It wasn’t long after Jessica Madison graduated in 2009 that she realized her student loans were a terrible mistake. She had borrowed $21,000 for a paralegal program at Everest College in Fort Lauderdale, Florida, in the hope of building a more secure life, but instead she spent the next three years looking for a full-time job that never quite materialized. Thanks to interest, Jessica’s debt ballooned during that time, and there were months when she skipped bills and went without power to make her loan payments. Her “college problems,” as she and her fiancée, Izzy, called them, had put at risk everything Jessica thought a degree would unlock: a house, decent credit, economic stability.

The two had met online. Jessica was the sort of deep introvert who preferred making friends on the internet, where she could feel safe and anonymous. Under the screen name Lavoix inconnue—the unknown voice—she’d fallen in love with Izzy before they’d ever seen each other’s faces. Now they lived together on the Gulf Coast, and their quiet moments together—coming home from work to their cats and dog Pikachu, going on beach walks—were what made life special.

But in the years since they’d moved in together, Jessica’s debt loomed ever larger. Her loans were the sole reason she and Izzy were waiting to get married; she didn’t want to impose this burden on her future wife. In 2014, they held a small commitment ceremony by the water with a beach-themed cake, and changed their Facebook statuses to married—because in every way other than paperwork, they were. One day, Jessica imagined, they would make it more than Facebook official. Once the debt was a little smaller. Once she’d figured this out.

Her alma mater, Everest, was part of an empire of schools run by the billion-dollar Corinthian Colleges chain, which had long targeted single parents and other low-income students like Jessica with aggressive marketing. In the last two years, then–California Attorney General Kamala Harris and the Consumer Financial Protection Bureau had sued Corinthian for fraud, exposing the lying admissions officers and fake job placement rates that had duped hundreds of thousands of students like Jessica into throttling their financial futures.

A few months after their ceremony, Jessica convinced Izzy to come with her to dinner with two activists who’d been strategizing about student debt ever since meeting at Zuccotti Park during the Occupy Wall Street protest. They were talking with Corinthian alums across the country about a project they would call the Debt Collective, which would organize borrowers to fight for student loan relief. Jessica listened, rapt, as the pair laid out a vision for a first-of-its-kind debt strike, in which a group of Corinthian alums would publicly refuse to make further payments. The goal was to get the Education Department—already investigating Corinthian—to erase the debts they’d accrued from fraudulent institutions. Their radical plan was grounded in the idea that the ubiquity of student debt might just give borrowers bargaining power. After a few more months of conversations, Jessica put aside her usual shyness and joined 14 other alumni to form what would be known as “The Corinthian 15.”

“I’m not looking for an instant payday,” Jessica explained on Facebook a couple of weeks after their strike became national news. “I just want to be able to start fresh.” She also wanted to help the many others like her who were living under the strain of relentless loan payments for an education of little value. “Student loans ARE keeping us from things that our parents were able to achieve by this point in their own lives,” she wrote in another post. “We aren’t laying down and taking it just because the people before us did. Not anymore.”

