worked this way in the district for as long as anyone can remember. The district’s chief judge, David Kennedy, who has presided over cases since 1980, said attorneys have been charging $0 down to file Chapter 13s at least since the 1970s.

He sees no clear need for reform. Chapter 13 “provides, I think, better relief, depending on the circumstances,” he said, adding that the large number of dismissals is not necessarily bad. “Just because it doesn’t go to discharge doesn’t mean it’s a failed case.” A homeowner might file Chapter 13 to stop a foreclosure, he said, then use the breathing room to work out a loan modification with the mortgage servicer and drop the case voluntarily.

That undoubtedly does happen. But most debtors in the district don’t own a home.Judge Latta said efforts to help the poor file under Chapter 7 for free have met with resistance. “We get a lot of pushback on pro bono programs here,” she said. “[Attorneys] say, ‘But, judge, we can put them in

That undoubtedly does happen. But most debtors in the district don’t own a home.

Judge Latta said efforts to help the poor file under Chapter 7 for free have met with resistance. “We get a lot of pushback on pro bono programs here,” she said. “[Attorneys] say, ‘But, judge, we can put them in

Judge Latta said efforts to help the poor file under Chapter 7 for free have met with resistance. “We get a lot of pushback on pro bono programs here,” she said. “[Attorneys] say, ‘But, judge, we can put them in a Chapter 13, and we can get paid for that.'”

It’s no secret in Memphis that bankruptcy works differently outside the South, but the scope of that contrast is staggering. In 2015, for example, there were 9,000 Chapter 13 cases filed in Shelby County, while in Brooklyn, New York, there were fewer than 300. Brooklyn has a similar poverty rate, median income and higher housing costs. Like Shelby County, it has a large black population. It also has 1.6 million more people.

What’s the biggest difference? How bankruptcy attorneys are paid. In Brooklyn, attorneys usually ask for around $2,000 upfront to file a Chapter 13, said Michael Macco, a trustee in the Eastern District of New York. As a result, poorer households simply can’t afford to file. The typical Chapter 13 debtor who hired an attorney in Brooklyn in 2015 was a middle-income homeowner with $420,000 in assets—over 40 times more in assets than filers in Shelby County.

The reasons for vast differences like these among courts are largely arbitrary. While bankruptcy is a federal institution, ruled by laws made in Washington, D.C., each local court is essentially its own kingdom with its own customs shaped by the judges, trustees and attorneys who work there. Scrutiny of these differences, and how they affect debtors, has been scant.

While judges like Kennedy are untroubled by the flood of unsuccessful Chapter 13s, our analysis found Memphis attorneys who have built successful bankruptcy practices in a different way. In an office park on the eastern edge of the city, I met Jerome Payne, who has filed more Chapter 7s on behalf of black clients than anyone in the district in recent years, despite not being in the top 10 firms in terms of total volume.

That alone would make Payne stand out. But Payne is also, unlike all but a few debtor attorneys in Memphis, black.

A cop turned nurse turned attorney, Payne, 66, has been practicing bankruptcy law in Memphis since the 1990s. Inside his office, the thick carpeting and friendly banter between Payne and his two long-standing employees give the place a homey feel, albeit a home with files stacked everywhere and large binders labeled “GARNISHMENTS” spilling out of a cabinet.

African-American identity is a major part of his practice. When his firm sends out letters to prospective clients—usually people who have been sued over a debt – he tries to make sure they know. “I use black heritage stamps,” he said. Sometimes he uses Kwanzaa stamps. He includes a page with inspirational sayings, like one with a quote from Marcus Garvey, a leader of the Black Nationalist movement, who is depicted with his body in the shape of Africa.

The emphasis on blackness is not just a marketing gimmick, he said. Because the clients are “people who look like me,” he said, “they feel more comfortable with me.”

And that, he said, may help in convincing debtors that Chapter 7 is a better choice. Payne’s challenge, he said, is getting them “to take the emotions out of a home, the apartment, out of the vehicle” and decide that they are better off without the debt.

