Visitors to the Department of Labor are turned away at the door by personnel due to closures over coronavirus concerns in New York. John Minchillo/AP

For the past year, economists and policy experts had been warning of a coming economic downturn. But the screeching halt the economy has experienced in the midst of the COVID-19 pandemic isn’t that, says Mike Konczal, who studies financial reform and unemployment at the Roosevelt Institute, a left-leaning think tank. “It is so difficult to describe how this is not the next recession that would have eventually happened,” Konczal tells me.

Recessions, Konczal explains, tend to unfold slowly; during the 2008 crisis, unemployment rose steadily, with roughly a million people losing their jobs in one month during the worst of it. But under current conditions, Konczal predicts we’ll see 3 or 4 million newly unemployed people this month alone. The second and third quarter of this year, he believes, will look like a depression. “This is such an absolute stop and such a shock across so many businesses—there really isn’t a good parallel,” he says.

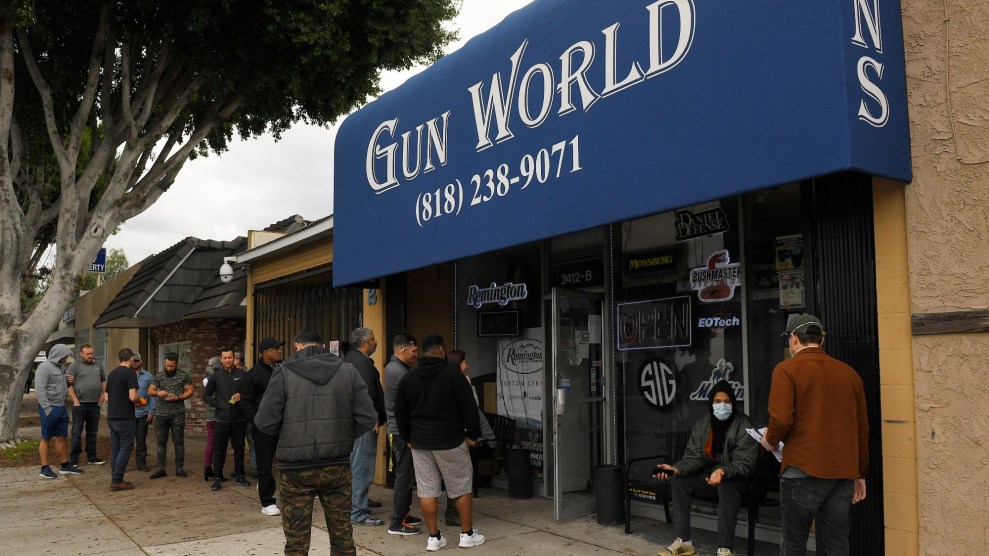

Konczal says that the federal government needs to do everything it can to keep small and medium businesses from getting “wiped out”—particularly those in the service sector that won’t reap the benefits of pent-up demand when life goes back to normal. On Wednesday morning, Senate leadership and the White House announced a deal on a $2 trillion relief package that addresses some of this: It includes $350 billion in loan forgiveness grants to small businesses and $10 billion in emergency grants to provide up to $10,000 per company in immediate relief. But will it be enough? “I worry about whether the SBA loan backstop is going to work, and whether it’s going to get overwhelmed,” Konczal said. The funds “might have a problem where it’s going to run out pretty quick, and smaller firms might not be in a position to take advantage of it in time or with the sophistication that’s needed.”

Beyond the immediate economic emergency, Konczal says the crisis has highlighted structural issues that also warrant attention. The stressors that health care workers already endure—dangerous work done in unsafe conditions for low pay—have multiplied exponentially on the frontlines of the pandemic. The way we do education and child care, Konczal says, is also worthy of a second look. Sectoral bargaining—the unionization of an entire industry, as opposed to just one company or workplace—could do a lot to address those concerns, since it can strengthen bargaining power and, in turn, help workers achieve more uniform pay and benefits. It would also provide a venue to arrange temporary furloughs and unemployment benefits for large numbers of employees when the companies they work for are forced to suspend operations in a public health emergency. “A lot of people have been talking about sectoral bargaining lately, and the fact that it could help prevent a cascade of business failures during a global pandemic was not part of that selling point,” Konczal says. “I hope this reinvigorates the case for a much more sane and humane labor policy.”

As the details of the Senate negotiations came together, I asked Konczal what he thinks the federal government should do to jumpstart the economy, what could hinder an effective recovery, and what lessons from the last recession could apply to this one.

Economists predicted that we’d experience a recession sometime in the next 18 months. Did COVID-19 help it come earlier than expected?

It is so difficult to describe how this is not the next recession that would have eventually happened. Let’s say that there’s a big corporate debt bubble and it collapsed, or let’s say that there was a big slowdown in a bunch of different countries at the same time. Think of the Great Recession, which was quite bad. Unemployment went to 10 percent, and every month in the last half of 2008 through 2009, unemployment would go up about a third of a percent. In the worst month, I think there were one million newly unemployed.

We will almost certainly have between 3 and 4 million [newly] unemployed this month alone. The severity of what’s coming is not like anything we have documented. For [the increase in] unemployment, I’m hearing 2 percent, and we’ve basically never seen that. This is such an absolute stop and such a shock across so many businesses—there really isn’t a good parallel.

In terms of the second and third quarter of this year, it will look like a depression. Now there’s a debate about how quickly you will recover. Maybe we will recover much faster, because it doesn’t have that sluggish recession to it—it’s just everyone stopped for a few months, and everyone’s gonna pick back up. Maybe not. It’s a really good question. But in the immediate short-term, I think the hit’s going to be much bigger, so this will not feel like whatever recession would have happened without the coronavirus. Now, that doesn’t mean we don’t know the tools we need to use to fight it.