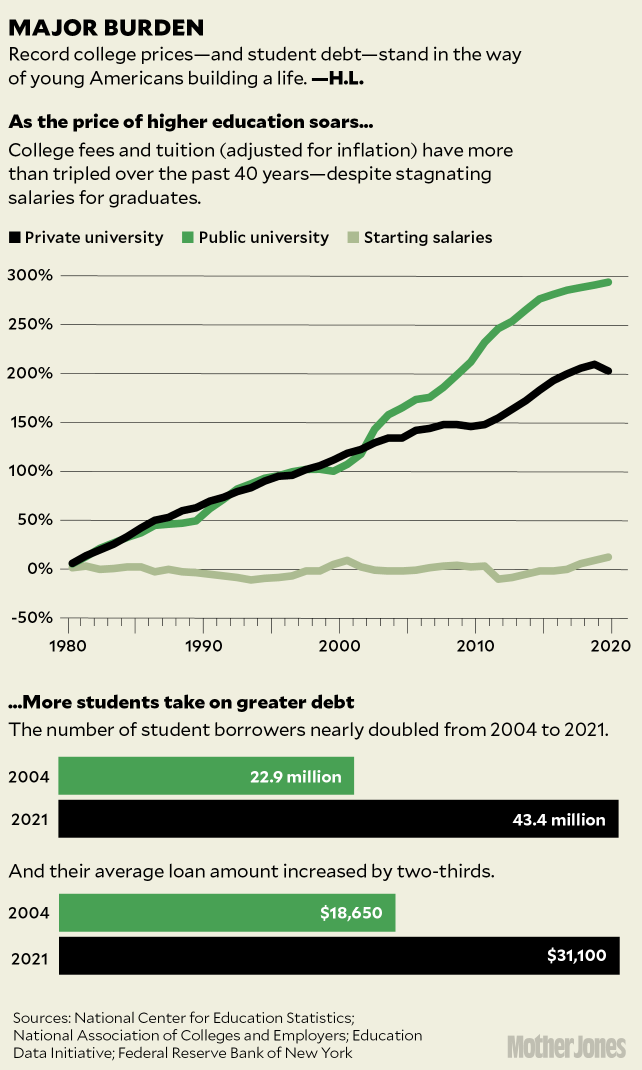

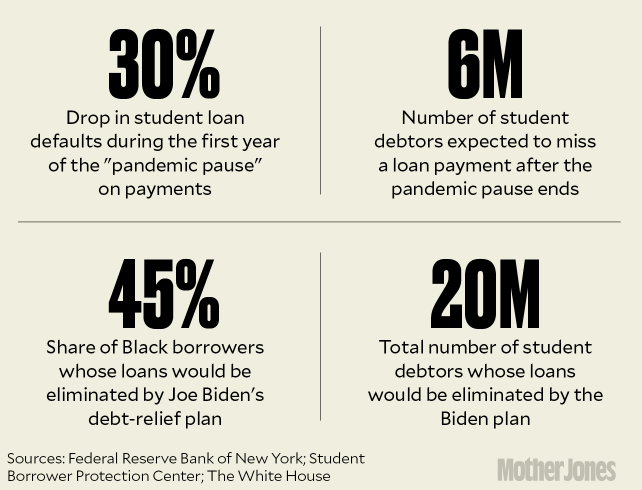

In the eight years since, Jessica’s advocacy has blossomed into a national fight over student debt cancellation. What began as a long-shot effort by a handful of people brave enough to go rogue helped eventually convince the Education Department to wipe out $7.9 billion in debt for nearly 700,000 borrowers who’d been defrauded by for-profit colleges like Corinthian. That campaign laid the groundwork for an even bigger prize: student debt cancellation for all. By 2020, this once-fringe notion had made it into the platforms of mainstream presidential hopefuls, including Joe Biden. Last August, the Biden administration announced up to $10,000 of debt cancellation for student borrowers below a certain income limit, and double that amount for students from the poorest backgrounds. The Biden plan would zero out the loans of about 20 million student debtors, including 45 percent of those held by Black Americans, who on average have the most student debt.

That certainly sounds like a success story: a rare national step toward economic justice. But Jessica never got to see it. Her loans continued to haunt her for years after the Corinthian strike. While debt collectors seized part of her paychecks, and the Education Department denied her pleas for help, an illness grew quietly inside her. She was so consumed with making her debt go away, working longer hours and skimping on doctor appointments, that she missed the cancer that would ultimately kill her.

Now, the movement Jessica poured so much of herself into is in peril. Last fall, six Republican-led states challenged the Biden debt relief plan, arguing that the administration lacks authority to dole out such a sweeping cancellation, leading to a high-stakes battle before the Supreme Court. Court observers are pessimistic that the Biden plan will survive the conservative majority, and even if the justices do allow cancellation to proceed, the administration faces the possibility of additional lawsuits. Meanwhile, the root causes of the debt crisis—skyrocketing tuition and a business ecosystem that profits from student loans—continue apace, with little federal intervention. What’s left is a generation of people who must continue waiting for the lifeline they so desperately need to start fresh.

Government-guaranteed student loans, part of a Great Society program to create opportunity for low- and middle-income kids, quickly became a cash cow for financial institutions. The Federal Family Education Loan program (FFEL), established in 1965, enticed banks and related businesses to lend to students by promising that the government would cover any losses from defaults. This risk-free incentive encouraged financial institutions to dispense student loans with abandon, and tuition soon swelled, generating mountains of higher education debt. Today, nearly 44 million Americans hold roughly $1.8 trillion in student loans.

