Jeff Chiu/AP

A couple of weeks ago, as companies began to ask their employees to work remotely amid early coronavirus fears, economist Jared Bernstein had a realization. “It occurred to me pretty quickly, although I didn’t recognize the magnitude, containing the virus was going to be antithetical to the economy,” Bernstein tells me. “In order to apply what was necessary on the health care front, we’d have to put segments of the economy into a deep freeze.”

Few are as attuned to the warning signs of economic ruin as Bernstein. A longtime scholar of income inequality, he served as the chief economic advisor to Joe Biden back when he was vice president. During his White House tenure, Bernstein worked on the nearly $800 billion economic stimulus and job recovery plan signed into law early in Barack Obama’s term as president—without which, Bernstein’s research determined, the country would have seen another 3 to 4 million jobs lost during Obama’s first months in office. Bernstein, who also ran the former vice president’s task force on the middle class, had been heralded by the left as a key counterbalance to more bank-friendly voices in the Obama administration, such as Treasury Secretary Timothy Geithner and National Economic Council Director Larry Summers. These days, Bernstein, now a senior fellow at the Center for Budget and Policy Priorities, informally offers advice to his former boss, now the presumptive Democratic nominee for president.

The remedies to address this pandemic-driven disaster can’t be the same as what was used to jumpstart the economy in past recessions. Bernstein recalls President Bush telling families to “go down to Disney World” after the September 11 terrorist attacks, a tragedy that similarly ground the travel industry to a halt. “Needless to say, such advice doesn’t work in this case,” Bernstein says. “A lot of the medicine that we usually apply won’t have the impact it usually does.”

And Bernstein says correcting that largely falls on the federal government—specifically, the sorts of measures that the Senate orchestrated this week with its $2 trillion emergency relief package. Bernstein is overall happy with the bill but doesn’t understand why the federal government reinvents the wheel every time a crisis like this hits. He points to the fact that the Senate’s stimulus package includes a dedicated watchdog and an accountability panel to oversee $500 billion in loans that will be given cities, states and industries hardest hit by the pandemic—an oversight setup similar to what was established to watch over the 2008 bailouts.

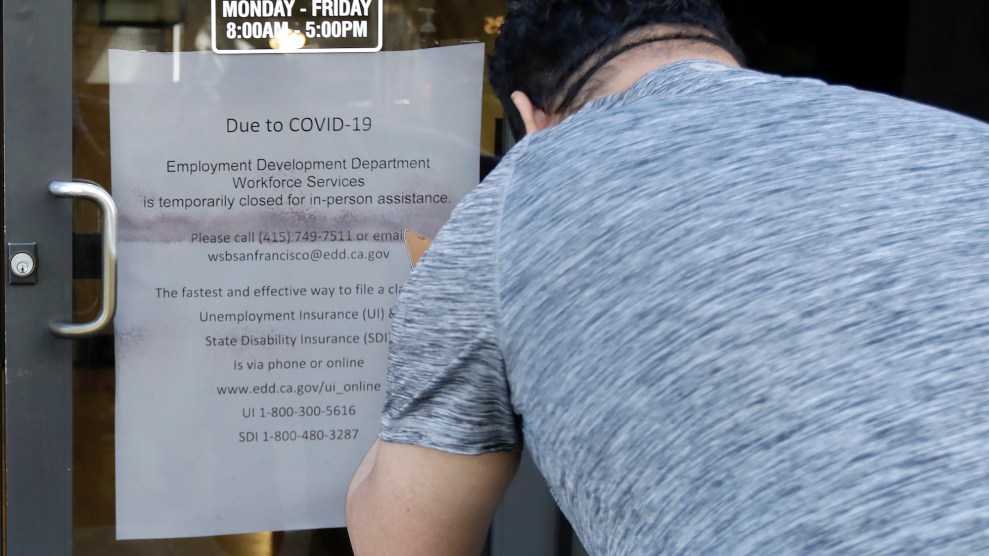

“Why do we have to create this every time we hit these kinds of stretches?” Bernstein laments. “It’s not hard to see what will happen when the market fails.” He points to the lack of a robust federal unemployment system—something currently managed, with varying degrees of success, by the states—as well as a lack of paid family and leave. “We need to be more prepared,” he says.

