This article was co-published with EdSurge, a nonprofit newsroom that covers the future of learning through original journalism and research.

Just before her 16th birthday, Cara Rothrock got her first job working at a 1950s roadside restaurant and ice cream stand, only a few miles from her parents’ house in a small town in Floyd County, Indiana.

She poured soft serve. She cooked burgers and fries. She cleaned counters and took orders and ran food out to customers seated at picnic tables. All behind the glow of a bright, neon-lit parrot and a sign that read, “Polly’s Freeze.”

That was 1994. A few years later, Rothrock went off to college in Bloomington, Indiana. And because her parents—both teachers—couldn’t afford to help out much with her expenses, she held onto her job at Polly’s, commuting two hours home on weekends to pick up shifts. She spent the money as she earned it, investing in her education so that she could pursue her dream of becoming an elementary school teacher, just like her mom and dad before her.

After graduation, she landed a teaching position close to home. But with a starting salary of $29,000 and nearly that much in student loans, she didn’t feel comfortable enough financially to leave Polly’s. Not yet.

“As I tried to get a house of my own, a car, I found that, as a teacher, there was really no choice. I kind of needed to work a second job,” she explained in January from her third grade classroom at a public school near her hometown.

Rothrock stands in the window of her second workplace, Polly’s Freeze.

Jon Cherry/Edsurge

Cara Rothrock, a third grade teacher at Slate Run Elementary School, points to herself in an old photo at Polly’s Freeze, a restaurant and ice cream stand in Georgetown, Indiana.

Jon Cherry/Edsurge

And anyway, it was a great job for young people, Rothrock said of Polly’s. Nearly everyone who worked there back then was in high school or college, padding their pockets with a bit of spending money before launching their careers. The same is true today, decades later. Rothrock’s oldest child, a sophomore in high school, now works at Polly’s herself. In fact, she and her mom sometimes carpool to work when their shifts overlap.

Twenty-eight years later, now 43, Rothrock still works at Polly’s. She never quit. She never could.

Rothrock didn’t intend to stay at Polly’s forever, watching generations of teenagers cycle in and out of a job that she was never able to walk away from herself. Back when she was starting out as a teacher, she had to work a second job just to get on her feet. Then she got married and started a family. By the time her student loans were paid off, she had added child care expenses to the budget. Now, with three kids, ages 8, 13, and 16, the costs continue to pile up.

She could quit Polly’s today, she said, and her family could make it. “But there wouldn’t be anything extra,” she added. The emergency fund would be meager, if it existed at all. Would her 13-year-old be able to get the braces she needs? Could they have replaced the refrigerator when it went out or saved to put a new roof on the house this summer? Could she have repaired the car when it broke down a few months ago, costing her family $3,000 they didn’t really have, even with income from Polly’s?

Cara Rothrock, a third grade teacher, speaks with students in a classroom at Slate Run Elementary School, in New Albany, Indiana.

Jon Cherry/Edsurge

Rothrock’s story is not exceptional—at least in her line of work, in this country. If she were any other highly educated American professional, that might be different. But Rothrock is a teacher. That a teacher must work a second, part-time job on weeknights and weekends, year-round, more than 20 years into her career, in spite of a master’s degree and a modest lifestyle, is so universally accepted among her peers and colleagues in education that it barely warrants notice.

