This article, a collaboration between High Country News and The Nevada Independent, was supported by grants from the Fund for Investigative Journalism and is republished here as part of our Climate Desk partnership..

Note: Because some sources were concerned about the possibility of retaliation, gender-neutral pseudonyms were used in this story. An asterisk is used to denote where a source’s name has been changed to protect their identity.

When Drew* started working for the Newmont Corporation at a large gold mine in northeastern Nevada, it was a relief. At their previous mining job near Elko, a Nevada town heavily reliant on the industry, safety was not a priority. By comparison, Drew said, Newmont supported its workers when they raised serious safety issues. “It was never geared toward the blame game,” they told us. When Drew was injured, there “was no debate on if we should report it.”

But, as Drew recounted in multiple interviews this year, that positive safety culture began to unravel after a merger consolidated the region’s gold mines—some of the world’s largest—into a single company: Nevada Gold Mines.

“All they care about is the bottom line, pushing ore through,” Drew said in an interview.

In 2019, Barrick Gold Corp and Newmont formed a mega-company that would be managed by Barrick’s executives. The new company, Nevada Gold Mines, now accounts for about 75 percent of the state’s gold production. Earlier this year, High Country News and The Nevada Independent published an investigation into Nevada Gold Mines’ outsized influence in northeastern Nevada. With about 7,000 employees and 4,000 contractors, Nevada Gold Mines dominates the economy of that part of the state, operating with enormous influence and little competition.

Since that investigation, which chronicled increased turnover as well as instances of alleged workplace harassment and discrimination, more than three dozen current and former employees, as well as others close to the situation, contacted us through a tipline to share their experiences. Many said that the jointly owned company’s top management has created a culture that appeared to emphasize profits and productivity above all else, seemingly at the expense of safety. In August, Mark Bristow, Barrick’s chief executive, sat down with The Nevada Independent and High Country News and acknowledged that Nevada Gold Mines has the worst safety record of all the company’s divisions, which operate in Tanzania, Canada, the Dominican Republic and Papua New Guinea.

More than 10 of the current and former workers who initially contacted The Nevada Independent and HCN agreed to follow-up interviews. Nearly all of them spoke to us on condition that we not disclose their identity because they feared retaliation, given the company’s influence in Nevada mining and the local job market.

This is not the first time that workers have voiced concerns about safety since the merger. Safety issues appear several times in a 2020 lawsuit that the National Labor Relations Board (NLRB) filed over the company’s unwillingness to recognize a union that had represented mine workers for more than 60 years. The federal agency, which is responsible for enforcing labor law, took the sworn statements of several workers. “I am worried that if I bring up a legitimate safety concern, there could be repercussions. I could be viewed as stirring shit, and they would say that I’m just a problem and get rid of me,” Mike Tangreen, a Nevada mine worker for more than two decades, stated in a sworn March 2020 affidavit included as part of the lawsuit.

Part of Nevada Gold Mines’ hold on the area is the good-paying jobs it provides. It also helps fund health-care clinics and supports community services in a part of the state where economic fortunes cycle with global metal prices. Even employees who criticized the company acknowledged this.

Others, like laboratory technician Sam Brown, believe that the merger’s long-term benefits outweigh the downsides. There have been “growing pains,” Brown said, but he believed a single company could operate more efficiently, making it more likely that its mines would be competitive and survive, even if the price of gold dropped.

“For the most part, people understand and appreciate that the company is a positive force in Elko,” Brown said. “As soon as the mines dry up, the face of Elko changes dramatically.”

Over the course of the last year, dozens of other mine workers we interviewed acknowledged the company’s economic influence. But they also wondered: At what cost?

When Barrick combined with Randgold Resources, a multinational mining company run by Bristow, he sought to cut costs and boost efficiency. Asked by Bloomberg in January about how Barrick has controlled costs amid rising inflation, Bristow highlighted an effort to “drop (the) overall age of our employee profile, particularly in North America,” among other measures.

Nevada Gold Mines has lost senior and experienced employees across several departments in recent years. Longtime workers said they were concerned that the attempt to bring in younger talent was driving away experienced employees who understood mine safety and the local geology. Hiring inexperienced replacements, they feared, could endanger other employees.

In an interview, Bristow, who is 63, said, “There is no one—I can say to you without fear of contradiction—that has been picked on because of their age.” Although the workforce has grown younger, he said the average age had dropped by only about a year. “It’s suicidal to chase away your experience,” Bristow said, citing exit interview statistics showing that about 60 percent to 70 percent of workers say they would return to the company.

Yet current and former employees said the focus on production and the resulting low morale contributed to a higher-risk environment where safety issues could become more pronounced. Nevada Gold Mines has written policies aimed at protecting workers from the hazards of heavy equipment operation. But the day-to-day incentives, some employees said, are misaligned with those policies.

“If you have a near miss, you lose your safety bonus, because it could have been a potential injury,” a worker testified as part of the 2020 NLRB lawsuit. “If you do have an injury, you lose your bonus.” Drew said that reporting a violation under Nevada Gold Mines became more challenging because workers feared retaliation or losing their safety bonuses, which were increasingly awarded to crews based on reported violations, according to multiple employees. When asked, the company did not provide information about the bonus structure.