Jessica’s first FFEL loan payment came due in 2010, the year after she graduated from Everest. She was still struggling to find a higher-paying job—the whole reason she’d taken the loan in the first place. Congress was then in the middle of replacing FFEL with a new program in which student loans would be owned by the federal government, not profit-hungry banks. But panicked lenders convinced the government to award them lucrative contracts to keep servicing and collecting student debt. Next, they crafted an ingenious bit of financial engineering to ensure the existing FFEL loans—then held by more than 25 million students—would continue to generate healthy returns: They bundled them into “student loan asset-backed securities” (aptly called SLABS) and sold them to hedge funds and other investors, often with the help of major banks like Morgan Stanley and Goldman Sachs. The more FFEL debt a servicer held, the more it stood to gain from the business of selling parcels of these loans to Wall Street.

One key player, the Educational Credit Management Corporation, embraced the new business model with gusto. As one of the largest holders of FFEL loans, it began issuing SLABS and boosting their value by badgering former students like Jessica who were struggling with payments. The company had no incentive to compromise, because doing so would degrade the value of the SLABS it was hawking to investors. Jessica sensed that a profit motive governed all of her interactions with ECMC: In the midst of a dispute with the company years after the strike began, she messaged a fellow activist: “Pretty sure they make it that complicated for good reason, to keep the money flow up.”

To ensure future profitability, the company went even further. With fraud lawsuits against the Corinthian chain ongoing, ECMC bought up almost half of its 107 campuses at a discount. It then converted the chain into a tax-exempt nonprofit and asked the government to release ECMC from Corinthian’s liability in exchange for forgiving more than $480 million in high-cost private loans that Corinthian had foisted on students. But the deal included no such provision for students like Jessica who’d taken FFEL loans. (ECMC did not respond to specific questions from Mother Jones but noted that because FFEL loans are backed by the Education Department, their discharge would come at the department’s direction.)

With all the parts in place, ECMC set about reaping the spoils of Corinthian’s misconduct. And the further Jessica got sucked into its dealings, the worse her situation became.

A couple of months after the Corinthian 15 launched their strike, Jessica formally asked the Education Department to erase her debt. The Debt Collective had pored over the law governing student debt and realized that an obscure clause gave the department power to cancel loans for students whose schools had lied to them during enrollment. The collective then built an application to help people claim this relief, called “borrower defense to repayment.” In March 2015, several members delivered a box of the first claims, including Jessica’s, to the department in person.

But there was a secret Jessica had shared with almost no one—even Izzy: Since about a year before the strike, ECMC had been garnishing her wages. It was a brutally efficient tactic the company had perfected on countless borrowers, taking up to 15 percent of each paycheck and keeping a slice for itself as a fee. Jessica was earning about $40,000 annually as a quality assurance analyst, and couldn’t afford to lose the almost $10,000 ECMC had already taken from her paychecks and her tax refund. In July 2015, she asked Thomas Gokey, one of the Debt Collective’s co-founders, for help. (In an email, ECMC said it follows Education Department regulations that require it to garnish the wages of eligible borrowers. It declined to discuss Jessica’s case, citing its privacy policy.)

Gokey was a veteran saboteur of the student loan bureaucracy. In 2011, with almost $50,000 of his own debt, he started a crusade to bring cancellation to the masses when he and fellow co-founders met at Occupy Wall Street and hatched the idea of a debtors’ union. An artist by training, he’d helped perfect the Debt Collective’s knack for public action that mixed sharp strategy with showmanship: In just its first few years, the collective hosted a celebrity-studded fundraiser that raised $750,000 to buy student loans on the secondary market to erase the debts of 9,000 people; built a borrower defense application that was so good the Education Department later used it as a prototype; and, to put an even finer point on its mission, convened people in front of the department’s DC headquarters and set their loan paperwork on fire. As the collective’s go-to guy for helping struggling borrowers, Gokey spent hours every week trying to resolve a litany of administrative nightmares with bottomless patience and meticulousness. In Jessica’s case, he started off simple, sending emails to ECMC and the Education Department requesting a pause while her application for relief was pending.