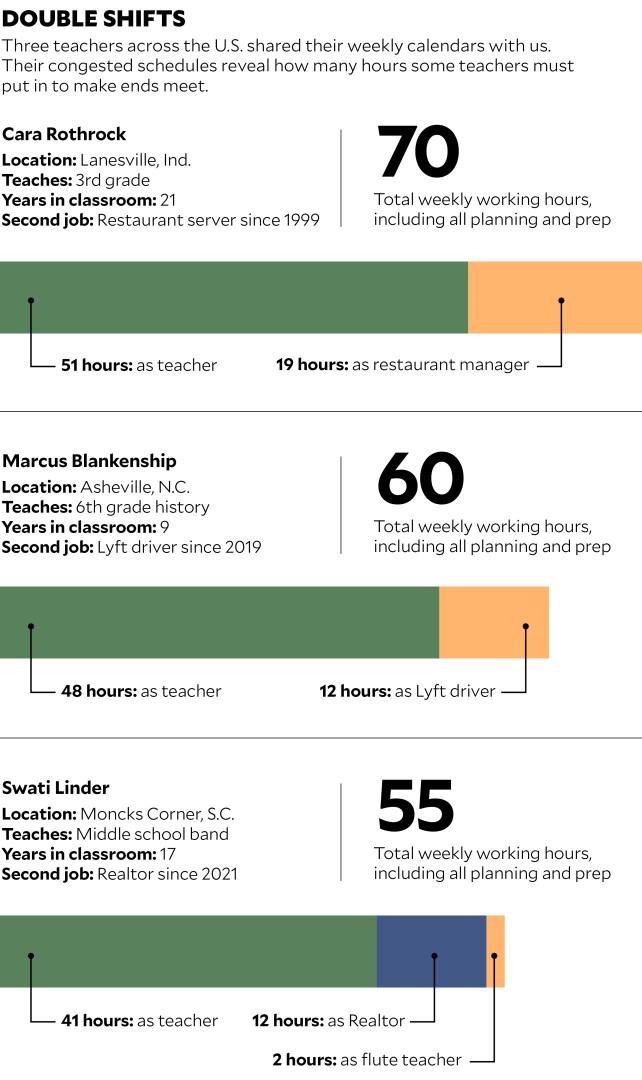

All 30 teachers I interviewed for this story have at least one other job outside of the classroom and many have other paid roles within the school, too. All of them know of colleagues down the hall and throughout the school building who work second jobs. Some work in retail, run Etsy shops or bartend. Others work at Home Depot, in pharmacies, or as house cleaners.

Swati Linder, a band teacher, reviews a piece of music with students in her class at Marrington Middle School of the Arts in Goose Creek, South Carolina.

Gavin McIntyre/Edsurge

Swati Linder, a band teacher at Marrington Middle School of the Arts, works a shift at the office of Carolina One Real Estate, where she is a realtor, in Summerville, South Carolina.

Gavin McIntyre/Edsurge

Swati Linder, a band teacher who works at a middle school outside of Charleston, South Carolina, said that when she first started dating her now-husband, she asked him, “So what else do you do?” Confused, he clarified, “I’m a teacher.” She replied, “‘And?’”

“It’s so commonplace,” said Linder, who doubles as a real estate agent. Colleagues in her school district work at Walmart; deliver food through DoorDash; and sell products for multi-level marketing companies such as LuLaRoe, Pampered Chef, and Mary Kay. “It’s not, like, an odd thing to hear about, somebody working a second job.”

Within the profession, it’s a fact of life, according to Eleanor Blair, author of the 2018 book, “By the Light of the Silvery Moon: Teacher Moonlighting and the Dark Side of Teachers’ Work,” and a professor at Western Carolina University.

“Teacher moonlighting is like some dirty little secret that we all know about, we talk about, teachers share ideas about, but nobody wants to put it on the table—that we work at Steak ‘n Shake or these other places,” said Blair, a former public school teacher who used to moonlight as a waitress.

Data is imperfect and sometimes lags a few years behind, but various credible estimates—from the federal government’s National Center for Education Statistics (NCES) to the National Education Association (NEA), the largest teachers’ union in the country—find that a significant percentage of U.S. public school teachers work at least one other job to supplement their income. For new teachers, that income averages just over $41,000, according to data from the 2019-20 school year collected by the NEA, while the average teacher salary across all levels of education and years of experience is about $64,000.

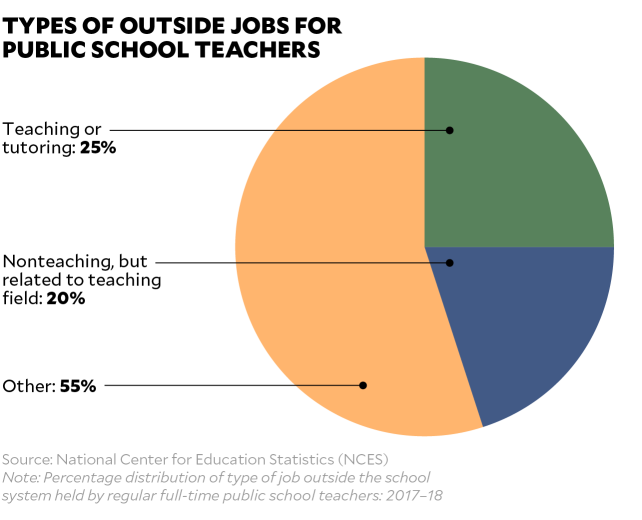

The most recent data made public by the NCES, drawing on surveys conducted in the 2017-18 school year, found that 18 percent—or about 600,000—public school teachers in the U.S. held second jobs outside the school system during the school year, making teachers about three times as likely as all U.S. workers to juggle multiple jobs at once.

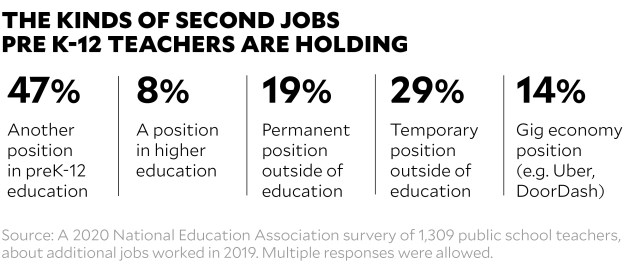

Other measures that account for second jobs both outside and within the school system have found the arrangement to be considerably more prevalent. NEA Research conducted a survey of more than 1,300 public school teachers in late 2020, asking them about the jobs they held in 2019, and found that 41 percent of preK-12 teachers worked more than one job. The NEA survey also breaks down what kind of second jobs teachers have. (These survey findings are being released publicly here for the first time with permission from NEA.)

