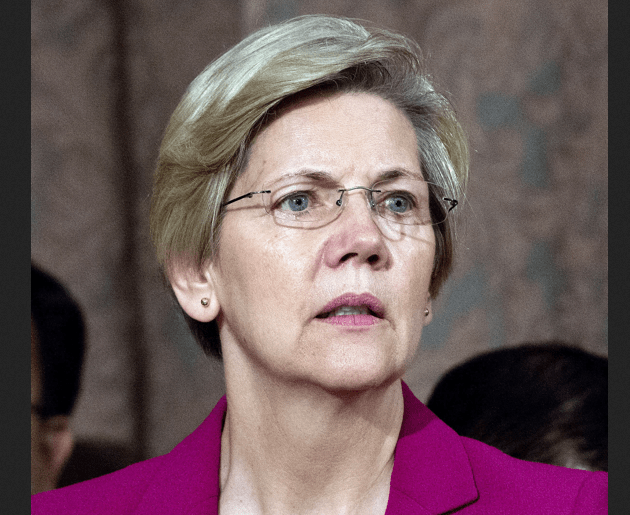

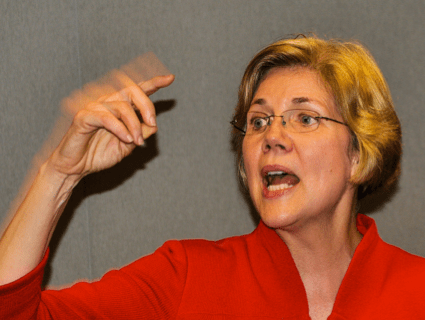

<a href="http://www.flickr.com/photos/mdfriendofhillary/7006244903/">mdfriendofhillary</a>/Flickr

During last year’s Massachusetts Senate race, the banking giant JPMorgan Chase heaped more than $80,000 on Sen. Elizabeth Warren’s opponent Scott Brown. And for good reason. The consumer watch dog agency that she conceived of and helped get running announced Thursday that it has ordered JPMorgan Chase to pay $309 million to more than 2.1 million Americans it scammed, plus a penalty of $20 million.

The Consumer Financial Protection Bureau (CFPB) found that between 2005 and 2012, Chase charged customers monthly fees ranging from $8 to $12 for services they didn’t ask for and didn’t receive. The bank collected money from customers for credit card products such as “identity theft protection” and “fraud monitoring,” even when the consumer hadn’t given consent.

The refund the CFPB ordered the bank to issue includes the total fraudulent fees charged, plus interest, and amounts to about $147 a person.

“At the core of our mission is a duty to identify and root out unfair, deceptive, and abusive practices in financial markets that harm consumers,” CFPB director Richard Cordray said Thursday.

The bureau is also forcing the bank to send out the refund checks in a simple, convenient way, so that consumers don’t have to take any additional action to get their money, and to submit to an independent audit of the refund process.

Thursday was not a good day for for JPMorgan. In a rare admission of fault, the bank was also fined some $920 million for a bad trade out of its London office last year that resulted in a $6.2 billion loss.