I spoke with Bernstein about the early warning signs of trouble, his take on the Senate bill, and what he’s watching for as emergency money finds its way into consumers’ hands.

A couple of weeks ago, when businesses started to send workers home and close up shop, what were your first thoughts about the potential economic fallout?

I thought early on that we were in for a lot of trouble. As every economist knows, the US economy is almost 70 percent consumer spending. So if you’re going to tell even a small portion of the American consumer population that they have to come out of the game for a while, that’s going to be a hit to growth. My initial thought was that growth in the first half of the year could be somewhere around zero. If things get as bad as I expect, I now see, of course, that was very wishful thinking.

There’s no doubt we’re in a recession. How is this different from the one you tackled during your time in the White House, and others in recent history?

Well, the easiest way to explain the difference between now and [other recessions] is to remember that after Congress and President Bush sent out the first round of stimulus checks [after 9/11], the president said, “Take your rebate check and go in a plane and go down to Disney World,” which may sound kind of cavalier, but it was understandable advice, given the role of consumer spending on our economy. Needless to say, such advice doesn’t work in this case. So one difference is that I don’t think any of us have ever been—with the exception of a couple days after 9/11—in a situation where our economy had to be put in a deep freeze in order to deal with a health threat. It means that a lot of the medicine that we usually apply won’t have the impact that it usually does. The Federal Reserve is a very good example. You can cut interest rates as low as you want, but you’re not going to reschedule a conference or go to a restaurant because interest rates are zero.

Because monetary policy simply can’t have the punch that it usually does, fiscal policy is that much more important. We’ve talked a ton about the Fed lately, but at the end of the day, it’s what Congress is doing. It’s going to make the biggest immediate difference to households and businesses. And that’s why they cannot get any further behind this fiscal curve.

We now have a picture of the emergency relief measures Congress and the White House agree on. Who benefits the most from this stopgap measure? Who gets left behind?

The most important thing is the $250 billion for unemployment insurance. That was something [Senate Minority Leader Chuck] Schumer insisted on getting in there—the next time I see him, I’m going to bump elbows with him heartily. The most important direct beneficiaries are families and small businesses. Obviously, there are literally millions—I would say at least 20 million middle and low-wage workers who have no paid leave—and even if they’re employed, but their workplace is closed, they’ve got no income. I can also tell you that they have virtually no savings. So these are people who if they lack a paycheck for a couple of weeks in a row, are looking at serious provation, possible eviction. There are things that some localities are doing, including eviction moratoriums, that can help them—food banks are ramping up, I get that. But the most important thing to do is get money in their pockets as quickly as possible.

Now, here’s the wrinkle that I don’t know how much of this is appreciated. In order to get the rebate check, you have to have filed a tax return for 2018 or 2019 or get Social Security [or Medicaid]. A lot of the people I’m talking about won’t have filed a tax return. That doesn’t mean they’re ineligible. In fact, they are eligible thanks to some of the work of the Democrats and my colleagues at the Center on Budget, by the way. That doesn’t mean they’re ineligible, it means that they have to file a tax return to get their check. And that’s going to be a super important thing. I mean, this is not something that we can fool around with for weeks or months. These folks needed assistance yesterday. So we have to make sure those of us who are in the policy community explain to these folks that they have to file, they can do it online, and they can even get assistance from the IRS to do so. But that’s going to be really important.

I think $350 billion for small businesses is very helpful, particularly because while that is a loan—a guaranteed loan, so that the creditors and the lenders will be backstopped by the government—the federal government is forgiving the part of that loan that businesses use to maintain their payrolls. So I thought that was a smart piece of work.

There are a couple of omissions, in terms of who’s not getting help. One of the most important omissions is fiscal relief for states. During the last recession, when I was in government, we had a really pretty robust, effective, efficient, quick-acting state fiscal relief program, which we administered by just tweaking up the federal government’s contribution to state Medicaid expenditures. It’s called the FMAP [Federal Medical Assistance Percentage]. We ratcheted up the federal contribution, and states could get that money. And it’s not just for Medicaid—it’s technically for Medicaid, but these dollars are fungible, so every dollar they don’t have to put into Medicaid because they get it from the Feds can go towards unemployment insurance or public workers or a full set of needs.