Of the teachers who said they work at least one other job, 17 percent reported working their second job on weekdays in the early mornings before school, 62 percent said they worked weekdays after school hours, and 48 percent said they put in their hours on weekends during the school year.

“It’s really kind of disheartening when you think that many teachers not only have bachelor’s degrees but master’s degrees and still have to hustle for their income. It sends a message,” said Donna M. Davis, an education historian and professor at the University of Missouri-Kansas City.

She added: “The system is clearly broken when we have highly qualified professionals needing to supplement their income to survive, who are one catastrophe—one paycheck—away from complete ruin.”

In a national survey of nearly 1,200 classroom teachers conducted in spring 2021 by the Teacher Salary Project, a nonpartisan organization, 82 percent of respondents said they either currently or previously had taken on multiple jobs to make ends meet. Of them, 53 percent said they were currently working multiple jobs, including 17 percent who held jobs unrelated to teaching.

In a free-response portion of the Teacher Salary Project’s survey, hundreds of teachers called out the field for failing them, describing, again and again, the “humiliating” experiences they endure to stay in a profession that the public purports to value.

“It’s embarrassing, as a college-educated professional, to be offered friends’ basements as a place to stay so that I don’t end up homeless for a bit,” wrote one teacher in Colorado.

“There have been months when I had to choose between a doctor’s or dentist’s appointment for myself,” wrote another teacher, who lives in North Carolina. “I’m so far from living the dream.”

Another said: “It can be a struggle deciding what bill to pay and what bill to skip so we can eat.”

Perhaps most jarring of all was the teacher in California who said that, in order to support her family financially, she has become a surrogate mother. Twice. “I’m literally renting out my uterus to make ends meet,” she wrote.

As the data suggests, nearly half of teachers’ second jobs are education-adjacent, such as tutoring, nannying, and coaching. But the majority hold jobs outside of education. Think restaurant servers, bartenders, Lyft and Uber drivers, food couriers for DoorDash, grocery shoppers for Instacart, real estate agents, cosmetics sales representatives, and retail associates.

“It’s important to distinguish between jobs that people are doing because it’s something that they’re excited about…versus someone who’s taking on that additional work because it’s the only way they can make ends meet,” said former Education Secretary John B. King, now a candidate for governor in Maryland, in an interview. “And unfortunately, because teacher pay isn’t what it should be, many folks are in that latter category.”

In interviews, economists and historians described how second jobs that align with education—say, an art teacher who sells artwork to clients outside of school—are more palatable than second jobs outside of the field entirely.

“For somebody whose side gig is playing in the local symphony, people could say, ‘Yeah, it’s great to have a real musician teaching the kids music,’” explained Dick Startz, a professor of economics at the University of California, Santa Barbara. “But someone who is shopping for Instacart? We’re glad someone does it, but a teacher is not who we expect that person to be.”

When teachers’ outside work is career-related, even if it’s not optional, it can at least be enriching and fulfilling, argued Paul Fitchett, an assistant dean and professor at the University of North Carolina in Charlotte who previously worked as a public school teacher. “I don’t think that all moonlighting is bad, especially if it’s in your job sector,” said Fitchett, who used to do financial administration for a temp agency during the summers.

A few of the teachers interviewed for this story argued that their work outside the classroom was refreshing and gave them opportunities to socialize with other adults. But on the whole, teachers who have to work in unrelated roles to earn their extra income found it demoralizing.

“I’ve done DoorDash. I’ve done Shipt grocery delivery. But every time I do that, it feels disheartening,” said Ashley Delaney, a high school art teacher in Paterson, New Jersey, who has been in the classroom for two years. “I went to school for teaching, but I can’t afford to pay my bills unless I deliver people’s fast food?”

Now, trying to keep her side hustles in the realm of education, she tutors after school, babysits, and occasionally accepts commissions for pet portraits. She is an art teacher, after all.

This trend of teachers working multiple jobs is hardly new. But pandemic-related stressors and the pressure of rising inflation, which forces them to stretch each dollar ever further, have propelled teachers to re-evaluate the cost-benefit calculations they’d accepted long ago and to reimagine how the rest of their careers might look. Some are plotting to leave the field, hoping to roll their side hustle into a full-time job; others have already left. The majority interviewed for this story, though, still love teaching and don’t want to leave it if they don’t have to. But to stay, something will have to change, they said. They can’t keep working extra jobs to subsidize their insufficient salaries.

“It’s sad, because I thought I’d spend my life being a teacher. I love teaching,” said Reaghan Murphy, a special education teacher outside of Chicago who bartends and nannies on weeknights and weekends. “This is what I want to do, but it’s just not sustainable.”