Drew saw how this played out firsthand. They hesitated to report a serious shoulder injury, for fear that it would leave a “bad mark.” But Advil and Tylenol were not enough; Drew needed medical attention, so they reported the injury and were escorted to the company-backed Golden Health Clinic. Ultimately, Drew was “given a full work release before it was fully determined what had happened, and there wasn’t much done to determine what had happened.” In other words, it was handled so that the injury wouldn’t affect the company’s statistics.

“Nobody wanted to report accidents anymore, because we could lose our bonus and everyone would be mad at you,” said Drew, who later left Nevada Gold Mines.

They told us they still experience shoulder pain.

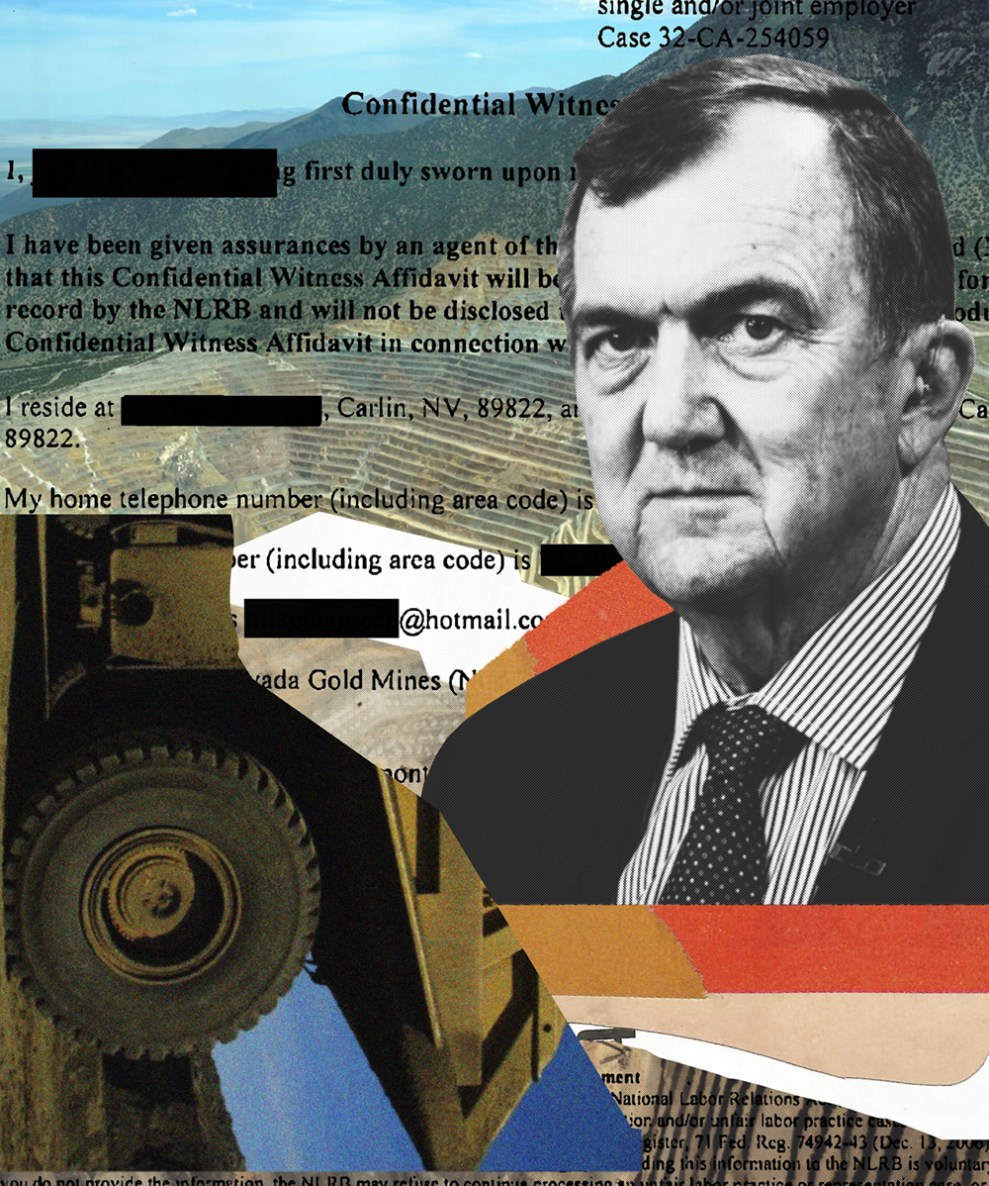

Mark Bristow, then CEO of Randall Resources Ltd., applauds the NASDAQ opening bell on May 15, 2006

Mark Lennihan/AP

Hundreds of miles away from its mining operations, Barrick keeps an office at a corporate center in Henderson, a suburb of Las Vegas. Earlier this month, Bristow sat down for an interview with The Nevada Independent and HCN in a nondescript conference room, tucked away in the corner of the office. Bristow, a geologist by training, wore a polo shirt with the Nevada Gold Mines logo. According to him, he inherited a workforce where “people were insecure in their position…I’ve never been at a company where people are scared of being fired. Dismissed. So that was something that we had to work on.”