[The final relief package, which was still being negotiated at the time of this interview, includes $150 billion in fungible relief. Bernstein tells me that’s a welcome change, but still thinks FMAP funds should be in there, as well.]

There’s been a ton of attention on the daily ups and downs of the stock market—particularly from the White House, which seems eager to make them stop. Do those daily fluctuations matter? And if not, what other economic indicators should politicians be looking at instead when planning stimulus?

I certainly wouldn’t pay attention to the ups and downs, especially from the perspective of if you have a big up day like Tuesday—don’t think you’re out of the woods. So I would be pretty asymmetric about my assessments. You know, they say the stock market is not the economy, but it’s not not the economy, and I think that’s fair. The important thing about the massive sell off is its impact on people—its impact on 401Ks and our retirement plans. I was talking to a friend last night who said, “Well, my retirement is now put off for another year.” That’s a big deal. And the stock market is one of these forward-looking indicators that suggests how steep and deep this recession is.

But the more structurally important indicator in the financial markets is actually the debt market—the market for treasuries, corporate debt, and things like that. And that’s where the Fed has been particularly active, because at least initially, it looked like that market was operating pretty smoothly, which is very important. We already had a supply shock, then we had a demand shock—we certainly didn’t need a financial shock on top of that. The last downturn was a financial shock that set everything off. In recent days and weeks, we’ve had some clogging in the pipes of the credit markets and the Fed has intervened aggressively to try to unclog the plumbing and they’ve been, at least, moderately successful. And that’s really important. I mean, we’re going to be borrowing our asses off to finance this stimulus and we need a functional Treasury market for that. Right now, I thought the intervention that the Fed did Monday seems to have helped. But we’ve seen this movie where things look clear for a couple of days, and then they get a little bit shaky again. The Fed is definitely on the case and committed to trying to make sure credit markets remain fluid.

In terms of the indicators that I tell politicians to look at: first of all, unemployment claims are very revealing, and we’ve already seen them spiking [to 3.3 million]. And that’s just after a week. In the Great Recession, we were tearing our hair out because we lost 2.3 million jobs in the first quarter of 2009. So I would look at the claims and basically more broadly, I would look at what we call “real economy” indicators. So not just the financial market—not that that’s false—but the real stuff has to be incomes and jobs wages. Those are the indicators I’d look at. The problem is that they’re either coincident or kind of lagging, and so you have to try to see around the corner where they’re headed.

Lawmakers predict this is only the first in a series of bills lawmakers will try to pass to address this crisis. What are the longer-term, structural economic remedies you’d recommend to better prepare for future disasters like this?

That’s pretty easy to me. We need a national paid leave program. We need a much more comprehensive unemployment insurance program with a larger federal role, because we’ve got some states that have taken their UI systems apart for ideological reasons—North Carolina’s a good example.

We are really bending ourselves into a pretzel if you spend five minutes reading what the Fed is trying to do in order to provide emergency lending to businesses. If you look at what the UK and Denmark did—the government is directly supporting businesses, especially small ones that are much less insulated against these kinds of storms. But we don’t do that structurally because we have this idea that the government can’t pick winners. I’ve always thought that was a phony issue, because if you look at our tax code, we pick winners all the time. It’s just sort of an ideological opposition.

There ought to be programs in place that both provide direct lending, but conditional on a set of requirements that balance investors and workers interests. So you could say, “Well, we do have a lending program like that.” It’s the $500 billion slush fund that everybody’s all up in arms about that has almost no conditionality. We had the same problem with the TARP. We had to do something very quickly for businesses in the economy, and the first day Congress said, “What is this crap?” and they just thought it was nonsense, and then next day the market fell 800 points and everybody said “Well, show me the TARP again.” And it didn’t have ample oversight and so we had to, from whole cloth, create this oversight board, which actually ended up being kind of okay, but we’re doing the same thing again.

And finally, the idea that our health care system is both incapable of a surge in demand and that people are having to deal with insurance issues just underscores how important it is that we recognize that health care is a public good, a human right, and act accordingly.