That’s the problem with teachers who moonlight, said Blair, the author of one of the only books on the topic. The ones who care enough about the kids, who believe in the transformative power of teaching, are the ones who stay. And in order to afford to continue being a teacher, they have to run themselves ragged working multiple jobs. Why, she asked, is this country doing so little to keep them in their jobs?

“If somebody wants to do the job, we need to find ways to support them and help them be successful,” she said emphatically. “Selling cosmetics or driving an Uber is not helping them to be a teacher.”

But while Blair and others have ideas for building pathways for career development, progress nationally has stalled. For years, actually.

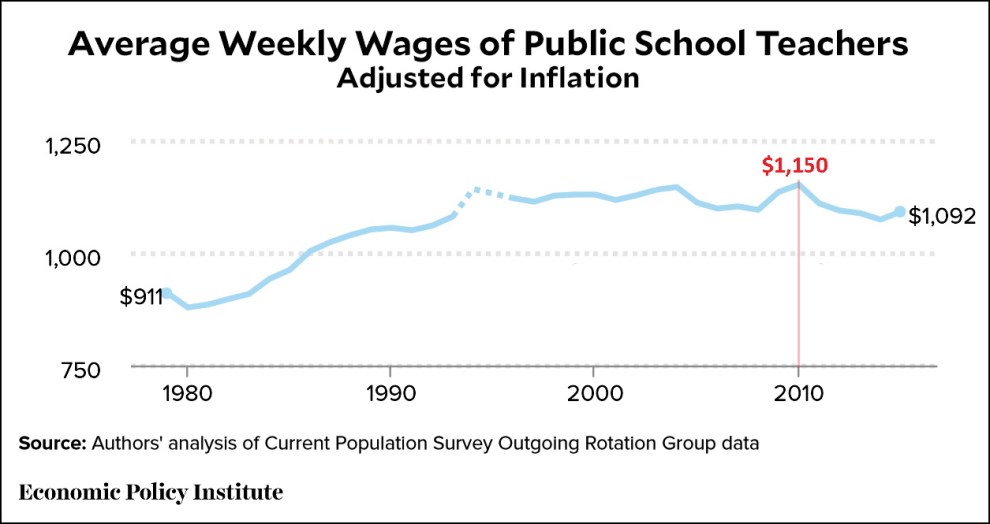

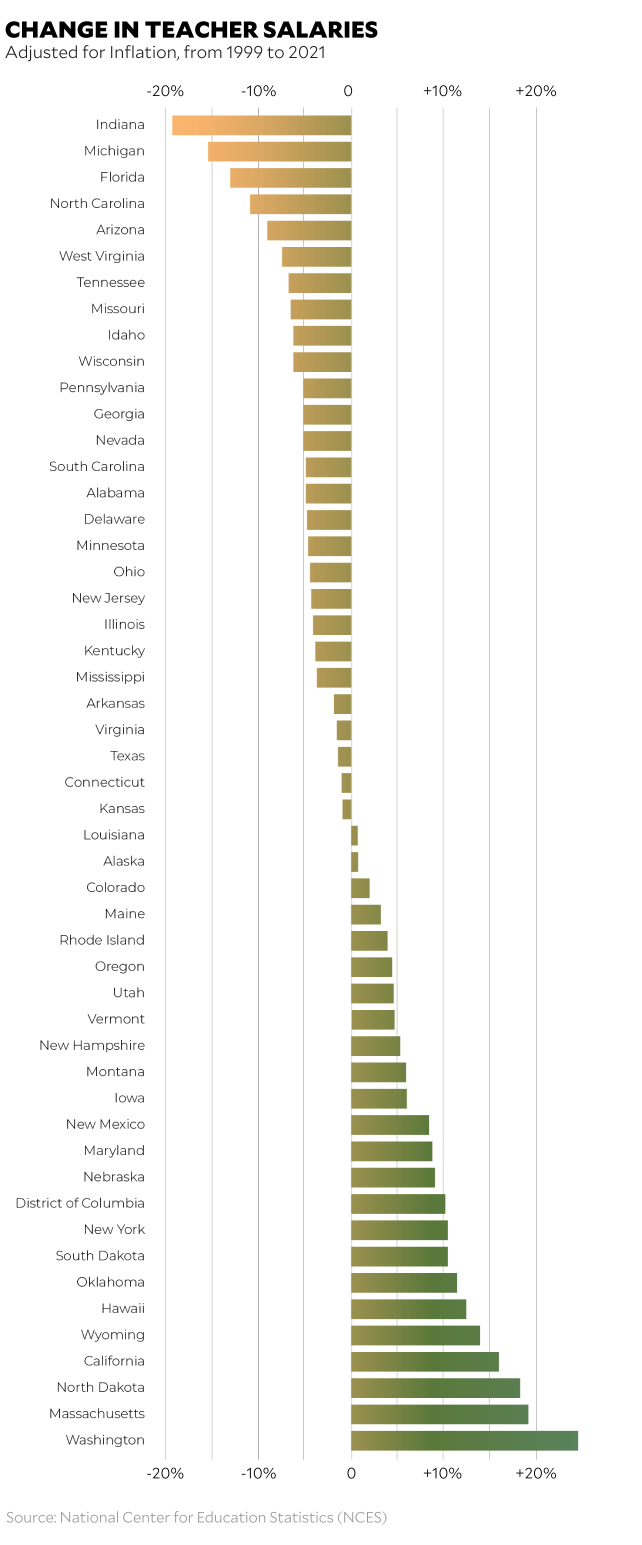

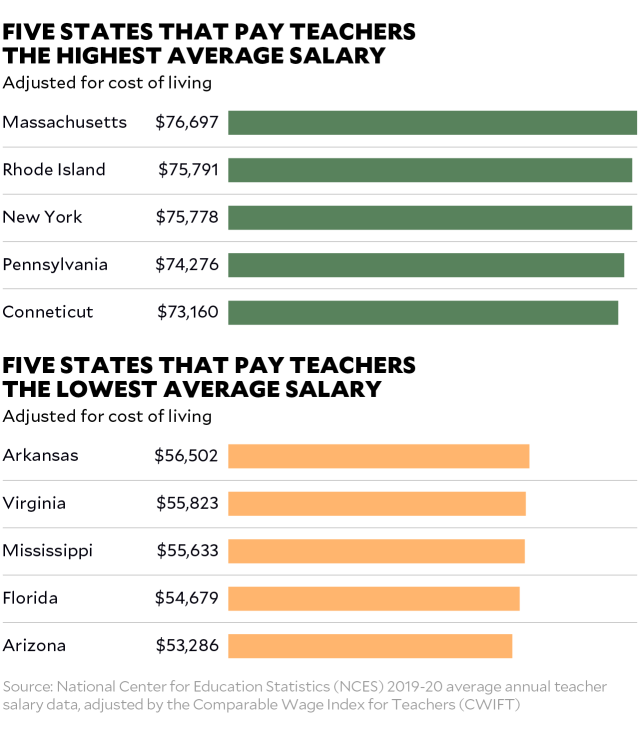

Though teachers across the U.S. have received modest pay increases over the past two decades, these raises have not been enough to keep pace with inflation in many places. As a result, teachers’ actual earnings between the years 1999-2000 and 2020-21 stagnated in two states, and in 27 states, they declined.

The worst offender of all is Rothrock’s Hoosier state, where, adjusted for inflation, average teacher pay has declined by almost 20 percent since 1999-2000, about a year before Rothrock landed her first teaching position.

On paper, Rothrock makes about $60,000 per year now, more than double her starting salary of $29,000. But adjusted for inflation, her starting salary in January 2001 would have the buying power of $47,000 today. This means her salary, in real dollars, has increased by only $13,000 in 21 years.

The pervasiveness with which teachers work second jobs remains, at best, invisible and, at worst, permissible to the general public.