Bristow said that he wanted “a culture where people feel comfortable about dealing with concerns openly…If you’re faced with an unsafe situation, you should have all the rights to not do the job.”

Bristow also said that even though Nevada Gold Mines has the same percentage of incidents as other divisions in the company, “the incident severity, the impact, the result of the incident is generally, on average, more severe.” But he rejected the idea that safety bonuses incentivized underreporting: “We’ve got enough checks and balances.”

Still, some federal regulators and mine worker advocates frown on bonus systems that hinge on safety, said Davitt McAteer, who served as the assistant secretary for the federal Mine Safety and Health Administration (MSHA) under President Bill Clinton. “It’s a flawed model that leads to underreporting of accidents, and cover-ups of incidents and frequencies of problems,” said McAteer, who has worked as a mine safety lawyer and investigated mine disasters.

Drew was far from the only employee worried about the new company’s safety culture. At a different northern Nevada mine, another former employee, Jordan,* described feeling unsettled by the changes after Nevada Gold Mines was formed.

Jordan, who worked in the health and safety department, said in a phone interview that they and other employees feared they would be punished or terminated for bringing safety concerns to superiors. Jordan eventually left the company. “My fear is that a major incident will seriously injure or kill someone,” Jordan wrote in the tip form, “and I can’t have that on my conscience.”

Because of mining’s high-risk environment, the federal government closely monitors workplace safety, injuries and fatalities. Multiple current and former workers said that their biggest fear was that a slip-up or lax enforcement of safety protocols could lead to a fatality.

On the morning of Feb. 14, Marissa Hill, a 34-year-old maintenance technician who had worked in mining for more than a decade, died after her lube truck fell more than 60 feet down an underground shaft at the Cortez Hills mining complex, a site operated by Nevada Gold Mines that the company is actively pushing to expand.

MSHA, a federal regulator with broad legal powers to enforce mine safety rules, is investigating and has yet to release additional details beyond a brief preliminary report.

Bristow and other company officials said they could not release any additional information, as the investigation was ongoing. In a statement, the company said it was “working closely with MSHA to fully understand the circumstances that led to the incident and take the correct course of action to ensure it does not happen again.”

More than a dozen employees at various levels, from hourly union-represented workers to people who managed large operations teams, told us that the profit- and production-focused culture was fostered by high-level executives. Several former managers pointed to Bristow’s leadership, saying that in meetings he had criticized the Nevada’s workforce’s lack of efficiency.

This August, we asked Bristow about the extreme cost-cutting measures detailed in a recent article in Mining Journal, an industry-friendly trade publication, which said that Nevada Gold Mines “shook the rug pretty violently to see what costs would fall out to appease their shareholders.” Bristow brushed it off. “I’m not that sort of person,” he said. “Why would you want to do that? You know, your most important asset in any business…is its people.”

But while Bristow may claim that the company’s greatest asset is its people, some have been offended by his comments. In early 2019, after Bristow took the helm of Barrick, a group of senior employees gathered in a conference room at the Turquoise Ridge mine near Winnemucca to bring the new CEO up to speed.

Bristow’s reputation as a hard-nosed manager who emphasized cost-cutting and production preceded him, according to a senior employee who attended the meeting and spoke on the condition of anonymity. Before the meeting, several attendees made a bet, pooling their money, with the pot promised to the person that Bristow treated the worst, the senior employee said. Barrick employees began the meeting with presentations regarding mine operations and workplace issues.

At one point, Bristow, who was described as sitting in the front row, interrupted. He said Barrick’s Nevada miners were overpaid, and he mocked their work ethic and physical fitness, according to the employee who was present. A second senior employee who attended confirmed this, saying Bristow called workers “lazy.”

Bristow remembered the meeting, but he denied calling workers “lazy.” His comments, as he recalled them, came from a “real concern about safety,” because physical health matters for workers who have to go underground. At one point, he suggested that the fact that incidents were more severe in Nevada “points you to the health of a person, the ability for somebody to take a knock or trip over his own feet—or her own feet—or things like that.”

In a recent article, the Elko Daily Free Press quoted Bristow as saying, “(Miners) need to be fit. We haven’t got a good safety record, and a lot of that is because people are actually not in a physical condition to look after themselves.” Later, he added: “We’ve got too many out-of-shape people working in our organization.”

Many Nevada Gold Mines workers are aware of Bristow’s comments, and his rhetoric is one of many factors—along with overall working conditions, changes to employee benefits and a soured relationship with the union—that concerns them.

“Don’t get me wrong: I love the people I work with in my little group,” one current worker, who has spent years working in Nevada’s mining industry and seen the changes firsthand, said. “But as for the company on the whole, I trust them about as far as I could throw my house.”