Izzy was a custodian at the local Hard Rock casino, making $8.50 an hour, so Jessica paid most of their bills. She hadn’t grown up with much, and she took pride in her role as the main breadwinner. It reminded Izzy of Mike Brady from The Brady Bunch. “That’s kind of how she treated it: She was the person in charge,” Izzy says. Not having enough money made Jessica feel like she was failing in her role, so she kept the garnishments a secret. But Izzy started to suspect something was up. For the last two years, they’d made a point of saving up to visit her hometown in Maryland for the Pride festival; as summer grew closer, they realized their savings weren’t enough, even though Jessica was still earning the same amount and had gotten a $3,000 bonus.

In the fall of 2015, ECMC denied the request to stop garnishing Jessica’s wages. She and Gokey had also appealed to the Education Department. Four unanswered emails later, Gokey started appending little postscripts to his follow-up messages: first a link to a video of black holes, then the text of a short story by Franz Kafka: “P.S. Below I’ve pasted Kafka’s parable ‘Before the Law,’” he wrote. “I’ve always wondered what it means. I have a feeling you might know.” (The Education Department did not respond to requests for comment.)

Jessica’s financial woes grew worse. First, she couldn’t cover the electric bill, so she started asking Izzy to pay for more expenses—and even reached out to her mom for help. They sold their tablet for cash. Their dog, Pikachu, started having seizures and needed a $600 drug that they couldn’t afford right away. “Each episode was like an earthquake coming down on you,” says Izzy, who did her best to soothe Jessica’s stress. But she still didn’t know about the wage garnishment. Or that Jessica’s inability to buy the dog his medicine represented much more: yet another blow by her years-old debt, on top of the wages she was losing week after week.

In November 2016, the Education Department issued regulations saying FFEL loans like Jessica’s should be removed from collections pending the outcome of borrower defense claims—exactly what Jessica had asked ECMC to do. But the new rule wouldn’t go into effect until the following year, and in the meantime compliance was voluntary. The company continued to garnish her wages.

Finally, in January 2017, the Education Department notified Jessica that her application for relief was approved. Corinthian had lied to her, the agency ruled, and her loans would be canceled entirely within two to three months. For the first time in years, Jessica allowed herself a modicum of hope. “Honestly I’d just be happy to get my credit score in a range where I can afford a house,” she told Gokey.

But ECMC kept on taking money from her paychecks. She wasn’t alone: Multiple lawsuits have accused the company of illegal collections, including garnishing wages in violation of bankruptcy code and collecting on student loans that were already paid. At the height of Covid, ECMC garnished at least $400,000 from people with student debt, despite department guidance that explicitly prohibited the practice during the pandemic. (ECMC said in an email that it attempted to stop and return garnishments after the pandemic guidance.)

Two months after the Education Department canceled her loan, Jessica’s car was repossessed. Gokey requested another hearing from ECMC about the garnishments—but was quickly denied by Performant Financial, then an ECMC affiliate that Donald Trump’s education secretary, Betsy DeVos, had financial ties to before she took office. (During DeVos’ tenure, the department awarded Performant up to $400 million in contracts to collect on overdue debt like Jessica’s; at the time, Performant denied communicating with DeVos about the contract.) It wasn’t until July 2017, after a Washington Post reporter who’d interviewed Jessica contacted the department and Performant to ask why her wages were still being taken, that the garnishments abruptly stopped—though neither party responded to the reporter’s requests. A few months later, Jessica got an email confirming her debt had been discharged. “Let’s celebrate!” Gokey wrote on Facebook. “If I could I’d hug every single one of y’all,” Jessica wrote back, followed by a toothy-grinned emoji.

By that point, ECMC had taken nearly $13,000 from Jessica—first bypassing federal regulations, and later ignoring her formal cancellation. Six months after the company stopped collecting on Jessica’s wages, she and Izzy were evicted over unpaid rent.

Gokey ramped up his advocacy to try to recover Jessica’s money—funds that could help her and Izzy get back on their feet. ECMC insisted it couldn’t do anything without orders from the Education Department, and told him to instead contact the department’s ombudsman, who referred Jessica’s refund request back to ECMC.