Look at popular culture, which perpetuates the normalization of the teacher side hustle. In the pilot episode of the hit television series Breaking Bad, protagonist Walter White, a high school chemistry teacher, is shown working after school at a car wash. His students mock him for it. Later, White turns to making and selling methamphetamines to cover his medical bills and secure his family’s financial future. In the teen comedy film Mean Girls, Sharon Norbury, the high school calculus teacher played by Tina Fey, bartends a couple of nights a week at a restaurant in the mall. Both White and Norbury are made to feel degraded by their part-time jobs. But as a viewer, while there’s the shock factor of White’s side job as a drug trafficker, the fact that these teachers would have a side job at all is presented as quotidian.

Among the public, misconceptions about the teaching profession abound, leading many to view teachers’ side hustles as innocuous. The assumption is that teaching is easy work, with short days ending at 3 p.m. and summers off, making the season well-suited for earning extra wages.

Of the 30 teachers I interviewed, whose annual salaries range from $32,000 to $98,000, every single one disputed that idea. So did King, the Education Secretary during the Obama administration and a former classroom teacher.

“Some of the things people miss is all the time that teachers spend…preparing for class, planning for class, all the time that teachers spend grading and looking at student work, and giving students and families feedback on student learning,” King explained.

Most people, he added, also overlook the benefits that are built into many professional roles but not available to teachers, such as the flexibility to schedule a doctor appointment on a Thursday morning or to excuse yourself to the restroom without any planning or strategizing. “That level of intensity is, I think, different from a lot of other work settings,” King said.

“We ask a tremendous amount of teachers,” he added. “We also ask them to hold the emotional weight of all the things their students are going through. And so I think we need to make sure that the compensation and esteem for the profession reflect the extraordinary work people are doing every day.”