And what are the impediments to economy getting back to normal once we’re all allowed to congregate together in public spaces again?

A really useful comparison is the Great Recession and the housing crash. The Great Recession—in my reading, and I think increasingly, the view of many economists—is that it was less about the Wall Street financial crisis, like your AIGs and Goldman Sachs, which were bailed out very effectively, very quickly, and largely stabilized very quickly. The real problems of the Great Recession pertained to the 5-to-6 million foreclosures that happened.

There was this very influential way of viewing the housing crash. People would say, “Look, at the end of day, it’s not going to cause a severe recession because, while the value of homes has gone down, the price of future housing has also gone down. So even though your house lost half its value, the next house you’re going to buy also lost half its value. So are you really worse off?” But what actually happened was: It really did matter that people were underwater in debt and were being swamped by bad debts. Foreclosures would drive down whole neighborhoods, and there was a cascading effect where one foreclosure would lead to other houses in the neighborhood being worth less money, which would then further decrease economic activity. I think the same thing could be true if we screw this up.

If all these small businesses went under a huge wave, they don’t just magically pop back up. That’s why there’s a lot more interest in backstopping businesses, particularly small and medium businesses. Because, for example, if you run a plumbing firm with five people, over the next few months, your van, your equipment, and your knowledge aren’t going to disappear. But if the business goes under, it’s not easy to just start it back up. You need money to do the advertisements, maybe store things—that kind of infrastructure of everyday economic relationships is really important to preserve.

The second part is: In manufacturing, you can move things forward or backwards. Maybe you were going to buy a car, or a house, or a couch this spring, and now you’ll just do it in the fall. If you were going to go out for a restaurant meal last night, and you did not, you’re not going to make that up in the fall. Maybe everyone will be very excited to go out, but you’re not going to triple-up on your yoga classes or whatever. We’re not going to make up all the service sector work that is a large part of our economy. That’s why people are extra concerned about small business and the service sector.

There’s been a lot of attention on the daily ups and downs of the stock market—particularly from the White House. Do those daily fluctuations matter? What other economic indicators should politicians be looking at?

The stock market is obviously reflecting serious concerns that are being reflected across every economic variable. The thing to watch closely are unemployment starts—people who are filing for unemployment for the first time, which has jumped something like ten-fold, depending on where you’re looking. Elise Gould at the Economic Policy Institute had a blog post last week about the employment ratio—not just looking at unemployment, but the total percent employed, because you may see a lot of people fall through the cracks in the short term. Unemployment is only people who are actively looking for a job, and since many people will not look for a job under quarantine—and many people will not be hiring under quarantine—the percentage of people who are employed might be an extra important metric in the next month.

Another thing I’d emphasize is long-term government rates, so-called “real interest rates,” which are adjusted for inflation and are zero or negative over the 10-to-30-year horizon. The bond market is telling the government that it is willing to effectively pay the government to take on debt with negative real interest rates. Also, the fact that they have collapsed directly says that we’re not going to have an inflationary crisis. The government has plenty of room to take really bold action, and it should do it.

A lot of the conventional numbers will not be correct for several months. Unemployment numbers, GDP numbers are revised all the time. And one of the problems we had in the Great Recession was that policymakers did not understand how bad it had gotten until after, say, the Obama stimulus had passed. Then, you could kind of look back and say, “Oh, wait, the recession was like 10 percent worse than we had understood. Everything should have been 10 percent bigger, and it wasn’t.” Here, I think people are aware that it’s going to get quite bad, but it’s worth remembering that the first round of government data has a lot of estimates and models and imputed values, depending on what you’re looking at. There’s a real chance that it’s going to severely understate how bad things have gotten.

Lawmakers predict this is only the first in a series of bills to address this crisis. What are the longer-term, structural economic remedies you’d recommend to better prepare for future disasters like this?

Two things really jump out at me. One is the way care and health work is done in this country. I think it’ll come under a pretty serious reevaluation. I think people having to do makeshift day care and school, and also there’s severe hardship that frontline nurses and health care providers are facing right now—often for very low pay. Home health care providers and many other people on the frontlines of our health care system are all under such severe pressure. I hope that it makes us really understand how we need to provide for those systems in a much more comprehensive way.

Two, if we’re thinking pie-in-the-sky here, this really shows the need for something like sectoral bargaining, or the additional benefits of large-scale unionization in this country. We are looking at other countries like Denmark, which are having really great responses and can coordinate 75 percent of people staying at home while the government pays their salaries. So they’re not going to lose all their businesses, people are going to be taking care of, and the system’s not going to collapse because they have sectoral bargaining.

A lot of people have been talking about sectoral bargaining lately, and the fact that it could help prevent a cascade of business failures during a global pandemic was not part of that selling point. I hope this reinvigorates the case for a much more sane and humane labor policy.

What, today, is the thing most worrying you about the economy?

One worry is that, because of a flubbed response by the federal government, we’ll end up repeating the cycle many times, and that will endanger and kill many people unnecessarily and make the economy much worse. You’re already seeing this, like, “Oh, of course we’d be willing to sacrifice people to keep the economy whole.” Beyond the sheer evil of it, people will not want to leave their house and spend money if the government is exposing them to a pathogen. And that would just delay the recovery.

Second, I worry that a lot of small and medium businesses are going to essentially be wiped out and not recover and not come back in any form, which means we’ll have a much different economy afterwards. I think that is preventable. But it would require us to have institutions in place that we don’t have, and it would require political will and imagination.