The request pingponged from office to office for a maddening four months. Emails asking the department for updates went unanswered. In one, Gokey copy-and-pasted all 12,000 words of Samuel Beckett’s Waiting for Godot. In another, he listed the number of days that had passed since each of their efforts—1,406 since their first request to stop Jessica’s garnishments, 1,343 since their second, 872 since the debt was formally canceled, 676 since ECMC promised to “monitor” the situation—cataloging just how long Jessica had been left to live without resources the department had agreed were rightfully hers when it canceled her debt. “This is no longer a fun game,” he wrote. “It’s time for you to give this money back to Jessica. It belongs to her.” The Education Department finally agreed to pay Jessica a partial refund of $2,041.80—enough, she hoped, to repair her car so she could stop worrying about losing her only means of getting to work.

The refund, though, hardly felt like a victory to Jessica, who for months had been experiencing intense, unexplained pain throughout her body. She hadn’t seen a doctor. She’d refused health coverage at work to save on premiums, and didn’t have paid sick time or the cash to pay out of pocket. By the fall of 2019, every movement hurt: sitting, standing, lying down. She eventually went to the hospital, where a doctor had funding to run diagnostic tests pro bono. The labs revealed a cancerous mass in her uterus that had already spread to her liver and kidneys.

Jessica was quickly admitted to the hospital. Even then, she wanted to be Mike Brady. She tried to shield Izzy from the bad news. She told her she’d get out soon, be back to her job and their beach walks—they’d gotten busy and stopped taking them as often. She felt bad for missing work, she said, because of the income it was costing them.

After several weeks, doctors said there was nothing more they could do and sent Jessica home. She stayed at her mom’s while Izzy shuttled back and forth, caring for their pets and keeping up with her new job at Walmart. Looking back, Izzy wishes she hadn’t been so frenzied in those weeks and had focused more on spending time with Jessica. But they had bills to pay. And on some level, she wanted to let herself believe Jessica’s assurances that everything would be okay. “There are a lot of things I would have liked to have been able to do,” she says.

In some of their last conversations, Jessica told Izzy about her regrets, and about old friends she wished she’d shared more with. When it was almost to painful to move, she drafted her living will in a notebook. “I have literally no wealth to divide up,” she wrote. “If you would like my debts, feel free, but I wouldn’t wish that on anyone.” Five weeks after her diagnosis, Jessica was gone. She was 42.

Izzy was given just three days to grieve before she had to go back to work. Gokey implored the Education Department to finally send Jessica’s full refund to Izzy—at the very least, it would help ease the burdens she now had to manage on one paycheck. “The harm you have done is material and concrete,” he wrote. “Do the right thing.”

The department never wrote back.

Six months later, when the pandemic struck, Izzy joked with Jessica’s mom about how much Jessica, ever the introvert, would have loved the chance to hunker down at home for months. The pandemic also became a turning point for the cause Jessica helped pioneer. First, the federal government declared a historic pause on student loan payments and interest, relying in part on legal strategies the Debt Collective had developed. That pause transformed millions of people’s finances, and helped make the idea of broader cancellation more politically tenable. Eight years after the Corinthian 15 first rallied for national student debt cancellation, the Biden administration made it real, announcing a plan to wipe out college debt for tens of millions of Americans.

This past winter, as the Supreme Court heard oral arguments in a case that could reverse that promise of relief, hundreds of debtors rallied outside, holding signs and taking turns sharing their stories at a microphone. Research had made clear that if the court blocked Biden’s plan, the postpandemic resumption of student loan payments would bring financial disaster to millions. Advocates like the Debt Collective have vowed to keep fighting if this comes to pass, pushing the administration to cancel debt through a different legal authority or pursuing congressional action. But for those who’ve allowed themselves to dream of a life without debt, it would be a crushing result.

Online during oral arguments, the debtors poured onto Reddit threads, trying to read the tea leaves on the questions the justices had asked. Much of the argument hinged on whether cancellation’s opponents had legal standing to bring the case in the first place—Justice Amy Coney Barrett, they noted, appeared skeptical; even Justice Brett Kavanaugh seemed to have his doubts. Maybe there was hope. Many grew convinced cancellation would move forward. Others focused on their spiking anxiety. All of them desperately waiting, as Jessica did, for relief that may never come.

Correction: The print version of this story misstated the number of borrowers in 2021.