Even before the pandemic, but especially now, teachers are expected to be not only instructors, facilitators, and subject matter experts, but mentors, family liaisons, behavioral interventionists, and whatever else the crisis du jour demands. With staff shortages ballooning into an all-out crisis of its own in recent months, many teachers’ planning periods have disappeared, as they fill in for absent colleagues down the hall, forcing lesson prep, grading, emails, and other ancillary work into the evenings and weekends. For teachers who pick up shifts after traditional school hours, or turn on apps like Lyft and DoorDash to earn some fast cash, the pressure of figuring out when and how to get it all done—to pay the bills, to be an effective teacher, and do it all with a positive attitude—has snowballed into a scenario that no longer feels tenable.

The balancing act takes a toll not only on teachers’ mental health but also on the quality of instruction they are providing in the classroom.

Marcus Blankenship, a sixth-grade history teacher in Asheville, North Carolina, who drives for Lyft a few times a week after school and on weekends, described the intense fatigue that sets in after eight hours of being “on” with his 11-year-old students and another four or five hours of being “on” with his passengers, many of whom are tourists eager for a full list of local recommendations or a regional history lesson.

Fitchett, the professor at the University of North Carolina in Charlotte who doesn’t view moonlighting as troublesome in all cases, said, “It’s the during-the-year work when you’re teaching from 7:30 a.m. to 3:30 p.m. then jumping in an Uber from 4:30 to 11 p.m.” that’s the problem. That rings true for Blankenship.

“It’s mentally exhausting by the end. What I need to do when I get home, at that point, is either grade papers or write lesson plans. But I just don’t have it. I don’t have it left in me,” Blankenship explained. “I can’t be the best teacher that I want to be and do everything I need to do in order to live.”

Monet Gooch, a special education science teacher in Prince George’s County, Maryland, gets surprised reactions from all sides about her outside jobs tutoring, modeling, and doing event security for concerts and professional sports games in the Washington, DC, area.

Her eighth graders have asked her why she’s late to school. They can’t believe it when she explains that she has a long commute and works other jobs after teaching.

“One of my students was, like, ‘You have got to slow down. Why do you work so much?’” Gooch recalled. “And I was like, ‘Well, teaching doesn’t pay enough. I gotta pay my bills.’”

Gooch’s coworkers at the event security gig—where a handful of other teachers from her school also work—are floored to find out that she is a public school teacher.

“Somebody will ask, like, what do I do during the day?” she explained. “I tell them that I’m a full-time teacher and they’ll ask, ‘How are you doing this and teaching?!’”

To that, she replies with the same answer she gives her students: She has to pay the bills.

A number of factors contribute to how far a teacher’s salary goes—family structure, caregiving responsibilities, health issues, and student loans among them. While many teachers in the U.S. must work second jobs to live comfortably, plenty do not.

Some of them live in states that pay better than others. An EdSurge analysis of 2019-20 teacher salary data, adjusted for cost of living, found the five states that pay teachers the highest are Massachusetts, Rhode Island, New York, Pennsylvania, and Connecticut. Rothrock’s state of Indiana, along with the Carolinas, falls in the bottom 20.

But it’s not just about geography. Others have partners or family members who support them. Dozens of teachers who filled out the Teacher Salary Project’s survey last year noted that, if not for their spouse’s income—which was in some cases several times greater than their own salary—they would be working additional jobs.

“It is very stressful and difficult to stay motivated and feel respected as a professional when you know you wouldn’t be able to support your family on your income,” a teacher in Colorado wrote. “If it wasn’t for my husband’s job, I wouldn’t be able to afford housing in my area and provide for my kids.”

Every teacher I interviewed had their own reasons for taking on a second job. Some were single or divorced and had to carry their rent or mortgage payments with their sole income. Others were single parents or caregivers, responsible for covering the expenses of others, or had family medical issues that siphoned away much of their monthly take-home pay. Many were married to other educators or had a partner with a similarly modest income, and a number of them had onerous amounts of student loan debt to pay down each month.

Delaney, the art teacher and tutor in New Jersey, was one of many single teachers who pointed out an assumption in the profession that educators just have to get by on their salaries for the first few years, until they find a partner who can support them financially.

“That’s not always the case,” she said, noting that she recently decided to live without a roommate for the first time and that it has caused tremendous financial stress. “Grown adult teachers shouldn’t have to rely on a partner to live by themselves.”

For educators whose lives didn’t follow their planned trajectory, there is little to no margin for error. Any disruption or deviation from what’s “normal”—going through a divorce, having a child with a disability, being unmarried in their mid-30s—can be financially devastating on a teacher’s salary.

Sixth grade teacher Marcus Blankenship gives student feedback after school.

Angela Wilhelm/Edsurge

Marcus drives Lyft in Asheville to make ends meet.

Angela Wilhelm/Edsurge

But within the population of teachers working multiple jobs, there’s also a spectrum. Most of the ones I spoke to are trying to make ends meet, while others take on a side gig to bring in extra spending money. And a few—though certainly not most—have found their side hustles to be quite lucrative.