This discussion is what he calls his “come-to-Jesus meeting.” Contrary to Arthur Ray’s emphasis on teaching his clients financial discipline through five years of payments, Payne promotes the discipline of letting go of possessions they can’t afford.

“Me being African American, and me understanding my community, maybe I’ve been more successful in showing them that this is not the way you ought to go,” he said.

Crucially, Payne also approaches fees differently. Whether it’s a Chapter 7 or Chapter 13, the down payment is usually a couple hundred dollars, and his clients can pay the remainder in installments.

He doesn’t file Chapter 13 cases for no money down, because he just doesn’t like the idea. And he has an employee, instead of him, discuss fee arrangements with clients, he said, because “I found that it colors the way that I do business.”

Brad George is another attorney in the district who often files Chapter 7 cases for his clients. His approach is simple. “It’s not rocket science, I can tell you that,” said George, who is white and has practiced bankruptcy in Memphis for 20 years. If there is a good reason to do a Chapter 13, like a threatened foreclosure or driver’s license issue, then he will file that way. Otherwise, he said, “I think you should try and always, always, always do a [Chapter 7].”

To file a Chapter 7 with George, it costs the debtor $555, with most of that due upfront. That is about half of what many other attorneys charge in Memphis. But, to George, it just seems like enough.

“I figure I spend about two hours on average per Chapter 7 [case],” he said. “So that’s pretty fair, I’d say.”

George also doesn’t file Chapter 13 cases for no money down, instead asking for around $200 dollars, giving his clients a much more balanced choice between how much money they have to come up with to file Chapter 7 versus Chapter 13.

George’s black clients file under Chapter 7 almost half the time, according to our analysis, a rate that is almost two and a half times what is typical in the district. There is also little racial disparity in what portion of his black and white clients end up in Chapter 7.

Payne and George agree that their flexibility with fees is likely a key reason they are able to file more Chapter 7 cases for black clients.

There are understandable reasons why attorneys tend to be less flexible with Chapter 7 fees. When debtors receive a discharge of their debts at the end of the case, outstanding fees to their attorneys are also wiped out. Any further payments are voluntary. As a result, debtor attorneys—in Memphis or anywhere else—generally require the entirety of their fee upfront. To address this problem, some scholars have called for Congress to change the law to make attorney fees clearly exempt from discharge.

Such a change could have a large effect. The firm that files the most bankruptcy cases in Atlanta, for example, files Chapter 7 cases for $0 down, with the entirety of the fee due through an installment plan that lasts several months. The chief judge in the Northern District of Georgia has ruled that such arrangements are legal, and other large firms in the Atlanta area have adopted the practice.

The result is clear. In the heart of the South, most of the filings in the Northern District of Georgia are under Chapter 7—compared to less than 30 percent in the rest of the state. And notably, black debtors in that district file under Chapter 7 almost half the time, a rate significantly higher than even the white debtors in the Western District of Tennessee.

For now, things in Memphis continue as they seemingly always have. In April, less than six months after it began, Novasha Miller’s Chapter 13 case was dismissed. Though she hasn’t heard anything yet, her old landlord’s collection agency is again free to attempt garnishment of her wages.

Miller said that a miscommunication with her attorney led to the dismissal. After she changed jobs again (the new one pays a little bit less, $9.36 an hour, but it’s full-time and she likes the people), she notified Ray’s office, she said, but the plan payments were never set up to be automatically withdrawn from her paychecks. However it happened, having paid about $600, all of which was absorbed by court and attorney fees, she was back to square one. Choosing Chapter 7 could have resulted in her emerging from bankruptcy with her student loan as her only remaining debt. Instead, her debts, having gone unpaid for months, were now larger—she’s not clear yet just how much—the interest applied as if the bankruptcy had never happened.

She is thinking of filing again, maybe with a different attorney. And hopefully, she said, this time it’ll work out.