On average, teachers’ earnings from outside jobs make up 9 percent of their income. But some do better. Some do a lot better.

For almost the first decade of her teaching career, Caryl Pawlusiak, a kindergarten teacher in Hooksett, New Hampshire, worked 15 to 20 hours a week at a Hallmark retail store. She met her now-husband, another teacher, during that time, and money was tight.

But a few years ago, Pawlusiak’s husband left teaching to go into technical recruiting, and Pawlusiak started as a consultant for Rodan + Fields, a multi-level marketing company that specializes in skincare products. Within months, she had paid off the last $3,000 of her student loans. By the end of year two, she’d paid off one of two mortgages they’d taken out on their house. And these days, her income from Rodan + Fields is enough to cover their remaining mortgage every month and then some.

It completely changed the way she and her husband live. They travel now more than ever. They renovated their kitchen during the pandemic and upgraded other parts of their home. “We go out to eat more because that was a luxury we never had before. I shop now more than I ever did. I get to buy clothes and shoes now,” she said.

The money is so good, she said, that she’s now saving for retirement. She wants to quit teaching in the next five to 10 years. She’s 40 years old.

Many of the educators I interviewed clip coupons, shop at thrift stores, and spend about half of their monthly take-home pay on rent or the mortgage. But none of them are living below the poverty line. When asked how they would describe their socioeconomic status, most placed themselves somewhere between lower middle class and middle class. Many say they live paycheck to paycheck, that they have no savings, that they are saddled by student loans and crippled by credit card debt accumulated from never having quite enough income to cover the basics. Some delayed starting their families because money was so tight. Others can’t imagine ever starting a family, when they can barely afford their existing expenses.

Many watch students in their classes go on routine family vacations that they know they could never afford themselves.

It’s not uncommon for teachers to run into their former students or parents at their second job, especially those whose side hustles are in the gig economy.

Matt Jenkins, an elementary music teacher in Ohio with 35 years of classroom experience, drives for Uber and has picked up former students—now in college—as they are heading home after a night out drinking in Cincinnati.

At least once, he’s given a ride to the parents of a student he is currently teaching.

“I was happy to do it,” Jenkins said of the experience of driving a student’s parents, “but I was also like, ‘OK, are they going to view me in a different way?’ Hopefully, they view me as their child’s teacher, as an educator. Do they view me as their chauffeur? Are they thinking of me differently?”

The teachers I interviewed are not ashamed of their outside jobs. What many of them expressed is resentment, even betrayal, by how the reality they are living squares with the visions of professionalism and promise of the “American dream” that they’d believed before they started their careers.

Americans like to think that the surest path to success runs through university campuses. That upward mobility begins in higher education and breaking the cycle of intergenerational poverty requires an entrance fee of a college degree. Many people, including aspiring teachers, internalize this and make steep sacrifices to attend college. Sometimes, that looks like a 19-year-old taking out hefty student loans and choosing a career path with a poor return-on-investment.

None of the teachers I spoke with expected jobs in the public school system to be a windfall. They knew the pay was paltry. But they look around at their peers, at their siblings, at the parents of kids in their classes, and in some cases at their own adult children, and wonder how all of these people working regular jobs have managed to eclipse their pay—sometimes by several multiples.

David Sinclair, a high school teacher in Jackson, Tennessee, who designs and runs Facebook ads for businesses, said he knows an electrical engineer making six figures and wonders if the expertise required in engineering, if the importance of that work, is really head and shoulders above education, as their comparative salaries would suggest. He’s not totally convinced.

“It would be nice if I could work one job and not have to worry about getting up early, staying up late, sacrificing time with my family,” Sinclair said. “It’s already so many hours as a teacher, and I’m adding hours on top of that. It’s an endless cycle.”

Rothrock made a similar comparison to her sister—eight years her junior—who, like Rothrock, has both a bachelor’s and master’s degree, except that her sister works in business and makes more than double Rothrock’s teaching salary.

“I knew going in that it wouldn’t afford me a lavish lifestyle,” Lindsey Spencer, a K-2 special education teacher in Bethlehem, New Hampshire, said of her teaching job. “It’s more like the American dream that has been laid out for me is unreachable on a teacher’s salary. That’s the thing that has become clear as I’ve been in it longer.”

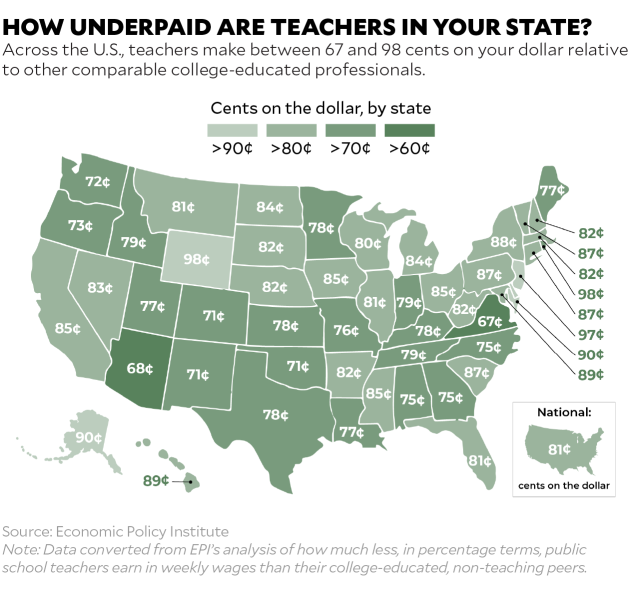

It’s true that, controlled for levels of education and years of experience, teachers make less money on the dollar than their peers in comparable fields, a concept known as the wage penalty. The Economic Policy Institute has been tracking this for years and found, most recently in 2019, that public school teachers nationally make about 19 percent less than employees in commensurate professions, or about 81 cents on the dollar. The trend has been getting worse over time; the wage penalty for teachers in 1996 was 6 percent.

The state breakdown is even more illuminating. In Rothrock’s state of Indiana, teachers earn about 21 percent less than other college-educated professionals with similar experience. In North Carolina, where Blankenship lives, the wage penalty is worse, at 25 percent. Virginia is the worst of all 50 states, with nearly a 33 percent wage penalty, while Wyoming is the best, at 2 percent—almost no wage penalty compared to other professions.

Blair, author of “By the Light of the Silvery Moon,” suggested that teaching is still being treated like a semi-profession in the U.S.—never mind that we have teachers with doctorate degrees and National Board Certifications.

She framed it this way: “I would be appalled if I got in an Uber and the driver told me he’s an orthopedic surgeon during the day. But if you hear your Uber driver is a teacher, you go, ‘Oh, yeah, OK. That makes sense.’”

Fitchett, the professor at the University of North Carolina in Charlotte, said that teachers “hate being told, ‘You’re doing the great work of society,’ or ‘It’s a noble profession.’ Just because it’s a noble profession doesn’t mean you shouldn’t get paid. Being a brain surgeon or an oncologist is also noble.”

Teachers made this point repeatedly. They may have wanted to become a teacher for as long as they can remember, but that doesn’t mean they don’t want to be well compensated.

“For a lot of teachers, they say, ‘It’s a calling,’ and, ‘Oh, it’s not about the money.’ Blah, blah, blah,” said Karen Lindner, a first grade teacher in Cortez, Colorado, who also works as a financial administrator for a nonprofit. “It is about the money. It is always about the money. Administrators are like, ‘Find your ‘why’ again,’ and it’s like, my ‘why’ is money and the health insurance.”

I asked each teacher I talked to what kind of salary they felt they deserved, given all the challenges of the job and the caliber of the instruction they provide. Their answers fell well short of the “billion dollars a year” that television producer Shonda Rhimes and others have proposed since the start of the pandemic.

Nearly all suggested only modest raises, hovering around $10,000 to $20,000 more per year. For many, that would offset the income they’re bringing in from part-time work and give them more breathing room to cover basic expenses.

Swati Linder, the realtor in South Carolina, makes $59,000. She said that between her 17 years in teaching and her master’s degree, she feels she ought to be making at least $80,000. That would be enough for herself, her husband and their two kids to take “a really nice trip” within the U.S., she said. “To put our family on a plane now? That alone would eat up our budget.”

Blankenship, the Lyft-driving history teacher in North Carolina, said that if he were offered $75,000 for a position outside of teaching, he’d take it. “I should be able to live comfortably,” he said. But at his current teaching salary of $45,000, and with six figures of student loan debt hanging over him, he doesn’t feel like he can. He can’t buy a house. He can’t live in an apartment without roommates. He’s lucky just to get a day off.

This year, Rothrock’s oldest daughter Taylor and her friends are all turning 16. “It’s car season. Everyone’s getting a car,” Rothrock explained. But she isn’t able to buy a car for her daughter.

That’s part of the reason Taylor started working at Polly’s. Between that and babysitting gigs, she’s been saving up to buy a used car.

It’s impossible not to notice the similarities between Rothrock’s story and the one beginning to unfold for Taylor.

Both are the daughters of teachers. Both grew up in households that didn’t have a lot of money left over after the bills were paid. Both were aware, for as long as they could remember, that to go to college, they’d need to take out student loans. And both started their first job at age 15, at Polly’s Freeze.

But the overlaps in their stories will end there, Rothrock said. Taylor will get to quit her job at Polly’s. Because even though she would be really good at teaching—a natural, even—her mom has strongly discouraged her from it, telling her it’s not worth it. Not with the workload and the stress and definitely not with the pay.

“I feel like I’m really good at my job, but if I had to do it all over again, there is no way I would ever be a teacher,” Rothrock said. “I hope she listens.”

Samara Ahmed contributed research.